/CL (crude futures or USO, crude oil ETN) will offer an objective short entry, including an indirect hedge to the QQQ swing short, on a solid break below this 60-minute bearish rising wedge pattern.

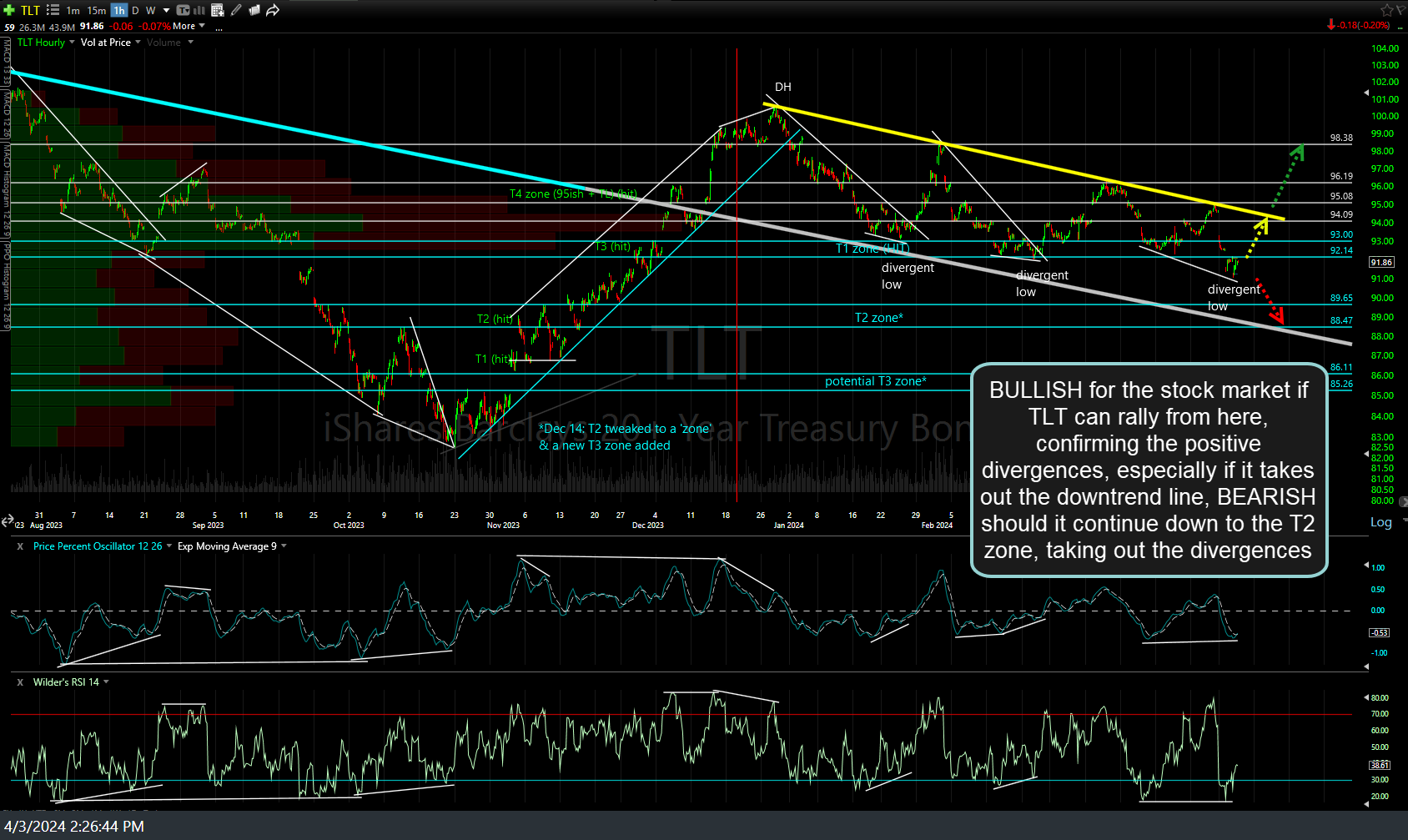

On a very much related note & as pointed out in recent videos, both the 10 & 30 yr Treasuries have positive divergences on the 60-minute chart which have the potential to spark the next counter-trend rally with IEF (7-10 yr Treasury bond ETF) currently backtesting the YELLOW ZONE from below. Net bullish for the stock market IF these divergences play out for a rally, especially if IEF regains the GREEN ZONE, very bearish if IEF is rejected here at resistance & takes out the divergences on another leg down.

Again, IEF is currently testing the bottom of the YELLOW ZONE (which is price resistance around 93.50) from below. As I like to say, resistance is resistance until & unless taken out. Therefore, there are two “plays” here:

- Short here (or add to a short position) Treasuries here with a stop somewhat above …or…

- Wait for a solid breakout back into the YELLOW ZONE to go long IEF or /ZN (or /ZB, TLT, etc..). TLT 60-minute chart for reference below.

