Today’s likely knee-jerk reaction to the retail sales data has spiked US Dollar Index futures up to a backtest of the recently broken 60-minute price channel. My preferred scenario has the $USD reversing off this backtest & fading all of today’s pop & then some with a marginal new high, which would extend the negative divergences that were already in place at the previous highs, before the next leg down in the $USD and rally in gold (edit).

- DX 60-min May 15th

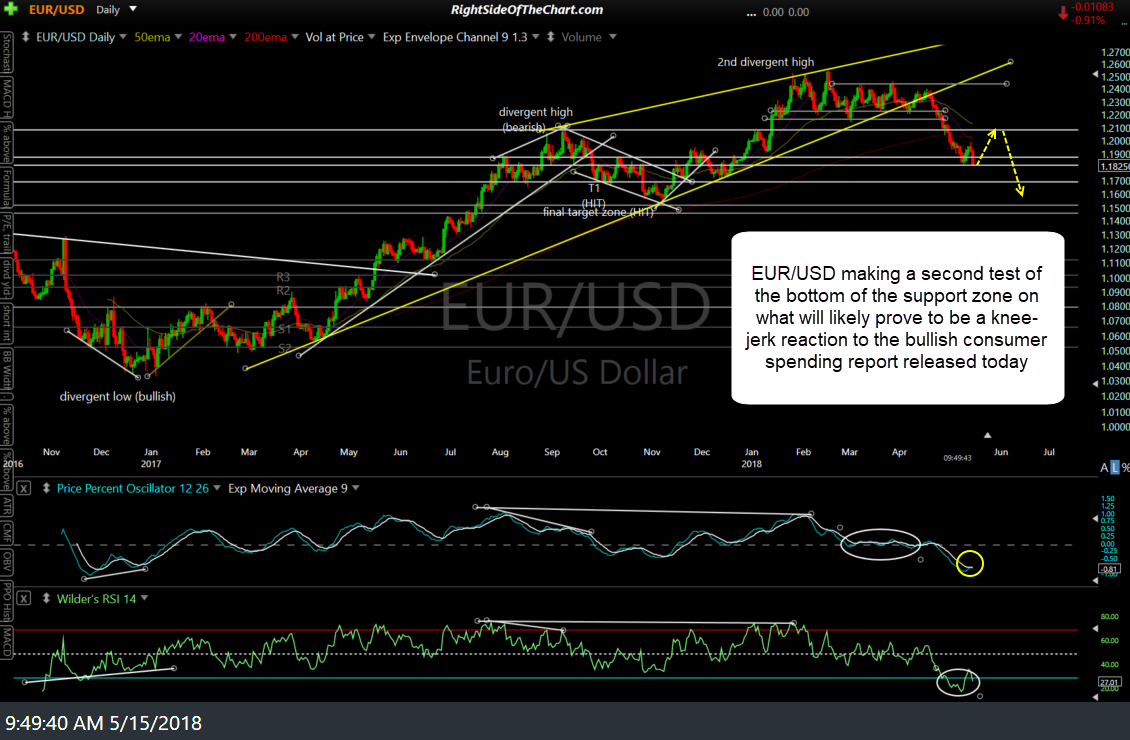

- EUR-USD daily May 15th

DX (US Dollar Index futures) 60-minute chart & EUR/USD daily chart above. Click to expand any chart image. Once expanded, charts can be panned & zoomed for additional detail.

