Cheap oil is bullish for the economy & stock market while expensive oil is not. Crude is rallying sharply today as the U.S. ends waivers for countries to import Iranian oil. Crude futures spiked as high as 3% today to a high of 65.98 so far, essentially right at the $66 ‘Red Zone”. I refer to that level as the Red Zone as crude oil had a similar over-extended bull run into the $66 level back in late January 2018.

Back then, just as today, crude oil was rallying in lock-step with the U.S. stock market on one of the strongest & most resilient rallies in decades… all up until the point that crude oil kissed $66/barrel at which point the rallies in both equities & crude oil came to an abrupt end, followed by one of the sharpest corrections in years with the S&P 500 plunging 12% in just 10 trading session & wiping out the previous 4½ months of gains in very short order. Following that initial 12% drop, the broad market mounted a fairly impressive 11% rally along with a concurrent recovery in crude oil which was once again checked at the $66/bbl level with both crude & the stock market immediately reversing course to take another sharp leg down.

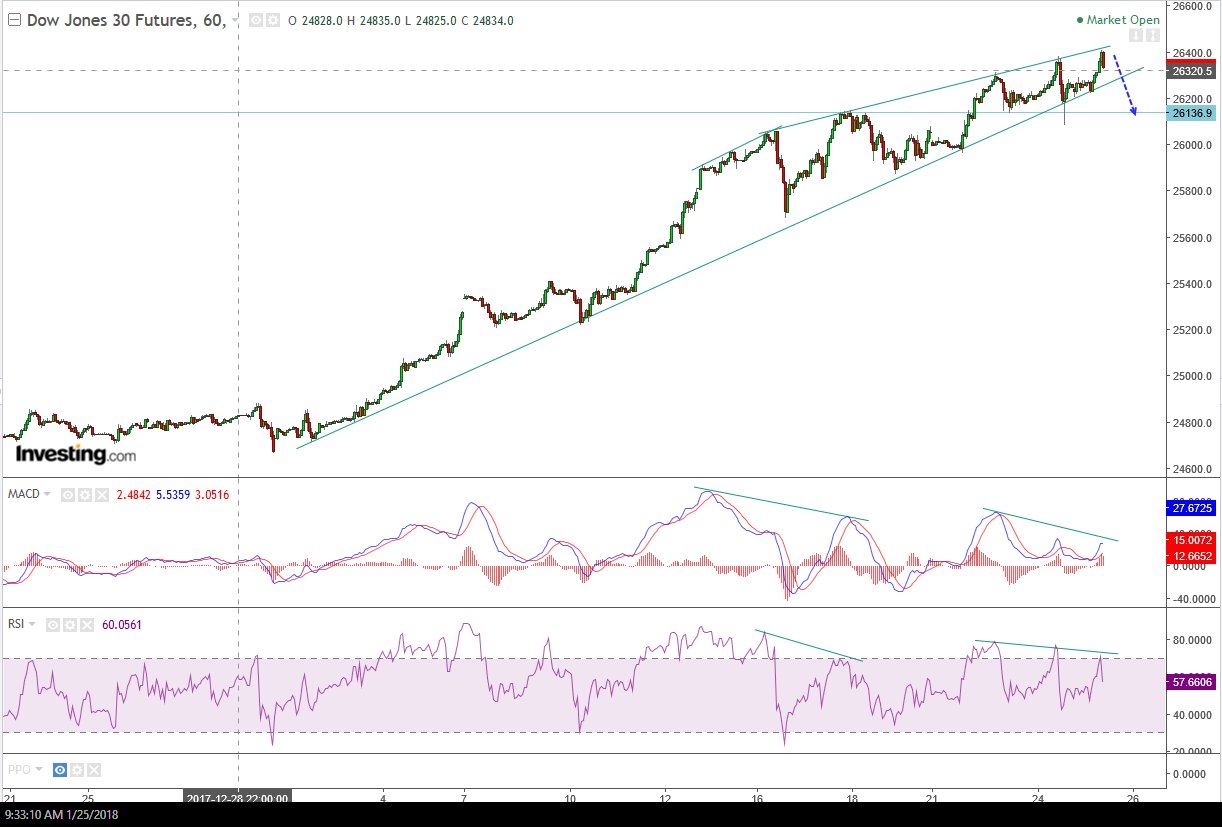

History doesn’t always repeat but it often rhymes. As was the case back then, both crude oil & the stock market were wedging higher on the 60-minute time frames with negative divergences building & the breakout & sell signal for that big drop in Jan 2018 was well-telegraphed in advanced as the charts below from this post back on Jan 25, 2018 (posted the very day before the market topped) show:

