Actually, the title “Market Update” isn’t very accurate as the definition of the word Update (as per Merriam-Webster) is: To bring up to date. Yet, the stock market ($SPX, $NDX, etc.. has gone essentially nowhere for over two weeks now, trading yesterday at the same levels it traded at back on August 5th and even more unimpressive, trading within an extremely muted trading range of approximately 1% (top to bottom) since then. Such tight trading ranges don’t last forever & quite often the move following such periods of consolidation can be quite impulsive & profitable to trade. As soon as there are some technical developments worth noting on the broad market I will do my best to communicate those asap.

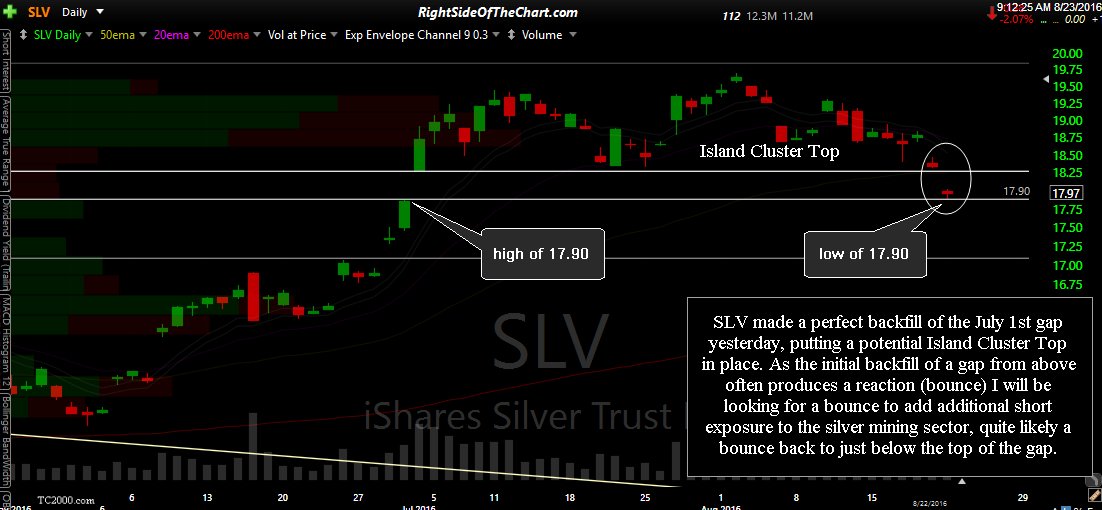

Until then, my focus remains on a few select sectors & individual stocks. The gold & silver mining sector highlighted last week, in particular the silver mining stocks, remains at the top of my list for swing trading opportunities right now. As I had pointed out in the trading room yesterday (along with the fact that SLV was at support & as such, not a good time to add or initiate any more short exposure), SLV (silver ETF) backfilled the large June 30th/July 1st gap yesterday, backfilling that gap to the exact cent before reversing & so far today following through to the upside in the pre-market session. I also mentioned that SIL (Silver Miners ETF) was now clearly trading below the very large & steep bearish rising wedge which helps to firm up the bearish case.

Yesterday’s gap also put in place a potential Island Cluster Reversal topping pattern in SLV, which will be confirm if SLV fails to regain the top of that gap in the coming sessions. As the initial backfill of a gap from above often produces a reaction (bounce) I will be looking for a bounce to add additional short exposure to the silver mining sector, quite likely a bounce back to just below the top of the gap.

One other sector that I’ve been monitoring & trading on the long side lately is the Agricultural Inputs sector with some of the official & unofficial long trade ideas recently highlighted such as MOS, RTK & POT. I plan to put together a video covering the ag stocks & possibly some of the agricultural commodities that may be setting up as swing trades and/or long-term trades.