One of the most significant developments & levels to watch is the 28030ish major resistance on the S&P 500 in which the broad market has failed at multiple attempts to surmount since first testing it from below back on Feb 25th. Both the /ES (SPX futures) 60-min chart $ the /NQ (Nasdaq 100 futures) 60-minute charts (below) both have negative divergences which indicate that any brief pop or even a daily close above that resistance level today could prove to be a whipsaw signal/failed breakout.

- ES 60-min March 15th

- NQ 60-min March 15th

/CL (crude futures) has broken down impulsively below this most recent 60-min bearish rising wedge pattern/divergent high to backtest the 57.85ish former resistance, now support level. Should crude successfully defend this backtest, that would be bullish while any solid break & move back down below that level would indicate a false breakout/bull trap would could have near to intermediate-term bearish implications for crude oil & the energy sector.

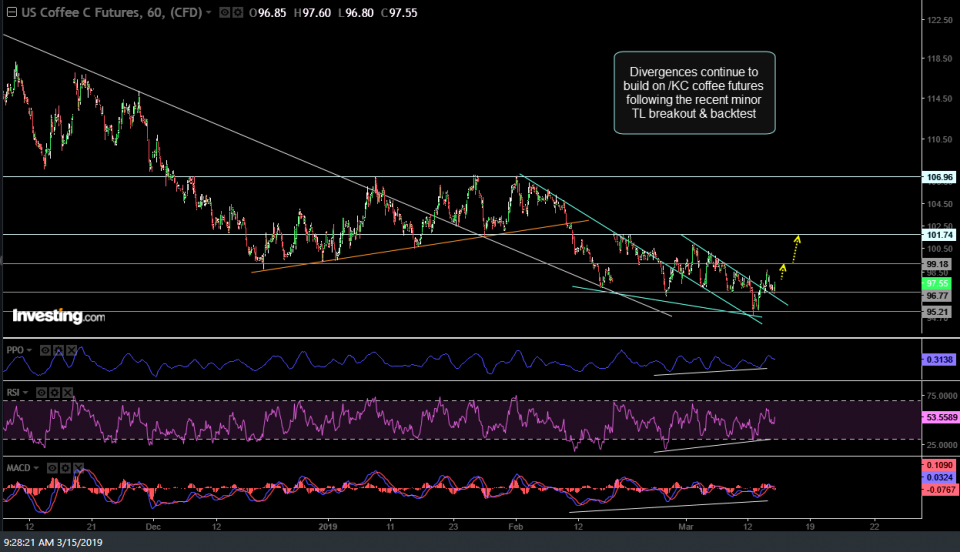

Divergences continue to build on /KC coffee futures following the recent minor TL breakout & backtest.

Along with other agricultural commodities, I’m keeping an eye on sugar as the next break aboive the 12.55 level on /SB, sugar futures,is likely to spark a rally to the 13.05ish level & beyond.

Divergences continue to build on /KC coffee futures following the recent minor TL breakout & backtest.

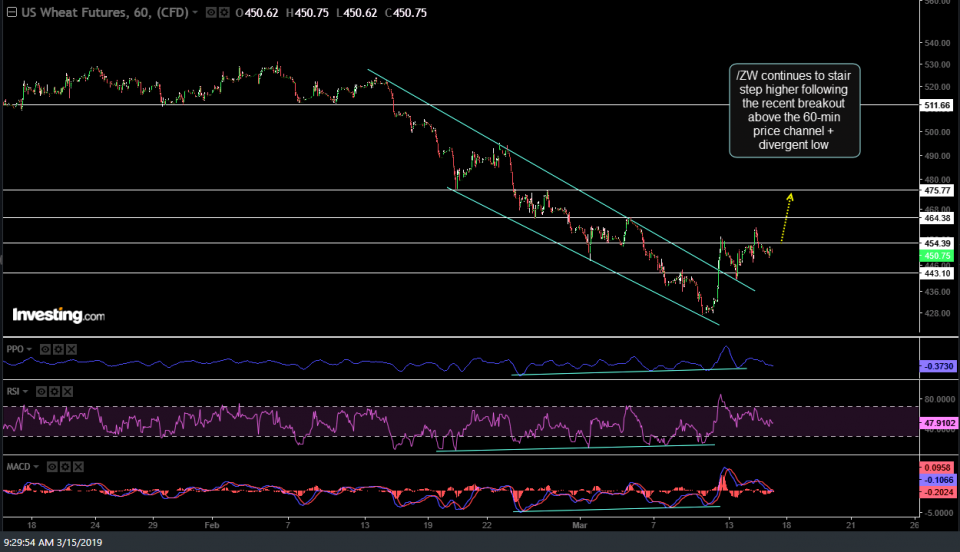

/ZW, wheat futures, continues to stair step higher following the recent breakout above the 60-min price channel + divergent low.

While the near-term outlook for gold remains unclear, /GC has been stair-stepping higher since the recent divergent low on this 60-min chart.