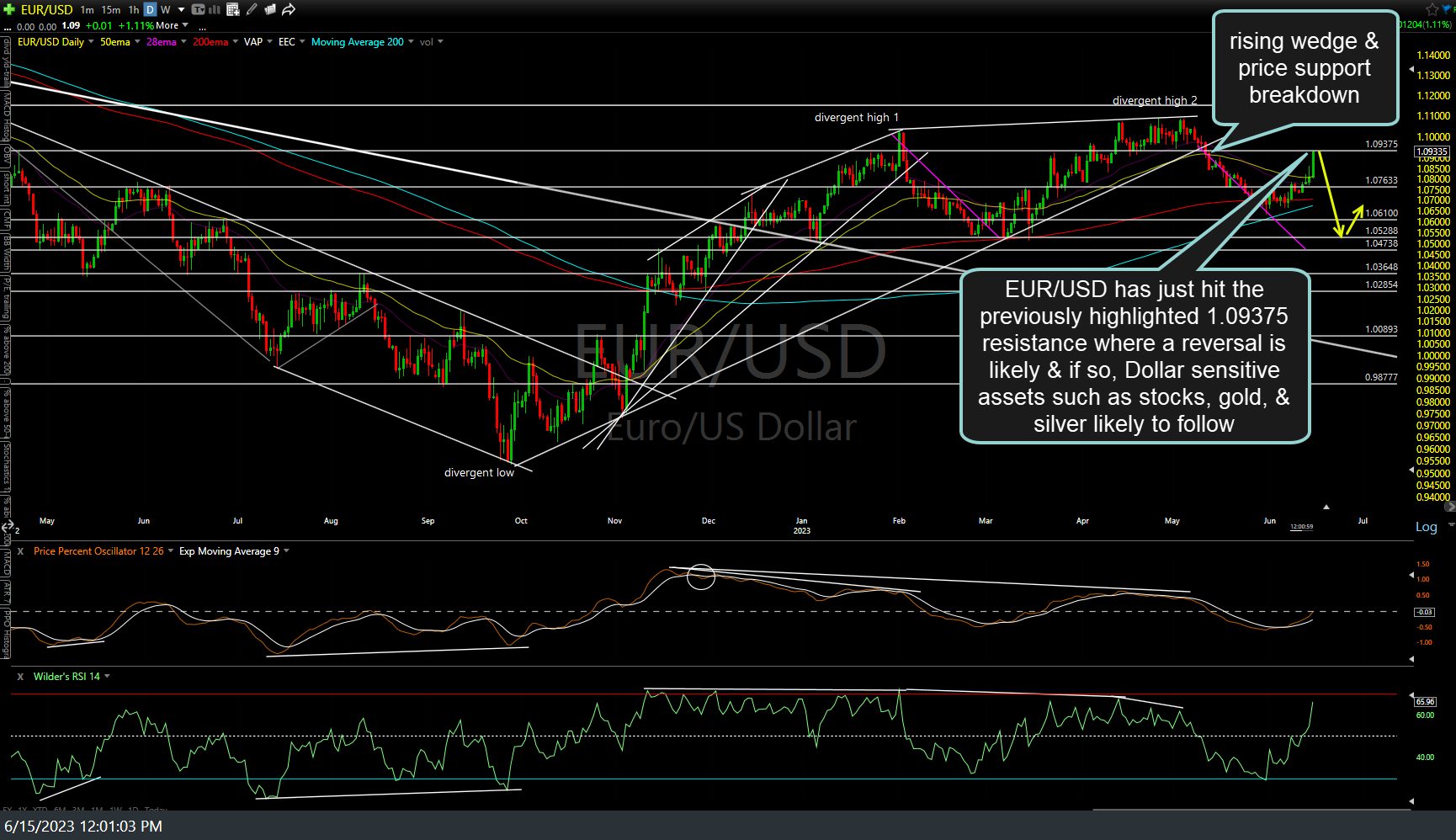

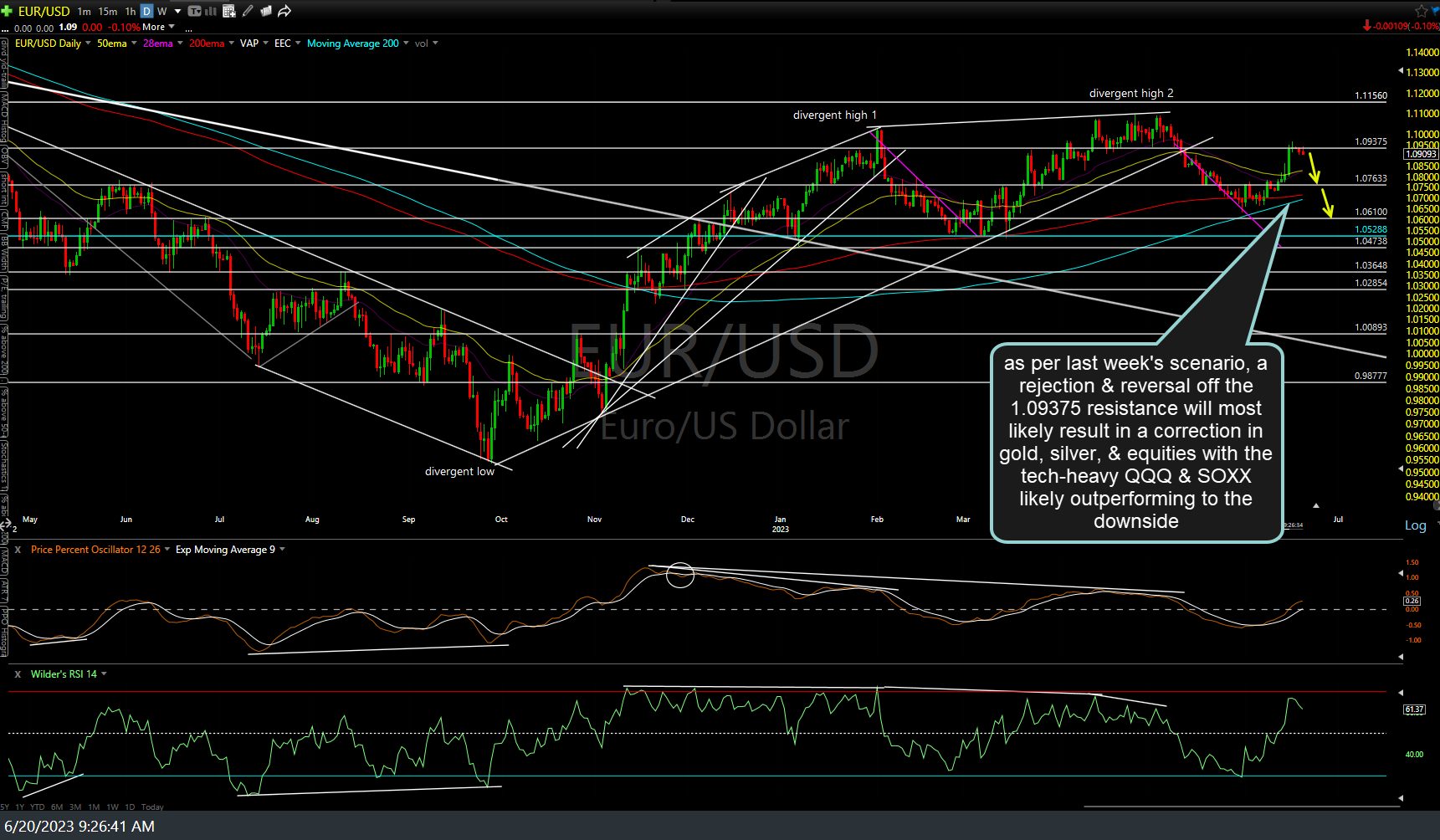

As per last week’s scenario, a rejection & reversal off the 1.09375 resistance will most likely result in a correction in gold, silver, & equities with the tech-heavy QQQ & SOXX likely outperforming to the downside. Previous (Thursday’s) and updated daily charts of EUR/USD below.

