Although not an all-inclusive list, I’ll keep today’s Charts I’m Watching simple with follow-ups to the securities from yesterday’s “Charts..” post with yesterday’s charts included. Note: The gallery (multiple) chart images below may not appear on the subscriber email notifications & can be viewed on the site.

Starting with the major stock index futures, /ES SPX futures have hit the first price target/2963 support while forming a small bullish falling wedge pattern:

- ES 60-min July 8th

- ES 60-min July 9th

Likewise, /NQ NDX futures have hit & slightly exceeded 7760.50 first target/support while forming a small bullish falling wedge pattern. While the much larger, recently broken, bearish rising wedge patterns indicate more downside likely to come, an upside breakout of these small wedges are likely to trigger a near-term rally/bounce.

- NQ 60-min July 8th

- NQ 60-min July 9th

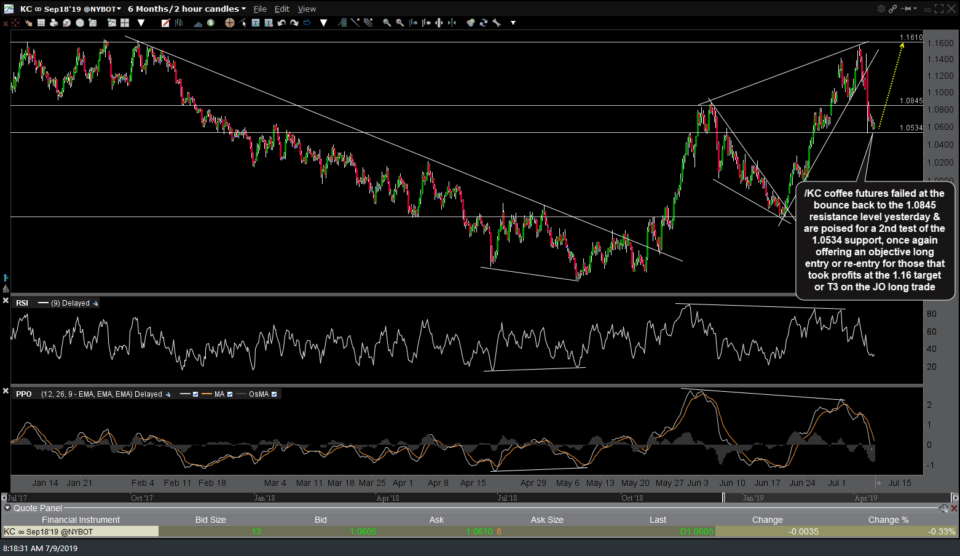

/KC coffee futures failed at the bounce back to the 1.0845 resistance level yesterday & are poised for a 2nd test of the 1.0534 support, once again offering an objective long entry or re-entry for those that took profits at the 1.16 target or T3 on the JO long trade.

- KC 60-min July 8th

- KC 60-min July 9th

/PA palladium futures sell signal was triggered on the break below the minor uptrend line. I’ve added a couple of additional targets since yesterday’s chart with 1468-1455 my current preferred swing target range.

- PA 60-min July 8th

- PA 60-min July 9th

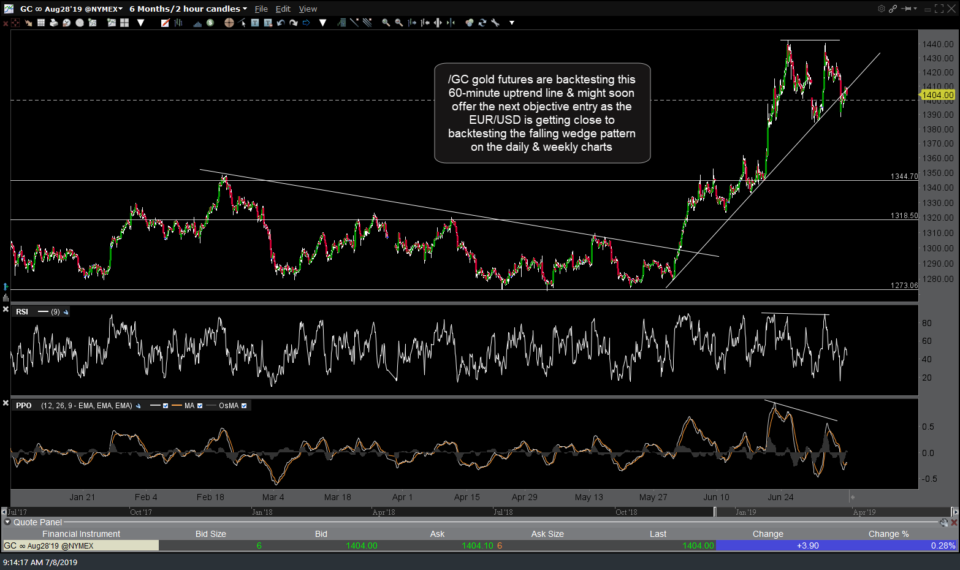

/GC gold futures were rejected off yesterday’s backtest of the uptrend line following the recent breakdown while a break below this 1385 minor support would likely usher in another wave of selling if taken out impulsively. Gold is on watch for the next longer-term swing/trend trade entry or add-0n with more in-depth analysis on gold, GDX & the US Dollar to follow.

- GC 60-min July 8th

- GC 60-min July 9th

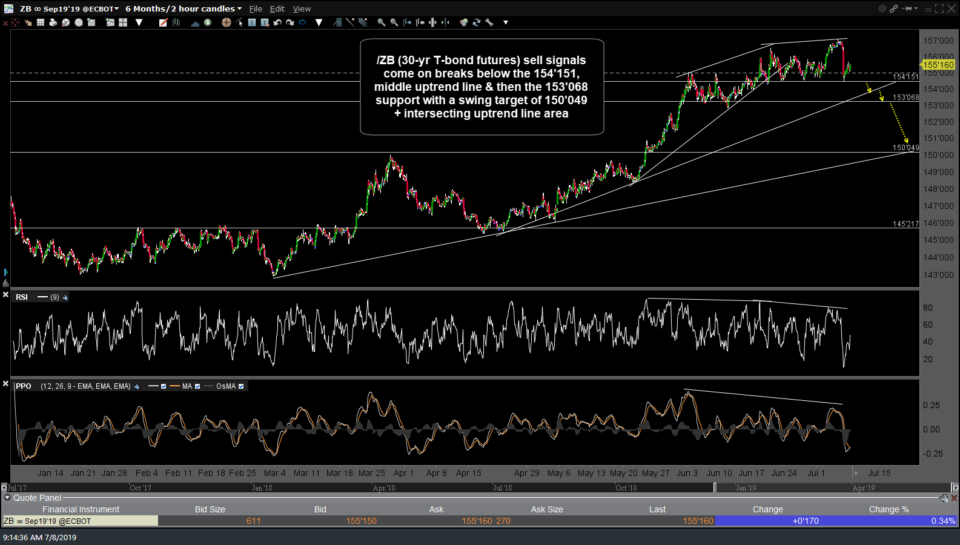

/ZB 30-yr Treasury Bond futures sell signals to come on a break below 154’151, then the uptrend line followed by a 3rd & final sell signal on a break below 153’068. One could also short TLT or go long TBT (2x short Long Bond ETF) to short long-term Treasuries.

- ZB 60-minute July 8th

- ZB daily July 9th