As I said recently, the markets would probably continue to grind around until the FOMC announcement barring any market-moving headlines & that’s exactly what we got today with a one-two punch from team Draghi & Trump. Stock index futures immediately started to rally as European Central Bank President Mario Draghi signaled that the ECB might soon cut interest rates or expand its bond-buying program, followed by a follow tweet of one from Trump simply stating that he “Had a very good telephone conversation with President Xi of China,” and “We will be having an extended meeting next week at the G-20 in Japan. Our respective teams will begin talks prior to our meeting.”… Sound familiar?

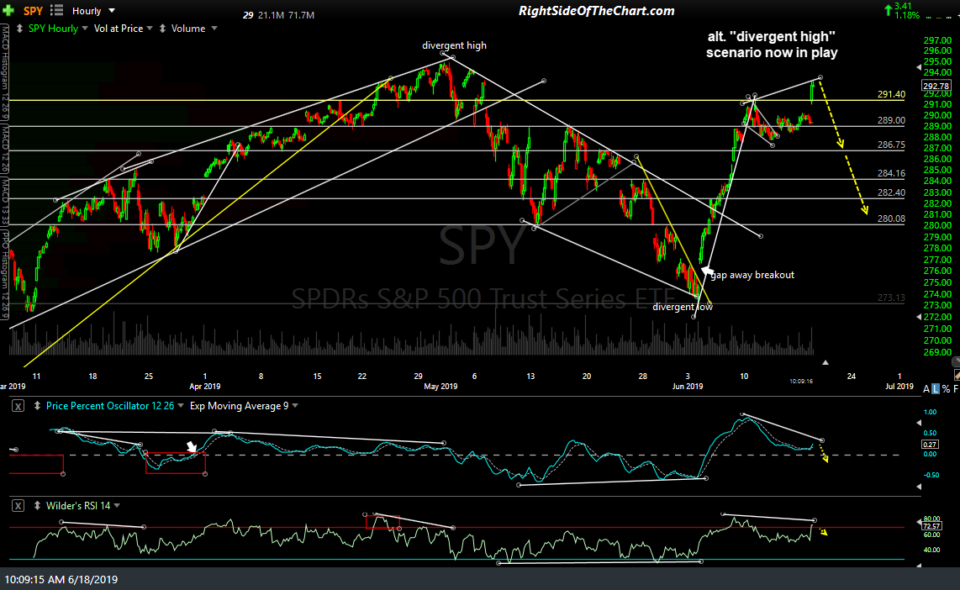

- SPY 60-min June 18th

- QQQ 60-min June 18th

From a technical perspective, this doesn’t change much although it does bring in my previous alternative scenario of a marginal new & divergent high on the stock indexes and with a lift of 1.14% on the broad market (S&P 500) as I type, just one day before the highly-anticated FOMC announcement, I would put very good odds that we’ve now seen the bulk of any gains, at least until after the rate announcement tomorrow afternoon. Despite the impulsive nature of today’s rally so far, I would caution against reading too much into this spike with the big FOMC announcement just over 27 hours away.

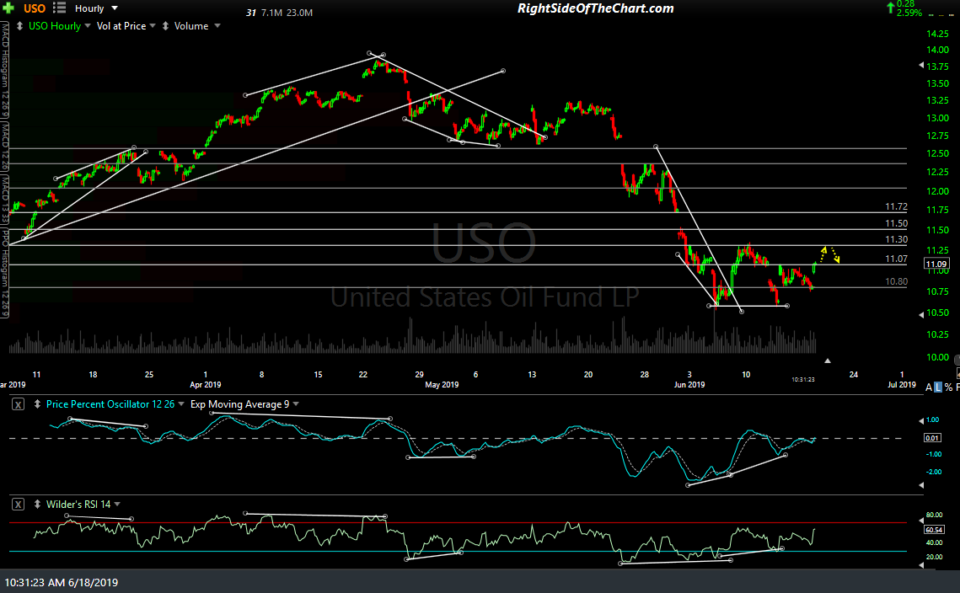

Changing gears, /CL (crude oil futures) made an impulsive breakout above the downtrend line followed by a quick rip up to my first price target where it has been consolidating since. Previous & updated 60-minute chart of /CL below along with a 60-min chart of USO for those that prefer trading ETNs vs. futures.

- CL 60-min June 17th

- CL 60-min June 18th

- USO 60-min June 18th