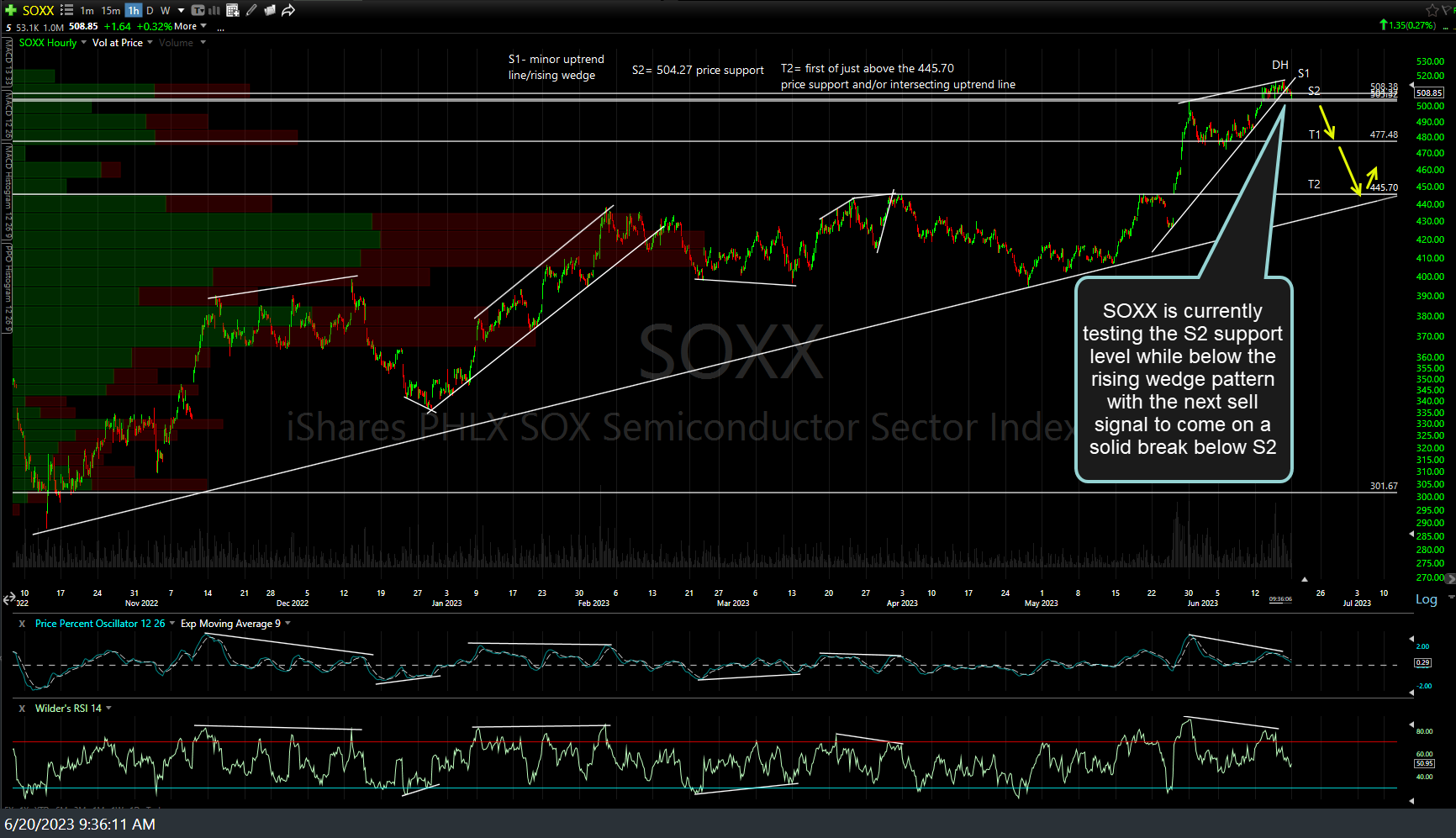

The SOXX (semiconductor sector ETF) short trade is currently testing the S2 support level while below the rising wedge pattern with the next sell signal to come on a solid break below S2. I view an snapback rallies up to but not above a backtest of the recently broken minor uptrend lines in both QQQ & SOXX as objective add-ons or new short entries. Updated 60-minute chart below.

