/ZN (10-yr Treasury bond futures) has hit the first target/resistance of 132’094 with the next buy signal to come on a solid break and/or 60-minute close above it. Should Treasury bonds continue to rally, that could be indicative of the smart money (institutions) rotating out of stocks & into Treasuries. IEF is the comparable ETF.

Likewise, /ZB (long-bond futures) has broken out above the 157’157 resistance level. TLT is the comparable ETF & a potential hedge to a long-equities portfolio at this time.

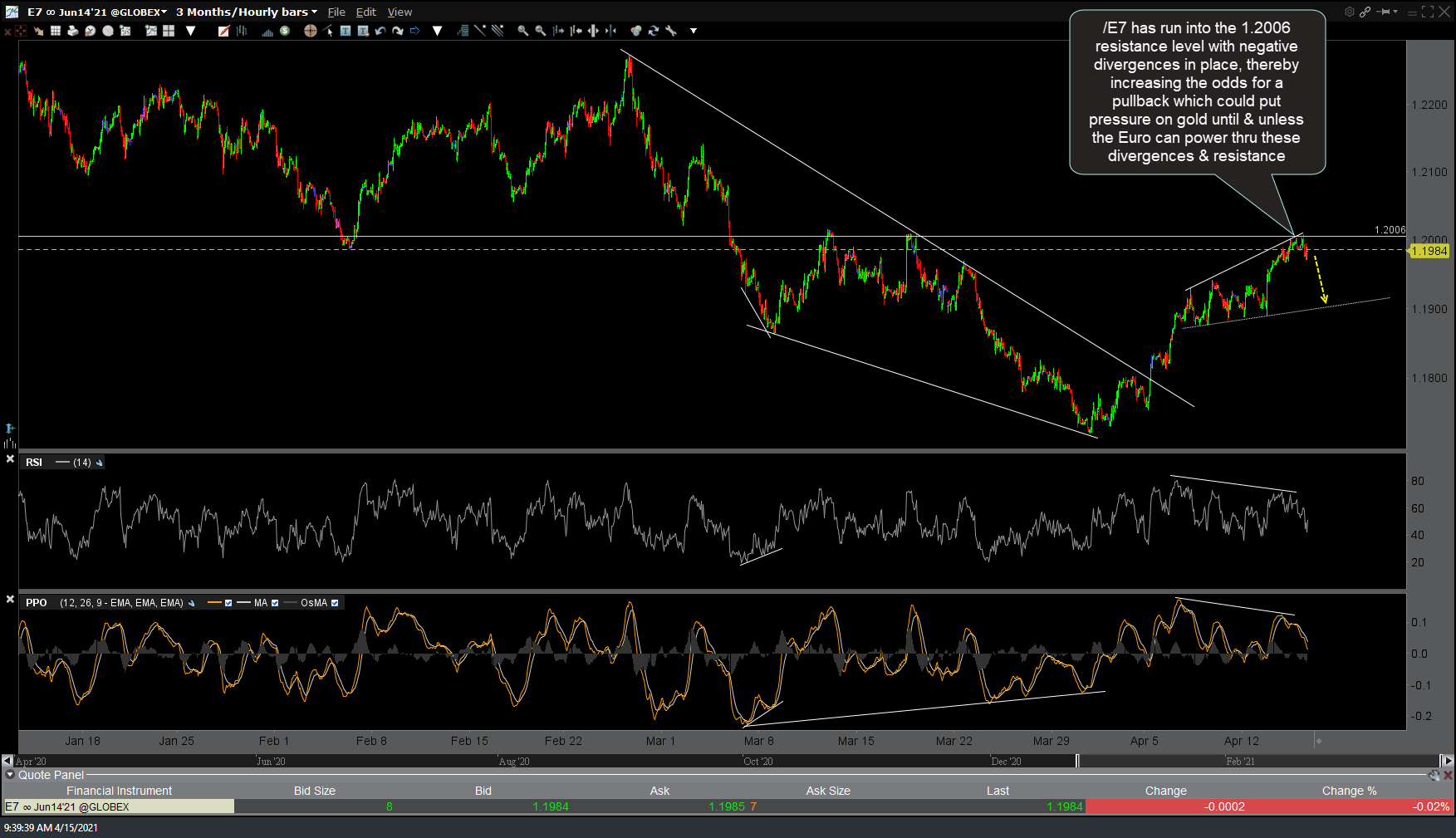

The next buy signal in /GC (gold) to come on a solid break above the 1759.75 resistance (target which was already hit) although see /E7 Euro chart/notes below. GLD is the gold ETF & GDX the gold miners ETF.

/E7 has run into the 1.2006 resistance level with negative divergences in place, thereby increasing the odds for a pullback which could put pressure on gold until & unless the Euro can power thru these divergences & resistance. FXE is the Euro ETN and UUP is the US Dollar ETN.

/NG (nat gas) has pulled back to minor uptrend line (support) offers another objective long entry or add-on with stops somewhat below (or below the 2.526 support). UNG is the natural gas ETN.