- SPX 60-min Jan 25th

- NDX 60-min Jan 25th

- DJIA 60-min Jan 25th

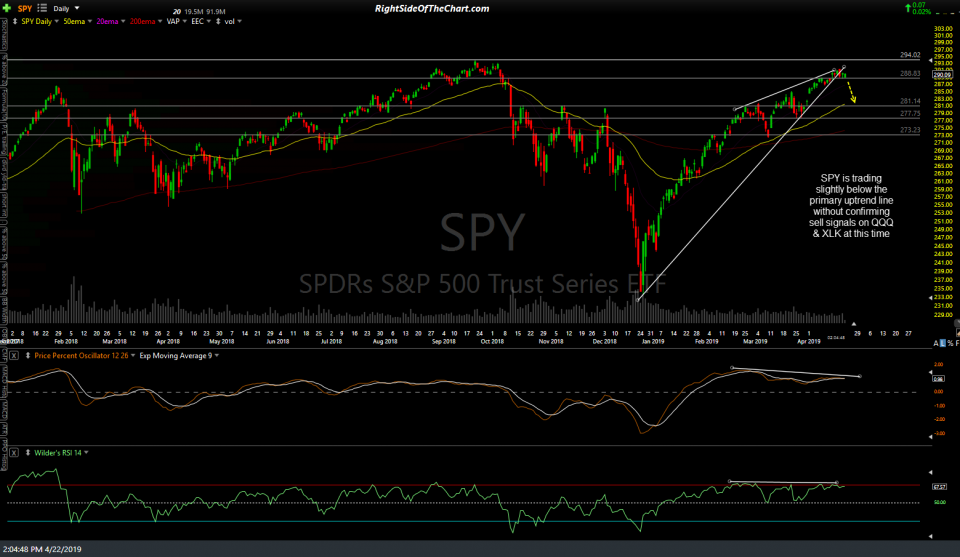

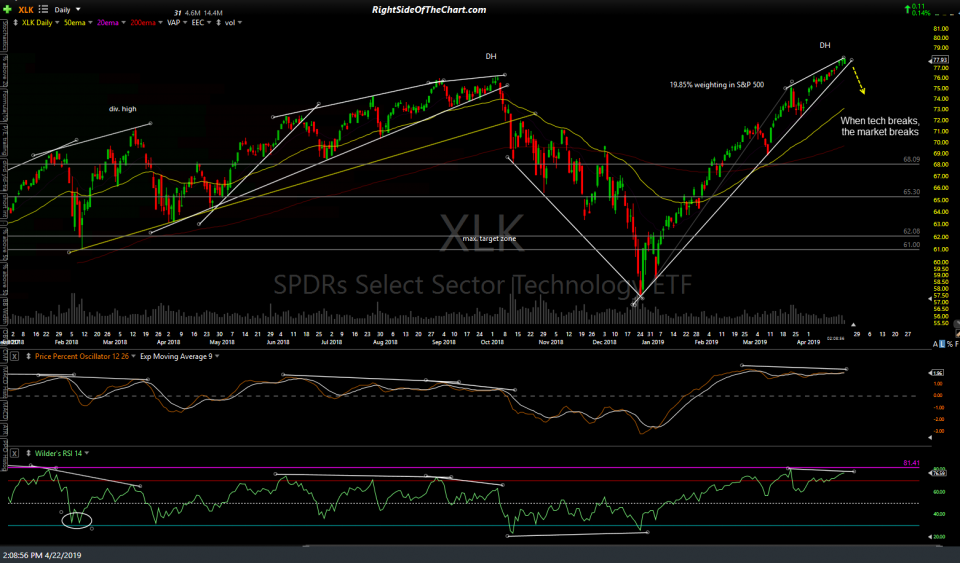

That was then, this is now (click the first chart to expand, then click anywhere on the right of each chart to advance to the next expanded chart):

- NQ 60-min April 22nd

- ES 60-min April 22nd

- SPY daily April 22nd

- QQQ daily April 22nd

- XLK daily April 22nd

Once again, we don’t have any sell signals on either crude oil or the equity market at this time but with the overbought conditions & divergences on both, as well as the fact that sooner or later, rising crude prices will begin to hit the pocket book of both consumers & corporations, not to mention the inflationary effects that certainly don’t help support the case for a continuing dovish stance from the Fed, chances are that the chatter on the Street will soon shift to the rally in crude as having a net bullish effect on the stock market to a net bearish effect.