Despite what might have appeared to be an impressive or convincing reaction to the FOMC announcement yesterday, that intraday rip which took the broad market from red to green in the blink of a machine (HFT machines, that is), the near-term & longer-term technical picture has not changed. For as long as I can remember, I’ve harped on the fact that for the most part, there are three things that you can count on during FOMC announcement days:

- A muted (mostly flat) market leading up the the announcement, which is typically released around 2pm ET.

- Very sharp, nearly vertical rips and dips.

- More often than not, the initial knee-jerk reaction is often faded with a nearly equal, if not greater, move in the opposite direction.

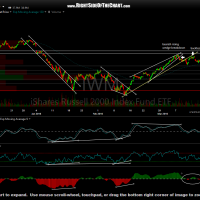

As these intraday charts above show (gray areas are pre & post-market trades, regular trading sessions in white), despite the post-FOMC pop, the major indices are trading at or below where they closed on Monday. The 60-minute charts below show that the markets are still at or below key resistance levels with bearish (negative) divergences still well intact.

- $NDX daily March 17th

- $SPX 60-minute March 17th

- IWM 60-minute March 17th