Over the years I have repeatedly stated the almost unique risk involved in trading biotech stocks, particularly smaller biotech companies and/or those with a lot (or everything) riding on the success of a single drug or very narrow pipeline.

In combing through one of my watch-lists today, PBYI (Puma Biotechnology) was on one end of the spectrum, closing up 40% on the day with IMGN (Immunogen Inc) on the other end, closing the day down nearly 47%. The risk that I warn of being unique to the smaller or even larger biotechs with a lot riding on just one drug is the fact that it is nearly impossible to limit your risk of loss on those trades* (referring to going long or short shares, not purchasing options as a pure play or hedge/loss mitigation, which brings in another element and quite often, is not cost effective).

While a position in any stock within any industry entails risk to some degree or another, including unforeseen negative news on a company that catches investors & traders off guard, the risk that is unique & much more likely to occur with biotechs is the release of negative or positive clinical trial results and at times, unforeseen negative results on a drug that has already gained FDA approval.

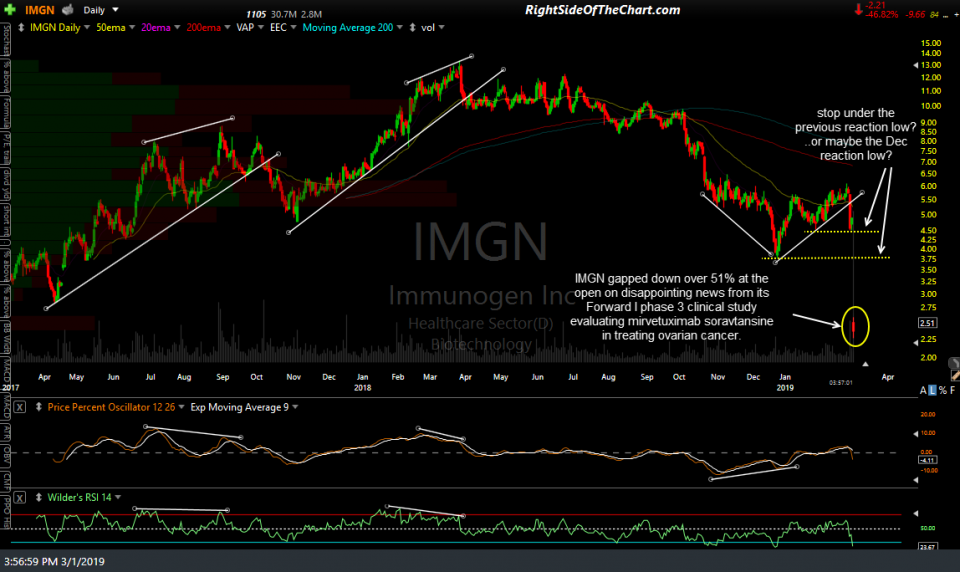

IMGN gapped down over 51% at the open on disappointing news from its Forward I phase 3 clinical study evaluating mirvetuximab soravtansine in treating ovarian cancer. Looking at the daily chart below, let’s say that a trader or investor went home with a long position in IMGN last night. Let’s also say that investor or trader is diligent about using stop-loss orders at all times to limit his/her losses on a trade.

Glancing at this chart and assuming a entry taking somewhere yesterday when the stock mounted an impressive 8%+ rally of the support level defined by both the previous day’s lows as well as the Jan 29th reaction low/hammer reversal candlestick (a seemingly objective entry), let’s then assuming that the trader/investor set a stop at one of two most logical spots: Slightly below that 4.54ish level which now had 3 reactions since Jan 29th to define it as support, or a much more liberal stop set just below the big Dec 24th reaction low/pivot point.

The problem with stop-loss orders is that they are bypassed on a gap. A trade might use a stop-loss order, which is technically converted into a market order & fills once the stock crosses the stop price. In that case, a stop-loss order placed at either of those two levels would have been filled shortly after the stock opened for trading today around 2.38, almost cut in half from where it closed yesterday. A stop-limit order is set to fill at a specific price (the stop-limit price) if & when the stop price is hit but only at the stop-limit price or better. In other words, a GTC stop-limit order at either of those 2 objective stop levels would still be a standing open & unfilled order with the position still active/long.

Unlike the most common cause for a stock to gap up or down, quarterly earnings reports, positive or negative clinical trial results often come out of the blue which makes them nearly impossible to navigate around as one can with quarterly earnings, as the release dates are published in advance. While those coming into the day long IMGN felt some pain today, gaps can & often do go the other way on small biotech stocks.

