Today has the potential to be a litmus test for the markets. After the market close yesterday, AAPL (Apple Inc.) unexpectedly slashed its revenue forecast for Q1 2019, citing weakness in China & lower-than-expected iPhone revenue. Apple’s woes immediately carried over to the index futures, dragging the tech & AAPL heavy Nasdaq 100 futures down over 3% from the yesterday’s highs.

While stock futures have been steadily advancing since 7 am EST today, they still have a way to go to recoup all of that AAPL-induced sell-off. The recent trend has been one of overnight weakness in the stock futures, only to see the market rally during the regular trading session, once the starters (big institutions) step onto the field following the opening bell. As such, how the markets trade today might give us some insight as to whether the recent shift from a market under distribution to one under accumulation will continue.

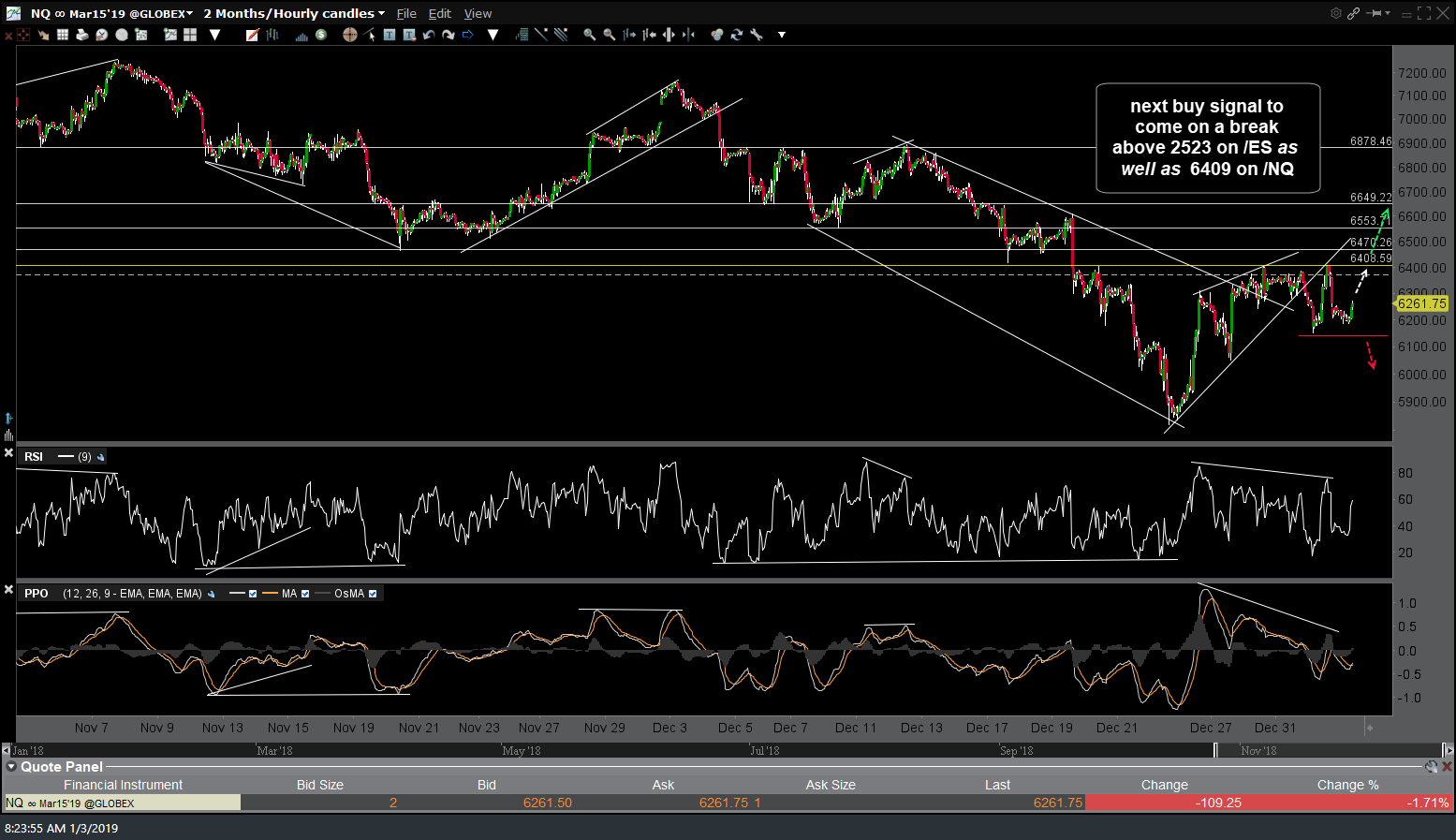

- NQ 60-min Jan 3rd

- ES 60-min Jan 3rd

So far, the AAPL smackdown was unable to take the /ES & /NQ E-mini futures below yesterday’s reaction lows, which came in the overnight/very early morning trading session followed by a strong & steady advance of 4% in /NQ. As of now, last night’s selloff hasn’t inflicted any technical damage to the near-term bullish case but would begin to do so if the stock futures take another leg down to undercut yesterday’s lows. As per yesterday’s comments, the next buy signal on the U.S. equity markets will come on a solid break above the 2523ish level on /ES & 6409 on /NQ/.