A long on Treasuries could also serve as an indirect hedge to the active QQQ swing short position as a solid rally back into the yellow zone, & especially back into the green zone, would be net bullish for equities as long-term rates fall (*unless that rally is due to a flight-to-safety bid due to QQQ breaking down below my key 433 support). As always, I like to make an upwards beta-adjustment to my position size on Treasuries of 2.0+ (i.e.- twice or more the size of a typical position on SPY or QQQ) due to the relatively lower volatility & price moves.

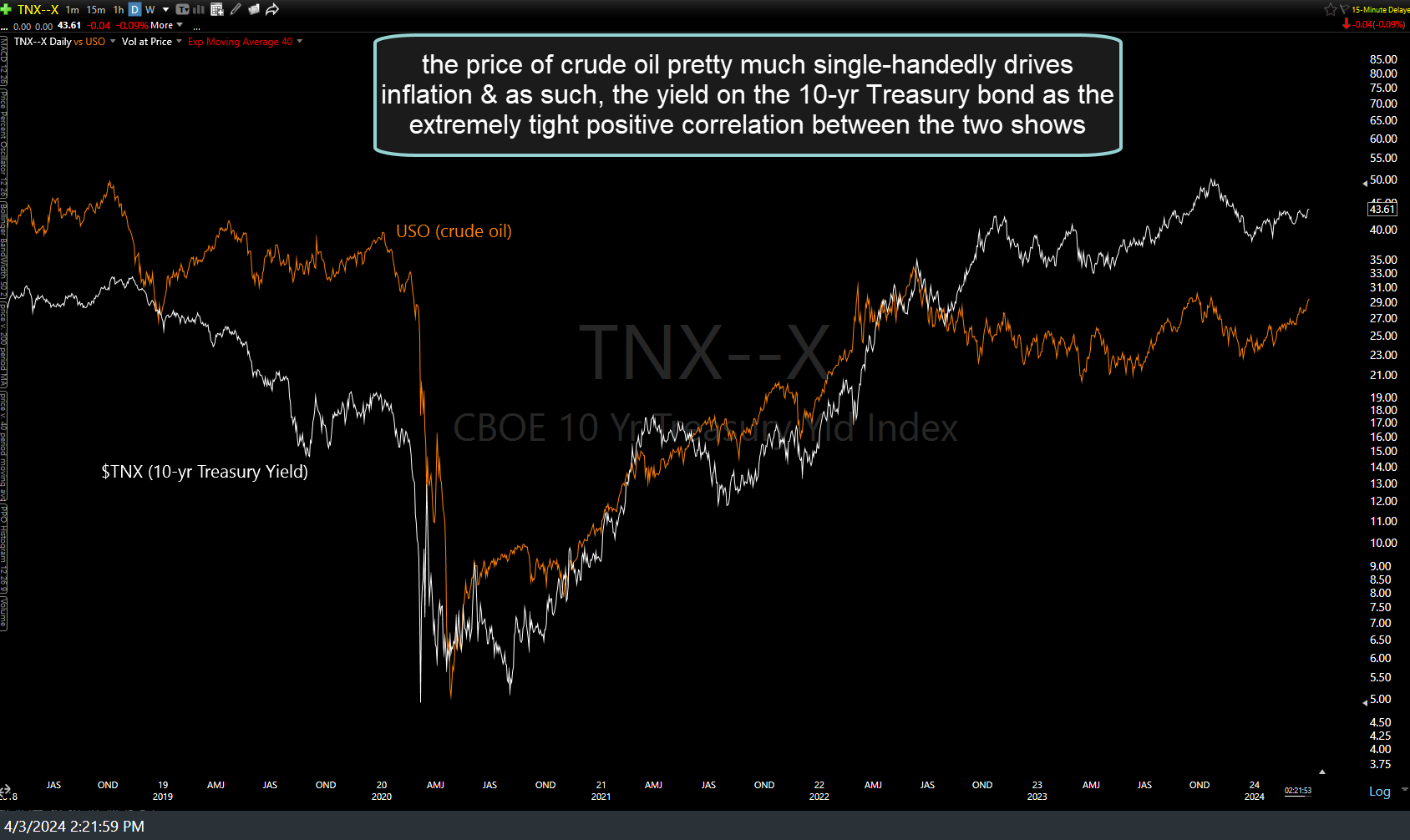

Likewise, a short on crude oil, should the setup above trigger an entry, could also provide an indirect hedge to a QQQ short as the price of crude oil pretty much single-handedly drives inflation & as such, the yield on the 10-yr Treasury bond as the extremely tight positive correlation between the two on the chart below shows. (Remember, yields ($TNX) move directly inversely to bond prices (IEF) so a comparison between USO & IEF would show an inverse correlation).