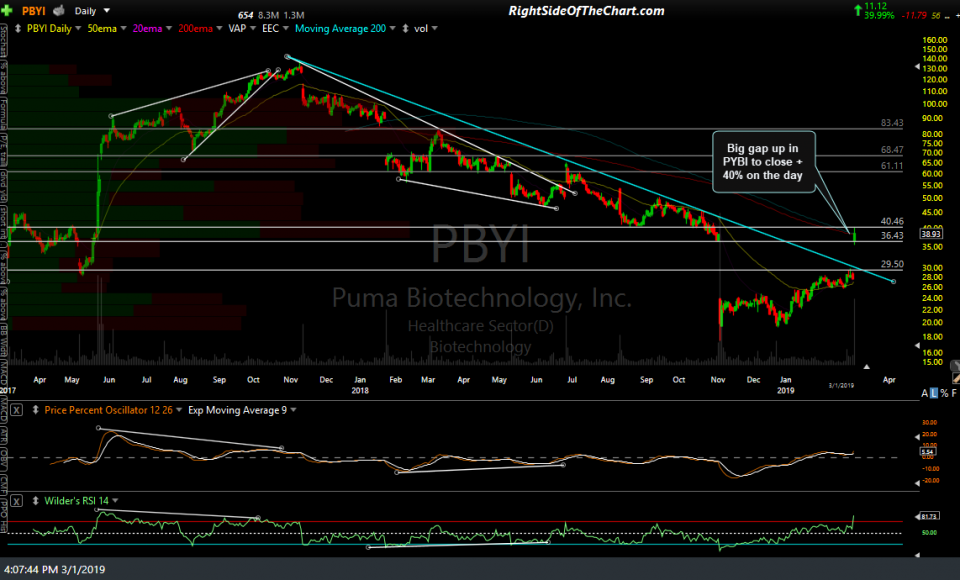

PBYI gapped up 32% today, although not on positive clinical trials but rather on a positive… er,’not as bad as expected’ earnings report. Small biotechs & smaller companies, in general, are prone to larger price swings from earnings & other news. So while the gap up today was a boon for those that went home long, the same pain felt by those that went home short with a strategically well-placed stop-loss order set somewhat above that primary downtrend line was inflicted as they either had their stop-loss order executed around today’s opening price, 32% above where the stock closed yesterday, or they watched their losses continue to mount throughout the day as PBYI added another 8% or so on top of the opening gains before peaking for the day around 3 pm.

Okay, Got it. Biotech stocks can run an above-average risk of unusually large & unpredictable/unforeseen gaps, I get it. Does that mean that I shouldn’t invest or trade anything but the largest, most diversified biotechs?

That depends. First & foremost, it depends on your risk tolerance, portfolio size & ability to sustain a loss of 50% or more on a position(s) and other factors. Many traders & investors are allured to the biotech sector as the gain potential for many of those stocks, particularly the smaller biotechs with one or more potential blockbuster drugs in their pipeline & for good reason. Those with relatively small portfolios are, generally speaking, better off gaining exposure to the biotech sector via a mutual fund or ETF such as XBI, IBB or PBE especially aren’t able to sufficiently diversify among a half-dozen different biotechs (assuming their overall exposure to the biotech sector within their total portfolio allocation is still within a reasonable percentage).

Those with sufficient capital & risk-tolerance might consider taking a ‘shotgun’ approach to investing in the biotech sector, assuming they prefer to hold individual stocks in lieu of or in addition to ETFs or mutual funds. Purchasing put (or call, if short) protection on individual positions will limit your risk against an unusually large gap against your position but many smaller biotech stocks often do not have options available & for those that do, the options are usually very thinly traded & costly (i.e.- fat premiums built into the options with wide spreads & low liquidity). As such, one will have to do the math to see if continually carrying put protection against a long position is cost-effective or not.

Most importantly, IMO, is proper position sizing when trading biotechs, or really any security for that matter. About the only constant that I know to exist in trading is the fact that risk & reward go hand in hand. Any stock you buy that has the potential to make 500% or more, such as many of the small biotechs working on that next “blockbuster” drug, are just as likely to potential to lose 50-100%. As such, when defining how much you are willing to lose if a biotech stock position goes against you, make sure you have done at least some minimal due diligence on the company’s fundamentals & are aware what that the impact for the company might be following an abrupt cessation of clinical trials on news negative results.

You can plug different values into the Trade Position Size Calculator to see what the gains or losses on these two stocks today would have looked like, had you had a position of $X amount in either of those stocks coming into today.

Safe Trading,

-RP