Barring any major market-moving headlines before then, the US stock indexes are likely to continue to chop around within the recent sideways trading range until the FOMC rate announcement at 2 pm EST on Wednesday. 60-minute charts of /ES (S&P 500) and /NQ (Nasdaq 100) futures below. (multiple/gallery chart images may not appear on subscriber emails but can be viewed on the site).

- ES 60-min June 17th

- NQ 60-min June 17th

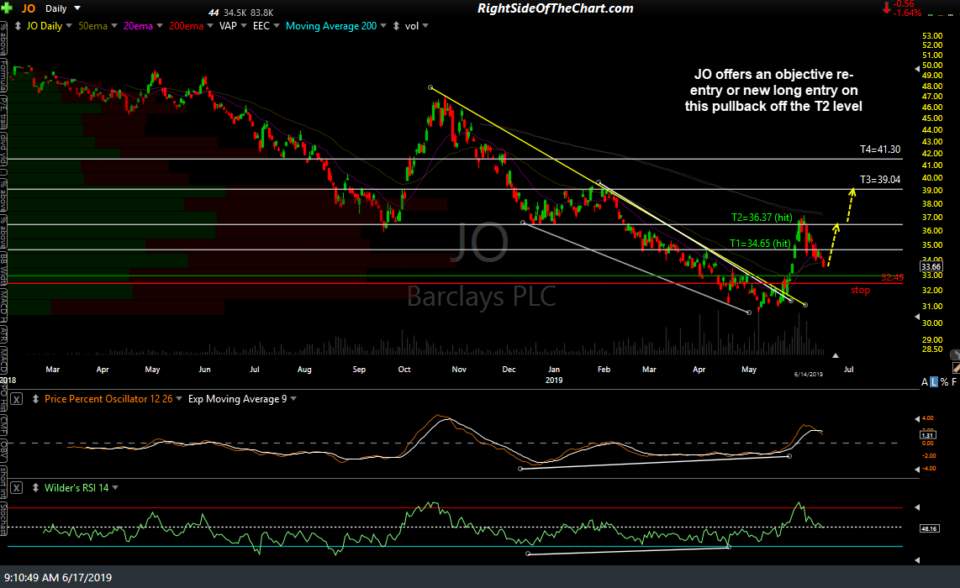

/KC coffee futures have now fallen to the 0.9528 support level, bringing my alternative scenario from last week into play while offering another objective long entry or add-on to the JO (coffee ETN) active trade. 60-minute chart of /KC followed by the daily chart of JO (coffee ETN).

- KC 60-min June 17th

- JO daily June 17th

Still awaiting a breakout above the 60-minute downtrend line for an objective long entry on /CL (crude futures), USO, UWT, etc.. 60-minute chart below.

/LB lumber futures might provide a quick pullback trade, followed by one more thrust higher with a possible swing short entry after that. 60-minute chart.

Regarding the UGAZ (natural gas ETN) active long swing trade, I’ll be watching for the next buy signal on /NG (nat gas futures) to come on a break above 2.425. I’ve also added a couple of support lines below that ‘should’ contain any pullback in nat gas. 60-minute chart below.