/DX (US Dollar Index futures) is testing the top of the recent post-breakout trading range (90.611 target/resistance) with a solid break above that level likely to trigger a rally up to the next target of 91.081. 60-minute chart below.

/NQ (Nasdaq 100 futures) has broken below this minor uptrend line following the recent divergent high although with AAPL, FB, & TSLA reporting tonight, the $NDX will likely pick the next tradable trend after the close today & into tomorrow. 60-minute chart below.

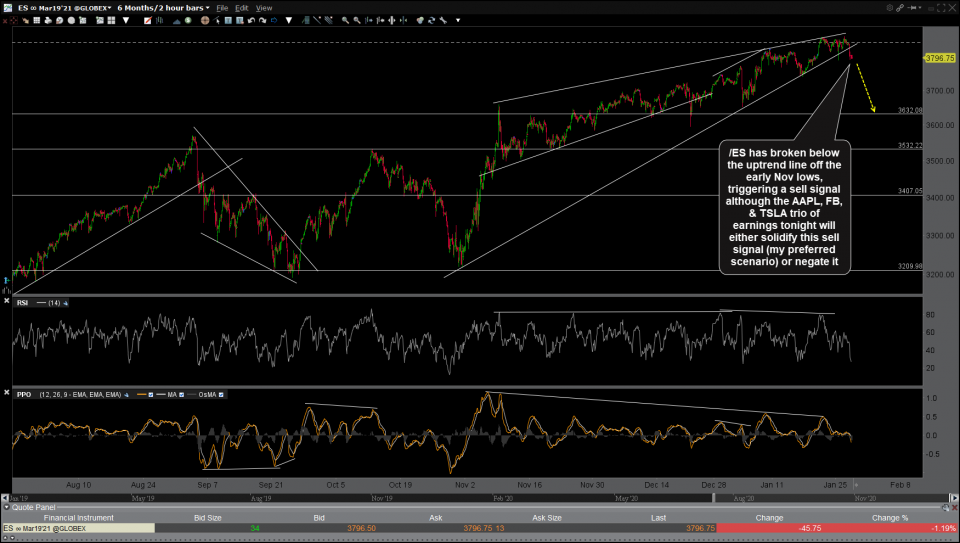

/ES (S&P 500 futures) has broken below the uptrend line off the early Nov lows, triggering a sell signal although the AAPL, FB, & TSLA trio of earnings tonight will either solidify this sell signal (my preferred scenario based on the technical posture of the charts) or negate it. 60-minute chart below.

/RTY (Rusell 2000 Small-Cap futures) is starting to move impulsively lower following yesterday’s break below this uptrend line & recent divergent high. 60-minute chart below.

A sell signal on GME (Gamestop Corp.) is still to come on this (since extended) minor uptrend line highlighted in yesterday’s video. As the stock continued higher since the video, the first target is now the intersecting secondary uptrend line & 145.88ish level. 5-min chart with the after-hours & pre-market trades in the shaded area below.