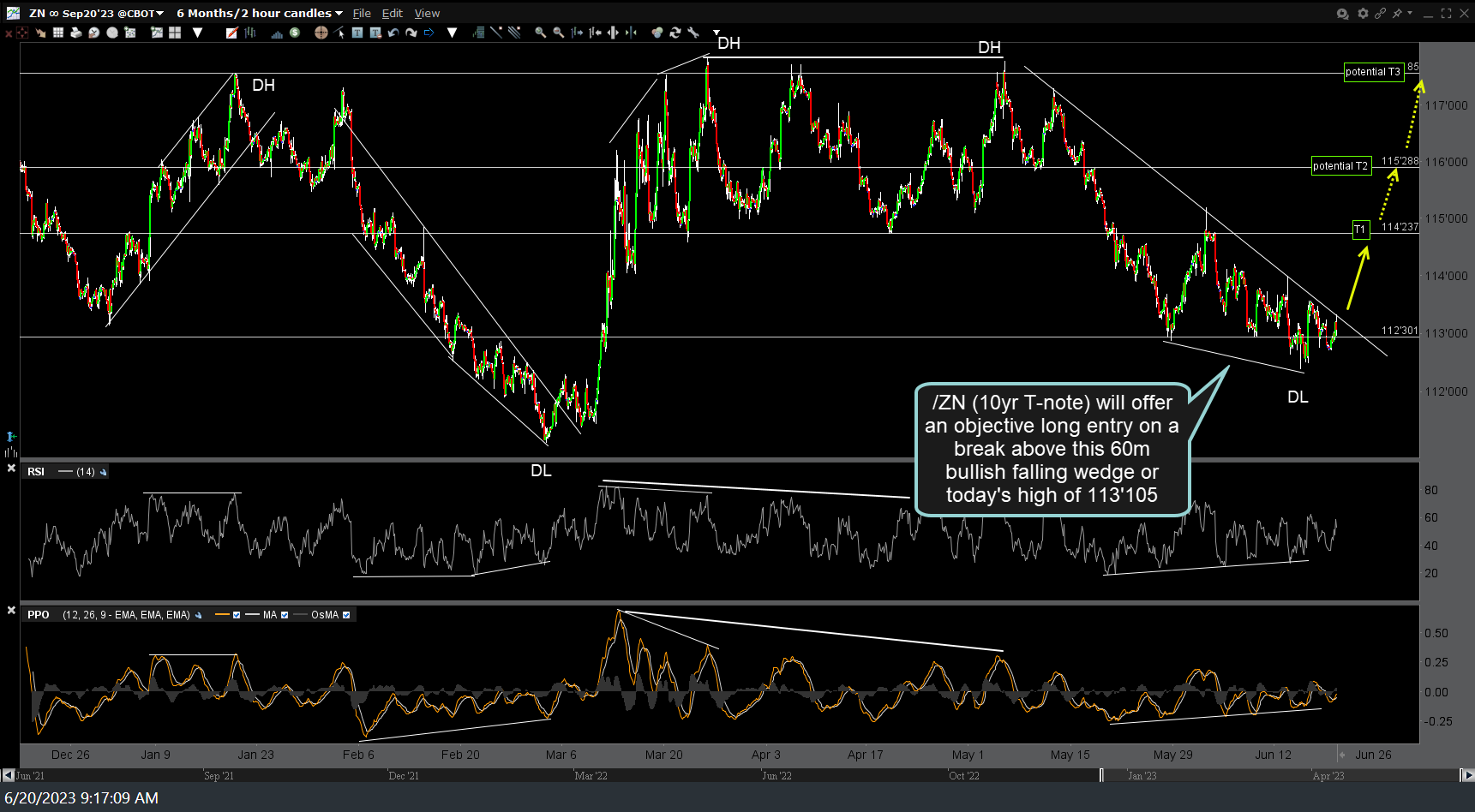

/ZN (10yr T-note futures) will offer an objective long entry on a break above this 60m bullish falling wedge or today’s high of 113’105. T1 at just below the 114’235 resistance level is the first & currently sole target with the potential for additional targets (T2 & T3 on the 60-minute chart below) to be added, depending on how the charts develop going forward.

