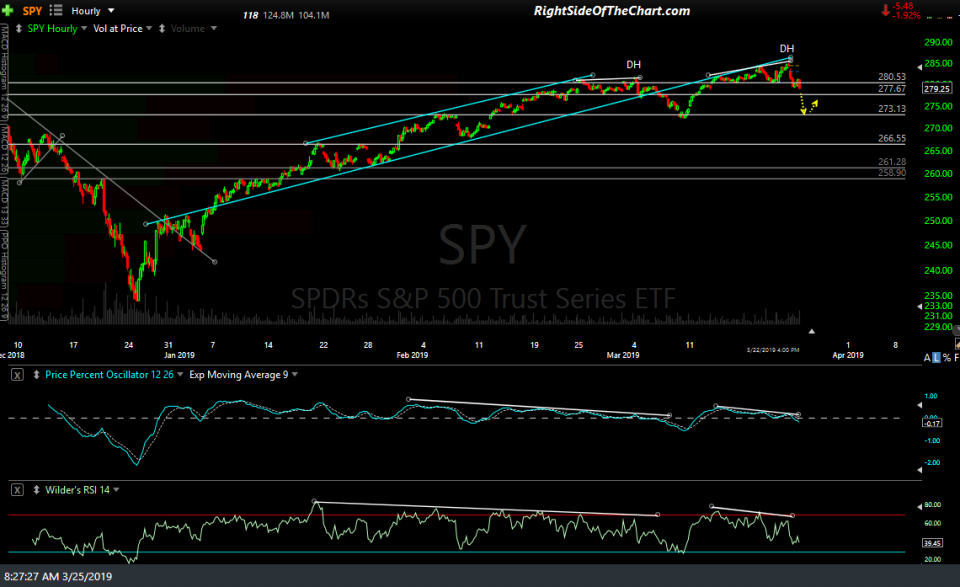

Not much to add since the equity market updates on Friday with the broad market (S&P 500) now entering it’s 5th consecutive week at testing the key 282ish resistance level following last week’s intraweek breakout & failed attempt to hold those gains & print a solid weekly close above that level. QQQ broke down & closed below this minor uptrend line and SPY below the 280.53 price support on Friday & if those TL’s aren’t recovered today, as is suspect they won’t be, here are some downside targets/support levels to watch and/or trade off this week. 60-minute charts:

- SPY 60-min March 25th

- QQQ 60-min March 25th

On a related note, I’m watching this potential bear flag continuation pattern on /NQ with the yellow arrow showing the measured target for the pattern. Sell signal to come on an impulsive breakdown below the flag (pending). 60-minute chart:

Crude oil has been highly correlated with the stock market since last fall, both falling sharply into the December 24th lows & mounting a strong rally, albeit on diminishing momentum since then. Should the correlation between the two continue and assuming the stock market moves lower this week, crude will likely follow suit. /CL (crude futures) have been backtesting the primary trendline off the Dec 24th lows since breaking down below it earlier this month with the first key support below around 57.86.

/GC gold futures continue to move higher following the recent divergent low & drop to support on this 60-minute chart with a minor uptrend line starting to form.

Positive/bullish divergences continue to build on the 60-minute chart of /KC coffee futures although they just can’t seem to catch & hold a bid for very long as the JO (coffee ETN) swing trade is at risk of the suggested stop (a daily close below 33.60) of being hit today.

/ZW wheat futures continue to move steadily higher following the recent breakout & still look good although a break of this minor uptrend line could spark a pullback & may offer another objective entry or add-on, if so.

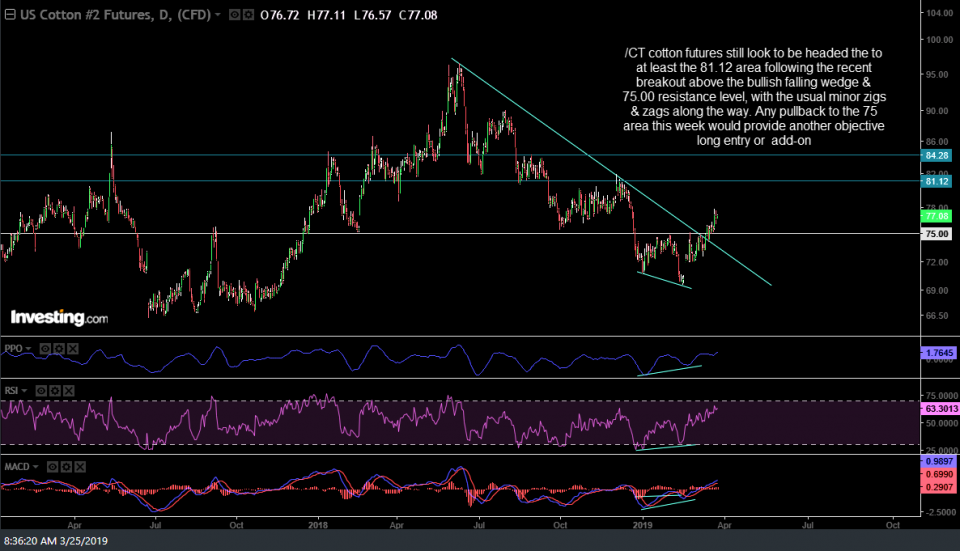

/CT cotton futures still look to be headed the to at least the 81.12 area following the recent breakout above the bullish falling wedge & 75.00 resistance level, with the usual minor zigs & zags along the way. Any pullback to the 75 area this week would provide another objective long entry or add-on. BAL is the cotton ETN & remains an unofficial long trade as well as an official long trade setup & still under consideration to be added as an official trade soon.