The pullback trade idea on the /ES and /NQ E-mini futures highlighted in yesterday’s closing market wrap video & then again posted here in the comment section below that post when /NQ had run into the 7620 resistance while /ES was also still trading at the 2460 resistance level was good for the expected ~3% pullback on both.

The /NQ short trade off the 7620 posted in that comment section below yesterday’s final post (first chart below) was good for a 3.2% pullback with /NQ falling to & making a perfect tag of the downtrend line highlighted in the video. From there, /NQ reversed & rallied, going on to make another run at & so far, a failed breakout above the 7620 resistance level (bearish) while also putting in a small divergent high (also bearish). While I’d prefer to see how the market trades once the regular session gets underway today before doing much, I’m currently leaning towards a little more upside from the futures are trading right now followed by another leg down, something along the lines as shown in the updated (2nd) chart below.

- NQ 60m 4 March 24th.png

- NQ 60m March 25th

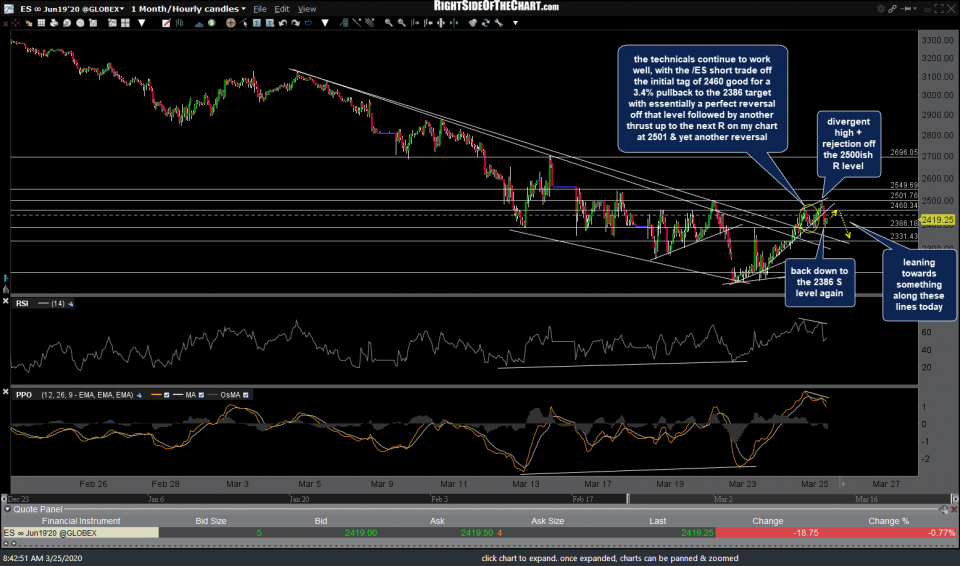

Yesterday’s post-market /ES short trade taken off the initial tag of 2460 was good for a 3.4% pullback to the 2386 target with essentially a perfect reversal off that level followed by another thrust up to the next resistance on my chart at 2501 & then followed by yet another reversal off that level… a futures trader’s dream (although unfortunately, I wasn’t awake at 5:30 am to catch that last objective short entry). From there, /ES put in a divergent high & was rejection off the 2500ish resistance level, reversing & falling back to the 2386 support level once again. As with /NQ, I’m leaning towards a small bounce from here first, followed by another thrust down although again, I would prefer to see how the market trades once all the players step onto the field at 9:30 am today. Yesterday’s & today’s 60-minute charts below.

- ES 60m 2 March 24th.png

- ES 60m March 25th