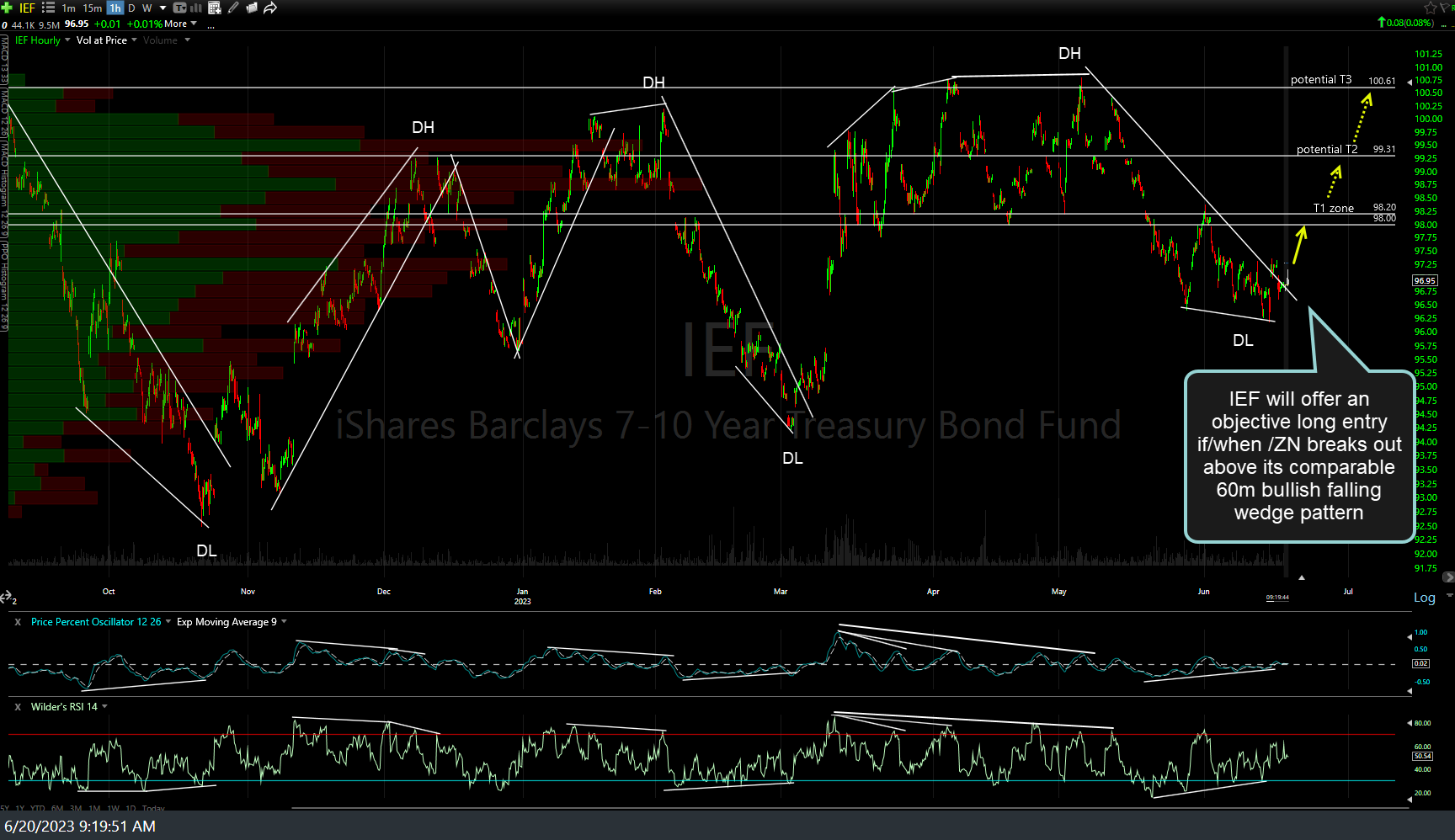

For ETF traders, IEF (7-10 Treasury note ETF) will offer an objective long entry if/when /ZN breaks out above its comparable 60-minute bullish falling wedge pattern. Due to the inherently low volatility & below average gain/loss potential in medium-term Treasury bonds, the suggested beta-adjusted position size for IEF is 2.0-3.0 & suggested stops based on one’s preferred price target(s).