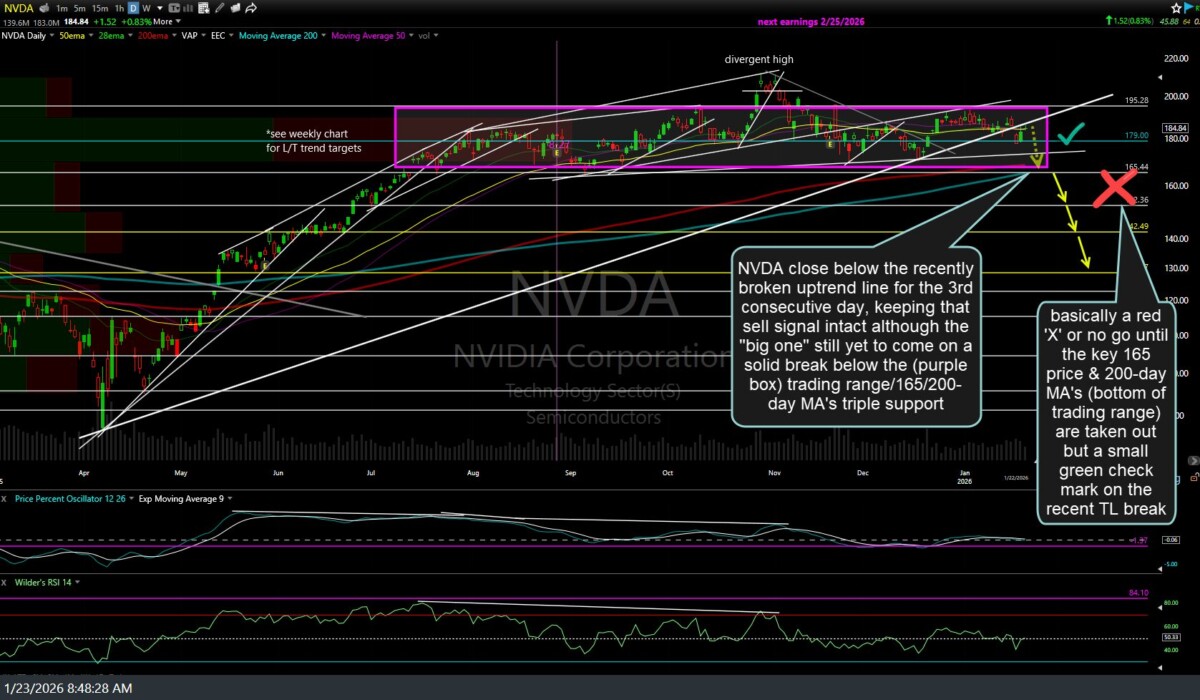

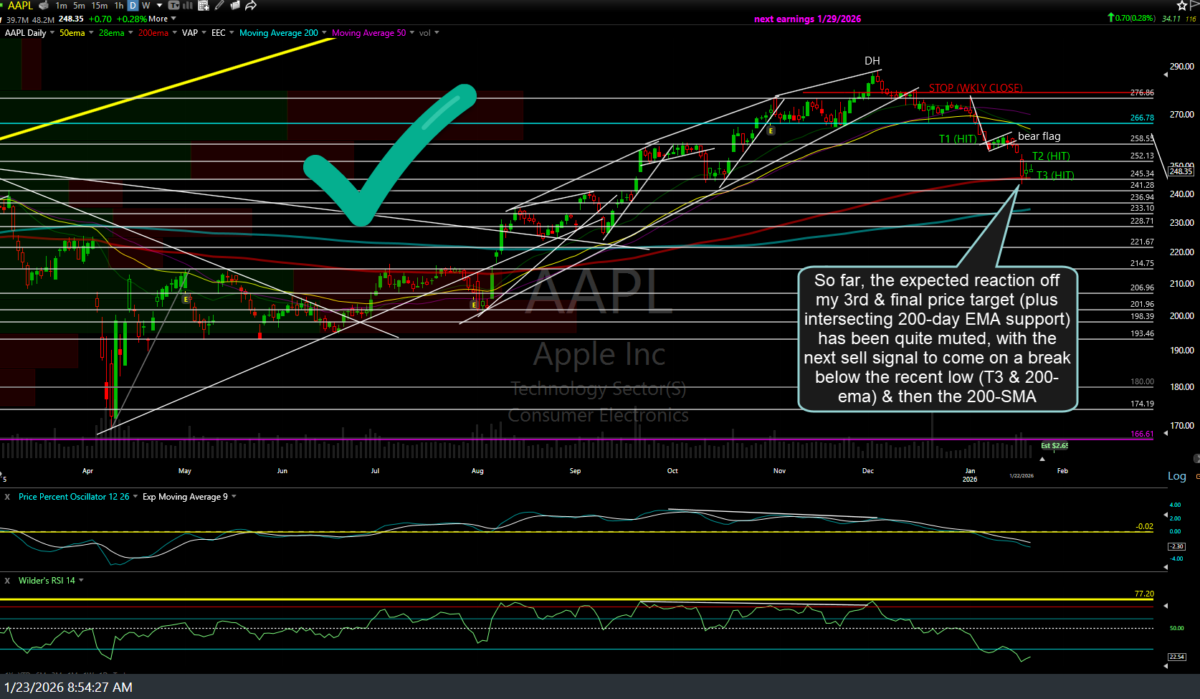

I continue to monitor the market-leading Magnificent 8 mega-tech stocks for additional sell signals (which would help to support the case for a stock market correction) and/or potential bullish developments (which would help to support the case for new highs in the Nasdaq 100 this year).

Not too much has changed since these previous charts of the Mag 8 were posted Thursday of last week, although the final holdout & second largest component of both the Nasdaq 100 and S&P 500, GOOGL (Google’s parent company, Alphabet) did go on to trigger the sell signal I was looking for, with a solid break & close below the primary uptrend line off the June 2025 lows, on Tuesday. GOOGL backtested & closed below/on the trendline the following day (Wednesday), and made a failed attempt to regain it yesterday by rallying slightly above it during on an intraday basis, only to see that rally faded with the stock closing down back on the trendline (i.e.- no solid recovery/close back above it…at least as of now).

Also worth noting is the sell signal on TSLA (although the ‘smallest’ of the Mag 8), which earned a checkmark when it clearly gapped down below the primary uptrend line earlier this week & closed yesterday on a backtest from below.

Again, although the Magnificent 8 stocks still very much impact where the overall stock market goes due to their abnormally large weighting on the major indices, until & unless the financials, and to a lesser extent, the discretionary, communications, & healthcare sectors (next largest weighted sectors of the S&P 500) also move lower, the market could continue to grind around sideways from the sector rotation that we’ve seen in recent quarters.

Updated Magnificent 8 charts, with key levels & potential developments to watch for, below. These charts are also posted in order of market cap, with the first stocks having a larger impact on the stock market.