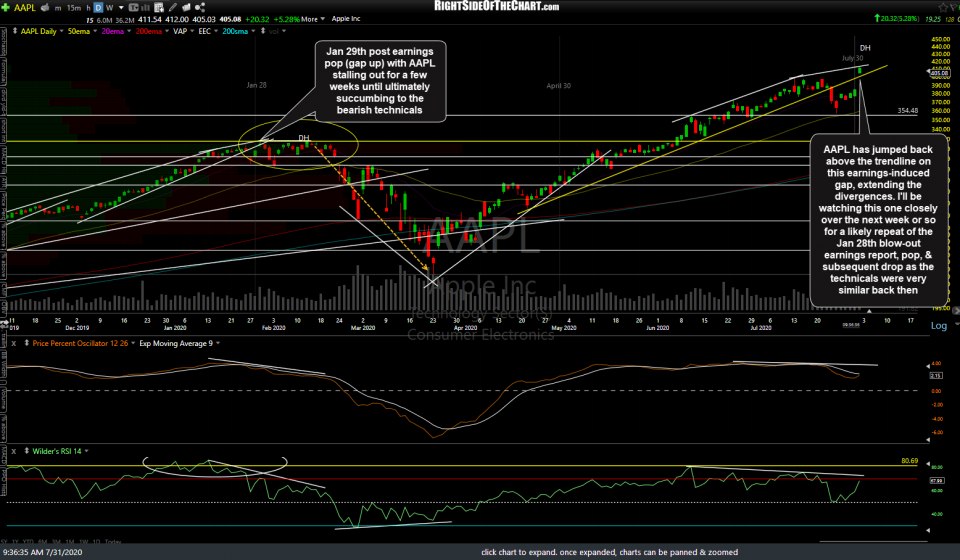

AAPL (Apple) has jumped back above the trendline on this earnings-induced gap, extending the divergences. I’ll be watching this one closely over the next week or so for a likely repeat of the Jan 28th blow-out earnings report, pop, & subsequent drop as the technicals were very similar back then.

The only FAAMG having previously reported before last night, MSFT (Microsoft) continues to show weakness following the recent divergent high & bearish engulfing candle as it continues to test the 201.35 support.

AMZN (Amazon) is rallying out of the gate following earnings so far although still trading below the July 13th bearish engulfing candle. A solid break above that level would invalidate the near-term downtrend since then while a reversal & drop below the 7/24 low would keep it intact & likely open the door to a larger wave of selling.

Google parent company Alphbet Inc (GOOGL) is under pressure out of the gate so far today following last night’s earnings while starting to crack below the 1479 support.

FB (Facebook’s) post-earnings pop keeps the divergences intact for now, indicating the probability this gap will be faded & then some in the coming days/weeks.

The story pretty much remains the same, these market-leading stocks, or at least most of them in recent weeks, continue to do most of the heavy lifting to hold the broad market up. Today is yet another day where the tremendous impact that only a handful of overweighted mega-cap $1T+ companies are providing the illusion of a healthy rally in the US stock market. As I type, QQQ is trading +0.77% yet the QQQE (equal-weighted Nasdaq 100 ETF) is trading down -0.46%. Of the 100 companies in the Nasdaq 100, 73 are trading red while only 27 stocks are advancing. Although the impact of the FAAMGs is most pronounced in the tech-heavy Nasdaq 100, it can also be seen in the S&P 500 with SPY trading slightly positive while RSP (equal-weighted S&P 500 ETF) is down -0.62% with 378 of the 504 stocks in the S&P 500 (a few companies have multiple share classes), trading red.

Bottom line: I’d put decent odds that today’s rally in the FAAMGs will be faded & then some in the coming days to weeks. QQQ remains above the trendline & July 14th low.. for now, with sell signals to come on breaks below both levels.

While we don’t have any sell signals on QQQ at this time, XLK (tech sector ETF) is close to backtesting the recently broken trendline from below, thereby offering an objective, although somewhat aggressive entry or add-on to any existing shorts on the tech sector or major stock indices.