Based on my analysis of gold, GDX as well as the US Dollar & other major currencies, while the longer-term outlook for gold remains bullish it appears that the odds favor a pullback in gold & the precious metals stocks along with a bounce in the US Dollar in the coming days to weeks.

- GLD 60-min Feb 6th

- GDX 60-min Feb 6th

- GLD weekly Feb 6th

The 117.32 area is fairly significant resistance & with potential divergences still in place, its quite possible that GLD (Gold ETF) may need one more decent pullback before a resumption of the current uptrend as shown on the 60-minute chart above. Along with GLD, GDX also still has potential negative divergences in place on the 60-minute time frame which increases the odds of another pullback soon unless those divergences are negated with new highs in the indicators. As such, the R/R in GDX appears skewed to the downside in the near-term (days to weeks) yet while the near-term picture remains a bit obscure but appears to indicate a pullback, the long-term outlook for gold remains bullish following this successful backtest of the downtrend line coupled with a bullish divergences which have now been confirmed as shown in this weekly chart.

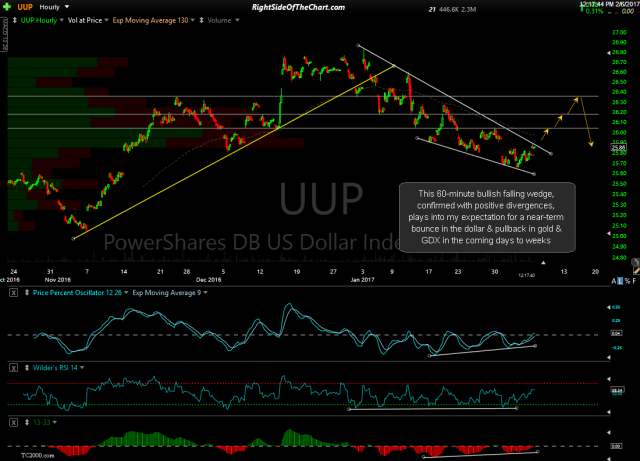

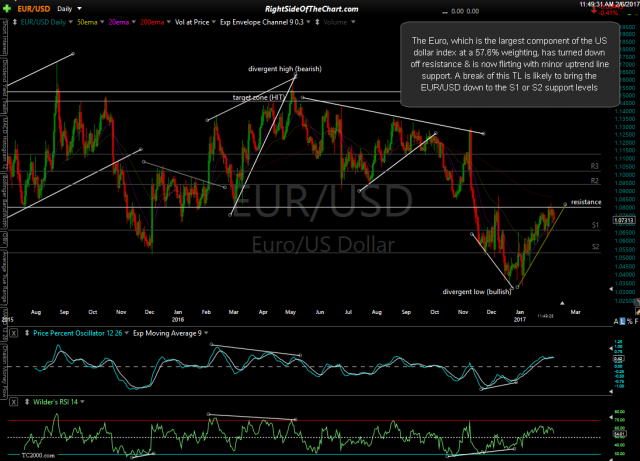

As historically there has been a fairly consistent inverse relationship (one up, the other down) between gold & the US Dollar, I always incorporate the outlook for the US Dollar & other major currencies into my analysis for gold. This 60-minute bullish falling wedge, confirmed with positive divergences, plays into my expectation for a near-term bounce in the dollar & pullback in gold & GDX in the coming days to weeks. The Euro, which is the largest component of the US dollar index at a 57.6% weighting, has also turned down off resistance & is now flirting with minor uptrend line support as seen the daily chart below. A break of this TL is likely to bring the EUR/USD down to the S1 or S2 support levels.

- UUP 60-min Feb 6th

- EUR-USD daily Feb 6th

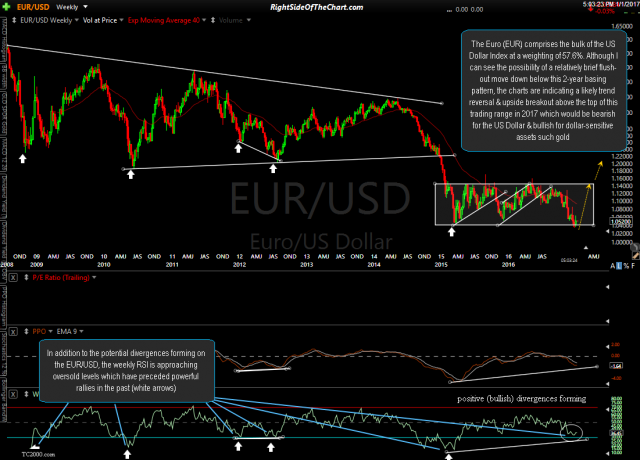

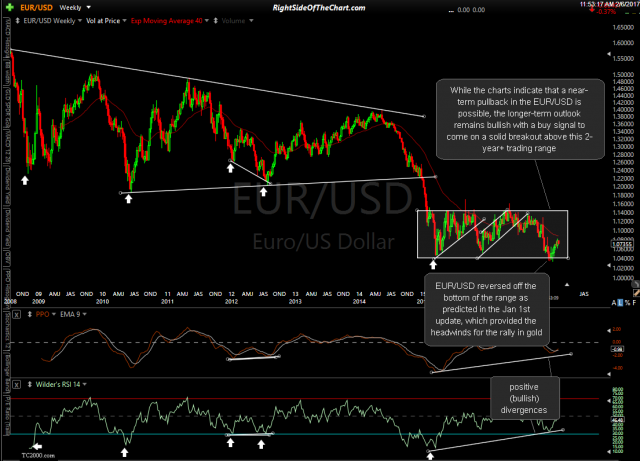

While there is a decent chance for an oversold bounce in the US Dollar index at this time, the longer-term outlook for the US Dollar remains bearish following the recent overbought / divergent high coupled with the longer-term bullish outlook for the EUR/USD. With the charts indicating that a near-term pullback in the EUR/USD is possible, the longer-term outlook remains bullish with a buy signal to come on a solid breakout above this 2-year+ trading range. The 10-year weekly charts of the $DXY (US Dollar Index) and the EUR/USD (Euro/US Dollar) are shown below along with the previous charts & scenarios posted back on January 1st where the EUR/USD reversed off the bottom of the range as predicted in that update, thereby providing the headwinds for the rally in gold over the last couple of months.

- $DXY weekly Jan 1st

- $DXY weekly Feb 6th

- EUR-USD weekly Jan 1st

- EUR-USD weekly Feb 6th