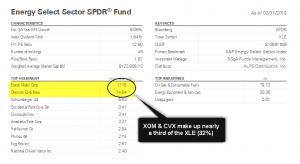

FYI- Regarding the recently posted bearish patterns on the two energy behemoths, XOM & CVX, one option to shorting either or both stocks would be to use XLE (Energy Sector ETF) as a proxy. In fact, these two mega-caps alone account for nearly a 1/3 weighting in that very liquid, actively traded ETF. Personally, that is my preferred vehicle for shorting XOM & CVX as you get the added diversity of shorting a basket of stocks versus just one or two.

FYI- Regarding the recently posted bearish patterns on the two energy behemoths, XOM & CVX, one option to shorting either or both stocks would be to use XLE (Energy Sector ETF) as a proxy. In fact, these two mega-caps alone account for nearly a 1/3 weighting in that very liquid, actively traded ETF. Personally, that is my preferred vehicle for shorting XOM & CVX as you get the added diversity of shorting a basket of stocks versus just one or two.

The leveraged energy sector etf’s, such as DUG & ERY are another option but as my current plan to a likely mult-week to mutli-month swing trade, I would avoid the leveraged ETFs (unless shorting the long versions, DIG & ERX) due to the decay that the leveraged ETF are prone to over time. I’ll to post a chart of XLE with some price targets and a suggested stop level soon.