Nice dump into the close to print red candles on the SPY, DIA, QQQ, virtually flat on MDY & a slight green close on IWM after the late session dump into the close resulted in a fade of about 75% of the earlier gains. Also worth noting is that only 2 out of the 11 sectors in the SPY closed positive today with XLY (SPDRs Consumer Discretionary ETF) closing virtually flat at +0.01% & PEZ (PowerShares Consumers Discretionary ETF) flat at 0.00%

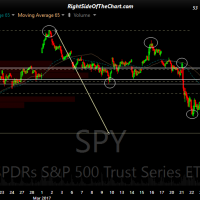

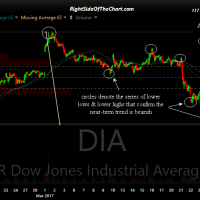

One day doesn’t make a trend but the price action on the 1-minute charts seem pretty clear that any rally attempts were used to unload long positions. However you want to slice it, every major US stock index other than the tech-heavy Nasdaq closed the month with the downtrend off the March 1st highs still very much intact, with all other major US indices (ex-Nas) making a series of lower highs & lower lows closing well below the mid-March reaction highs today. Longer-term trends remain bullish although I have several intermediate-term trend indicators close to flipping to bearish so we’ll just have to see what next week brings. 30-minute charts of the major stock index tracking ETFs, large, mid & small caps, below:

- SPY 60-min March 31s

- DIA 30-min March 31st

- QQQ 30-min March 31st

- MDY 30-min March 31st

- IWM 30-min March 30th

Have a great weekend! -RP