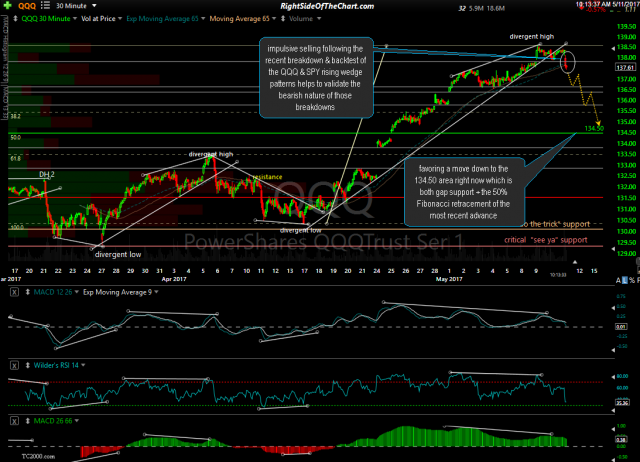

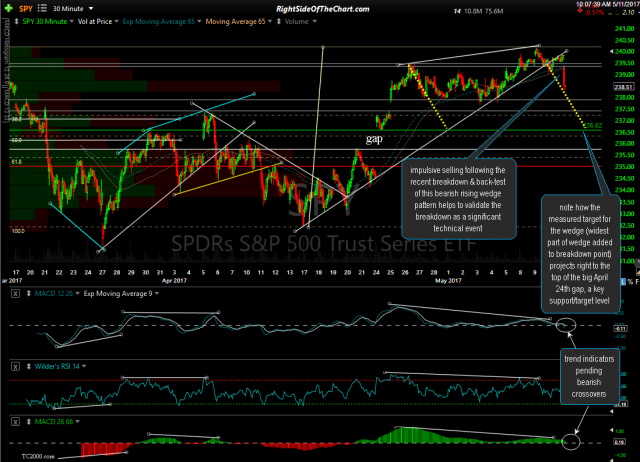

Lots to cover today so I’m going to try to wrap up some of the more significant recent technical developments in this one update. Starting with the SPY & QQQ, both are experiencing impulsive selling so far today following the recent breakdown & back-test of this bearish rising wedge pattern which helps to validate the recent breakdowns as a significant technical events. My expectation at this time is for at least a ~50% retracement on both, price targets shown on these updated 30-minute charts below, which are preceded by the 2 previously posted 30-minute QQQ & SPY charts:

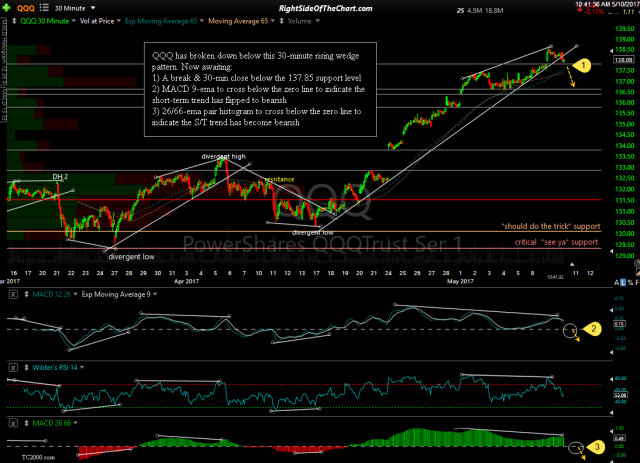

- QQQ 30-min April 9th

- QQQ 30-min May 10th

- QQQ 30-min May 11th

- SPY 30-minute April 9th

- SPY 30-minute May 10th

- SPY 30-min May 11th

I also need to remove the SOXX/SOXS and XLK/TECS trades from the Active Trades category to the Completed trade category as both have exceeded their suggested stops. The SOXX/SOXS short trade exceeded the suggested stop of any move above SOXX 138.20 on April 27th for a modest loss of 3.4% (any trade using SOXS as a proxy should have been adjusted down by 1/3 to account for the 3x leverage, effectively providing an equivalent net loss). That loss also does not factor in the 0.90 suggested downward beta-adjustment to the position size which would effectively account for a loss closer to 3%.

The XLK/TECS trade exceeded the suggested stop of any close below 11.40 yesterday to close at 11.37 for a loss of 4.9%*. (*The net loss was 12.2% but suggested position size listed, which included the downward adjustment necessary for the 300% leverage was 0.40, or 2/5ths of a typical position size). My comments regarding both the semis & tech sector shorts as a reply to questions in the trading room earlier today:

Q: Randy, The semis took a beating today, are you stopped out of your short?

No, not personally. My conviction is strong on the semi short. The semi & tech etf shorts just cleared the official stops with TECS closing w cents below it’s stop yesterday so both of those will be removed from the Active Trades category & almost certainly added back as official trades soon but again, personally, I’m even more short tech & the semis by shorting NQ (Nasdaq 100 e-mini futures) early this week for the first time & a while & plan to hold my semi & tech shorts for the time being.

Q: TECS closed at 11.37..does that mean we are stopped out?

Yes, officially the trade was stopped out at the close yesterday by 2 cents below the suggested stop of any close below 11.40 (i.e.- 11.39 or less). I will most likely be adding it back as an official trade due to the fact those bearish rising wedges on SPY & QQQ (30-minute charts) recently broke down & are playing out with additional downside so far today (i.e.- validation/confirmation of the breakdowns).