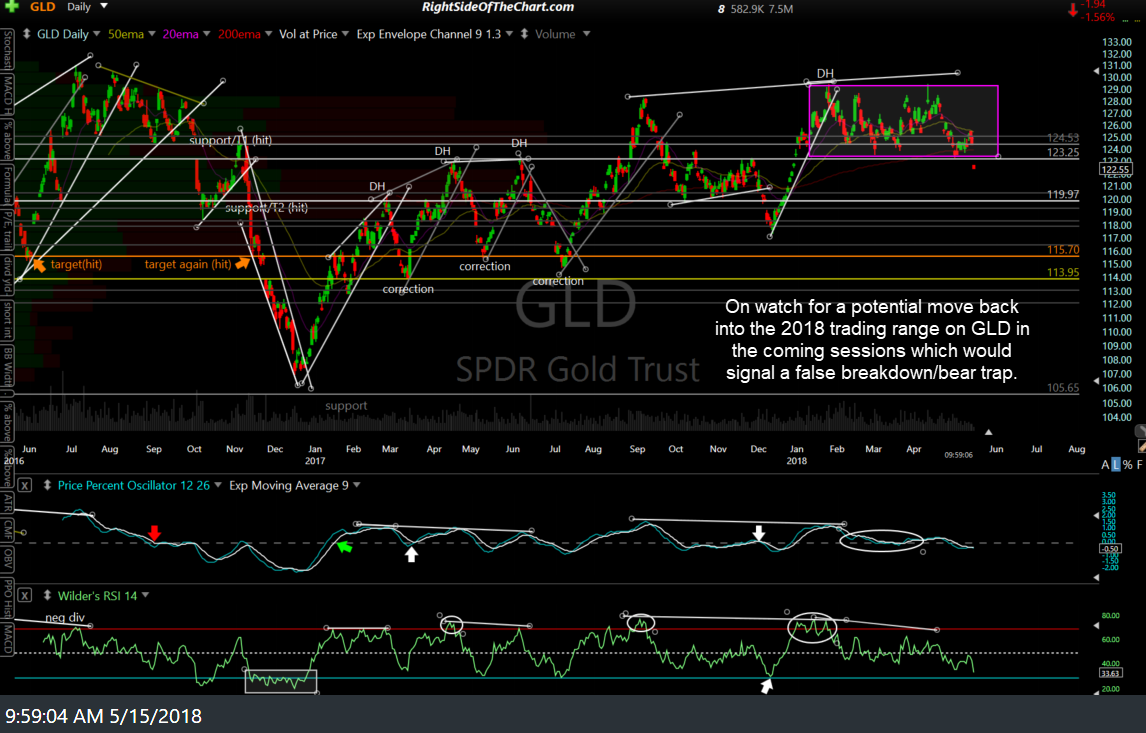

Should that scenario on the US Dollar pan out, I will be on watch for & expecting a move back into the 2018 trading range on GLD in the coming sessions which would signal a false breakdown/bear trap. My reasoning for thinking this is most likely an over-reaction to the consumer spending report released before the market opened today is as follows:

The dollar had already started a bounce off the 92.13 level when hit yesterday, as was expected. The bullish retail sales report immediately caused market participants to assume that the bullish consumer spending report will cause the Fed to become increasely hawkish & increase the odds & trajectory of future rate hikes, which in turn is bullish for the US Dollar (as our interest rates will increase relative to the Euro, Yen & other major currencies in the Dollar Index).

What I believe market participants fail to realize is that consumer sentiment & hence, consumer spending, which accounts for roughly 2/3rds of GDP, can & often does turn on a dime when the stock market experiences a substantial correction.

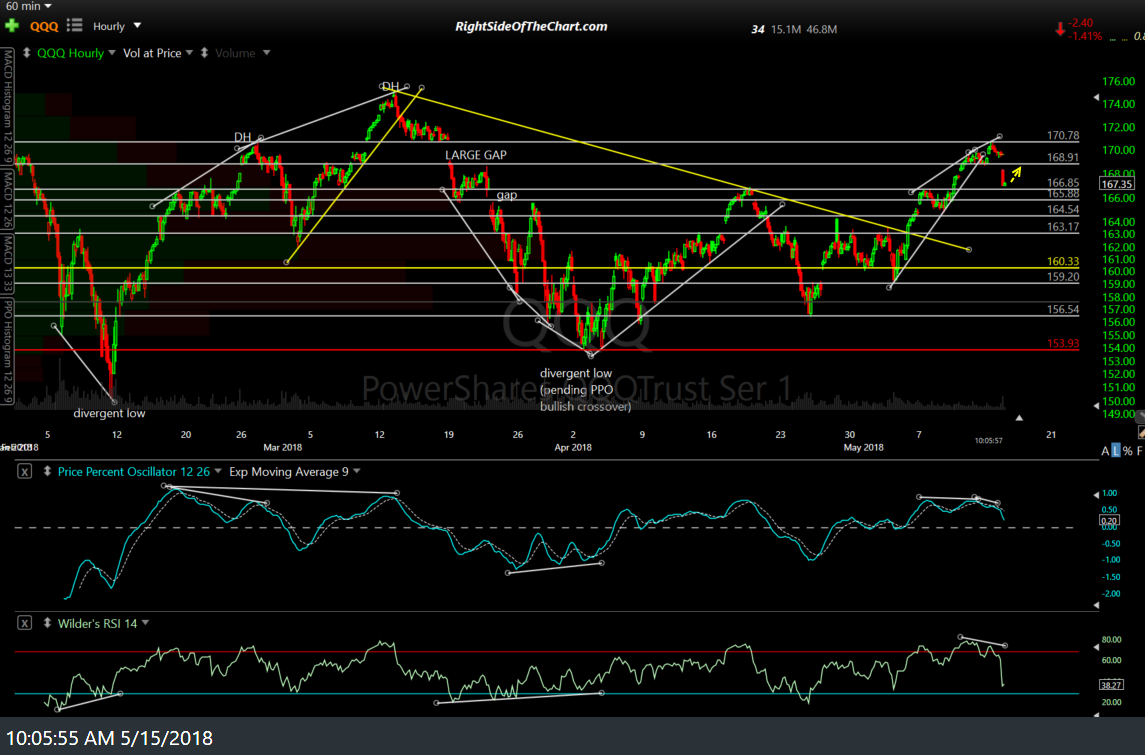

Essentially, the catch 22 that the Fed is in, which is likely to hamper the extent of QT in the coming months, is the fact that this market has been dependent on low-interest rates & will most likely continue to balk at any perceived expectations that interest rates are likely to be increased beyond what that market has already priced in and accepted. Just my 2 cents, of course, but if one thinks that the near-vertical 1½% plunge in the Nasdaq 100 futures immediately following the release of the retail sales report at 8:30 am ET today, which came in conjunction with the sharp spike in the dollar, was mere coincide then we’ll just have to agree to disagree.

That swift drop has taken /NQ & QQQ to my preferred pullback targets following yesterday’s 60-minute bearish rising wedge breakdowns. While I can’t rule out more downside beyond these support levels/targets just yet but expecting a bounce off this 6853ish support level on /NQ & the 166.85ish level on QQQ.