The positive divergences in place at the recent lows heading into today (first chart below from earlier today) were the technical catalyst for a bounce into the intersecting downtrend line + 3046ish resistance levels on /ES (S&P 500 futures), with a reversal & pullback off this rally into resistance likely (2nd/updated chart below).

Likewise, the small divergent low & reversal off the 1368ish support was the technical catalyst for today’s rally into dual resistance (trendline + 1417) on /RTY (Russell 2000 Small-Cap futures) as well.. This rally into resistance offers an objective short entry for another leg down with the falling wedge pattern. Note: the downtrend line was revised since the screenshot of the first chart below earlier today to better align the trendline to the previous reaction highs.

The small divergent low put in shortly after the market opened today was the technical catalyst behind today’s bounce in /NQ (Nasdaq 100 futures). Unless /NQ reverses & drops back below the neckline without taking out the 10,000ish resistance level just overhead, the Head & Shoulders pattern breakdown may prove to be a whipsaw signal.

QQQ (Nasdaq 100 ETF) managed to close a hair above the key 242 support level + uptrend line with a sell signal still pending a solid break and/or daily close below.

XLK (tech sector ETF) managed a stick save to close back slightly above the key 101.79 support following a very brief intraday dip below.

/GC gold remains just below the top of the multi-month trading range with key support & resistance levels in yellow on this 60-minute chart.

/KC (coffee futures) held the 0.9950 support (former resistance) on the pullback following today’s downtrend line breakout & brief momentum-fueled overshoot of the 1.0165 resistance level.

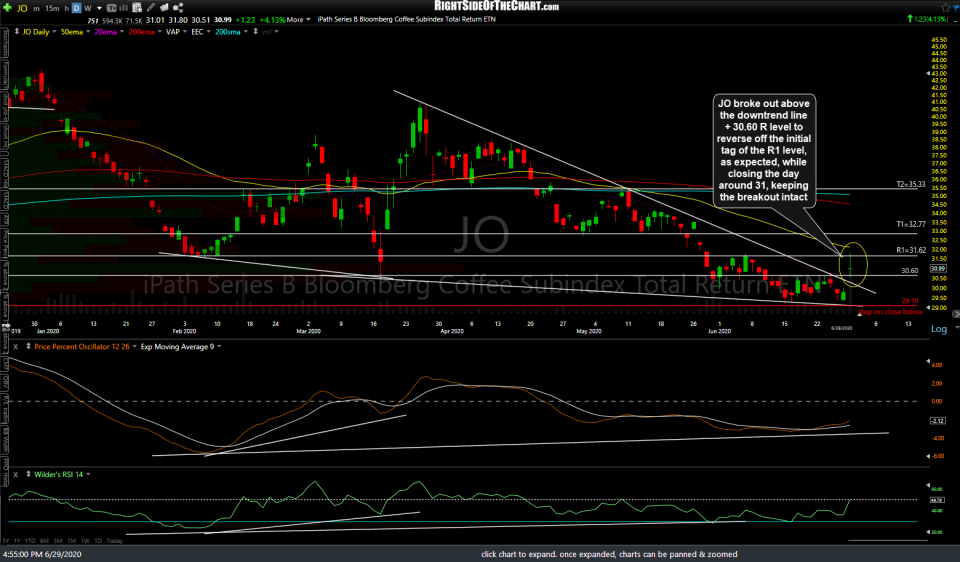

JO (coffee ETN) broke out above the downtrend line + 30.60 resistance level to reverse off the initial tag of the R1 level, as expected, while closing the day around 31, keeping the breakout/buy signal intact.