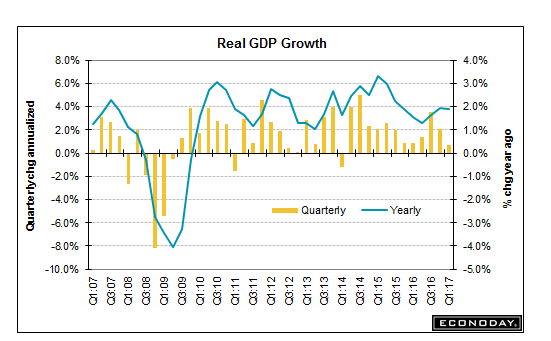

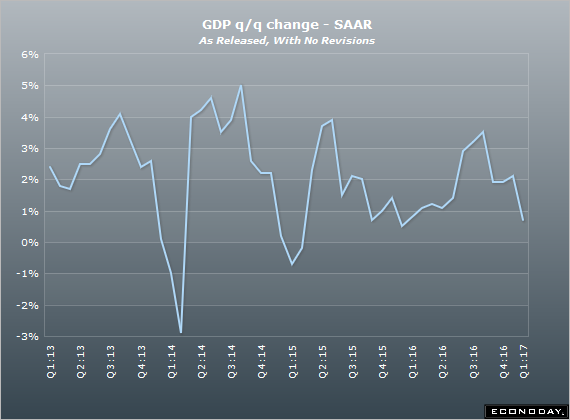

A couple of potential market moving events are scheduled this week. AAPL (Apple Inc.) is scheduled to report earnings tomorrow (Tuesday) after the market close. On Wednesday, the FOMC meeting announcement is scheduled for 2:00pm ET. As of today, Fed Fund futures are pricing in a 95.2% probability of no change in the federal funds rate. While that will most likely be the case, with Friday’s soft GDP report coming in below expectation, particularly the unexpected slow down in consumer spending, the fact that no change in rates is nearly fully priced in, that skews the potential for any market moving surprises to the downside although again, the odds strongly favor no change in rates following this week’s meeting.

- Real GDP Growth April 28th

- GPD q-q change April 28th

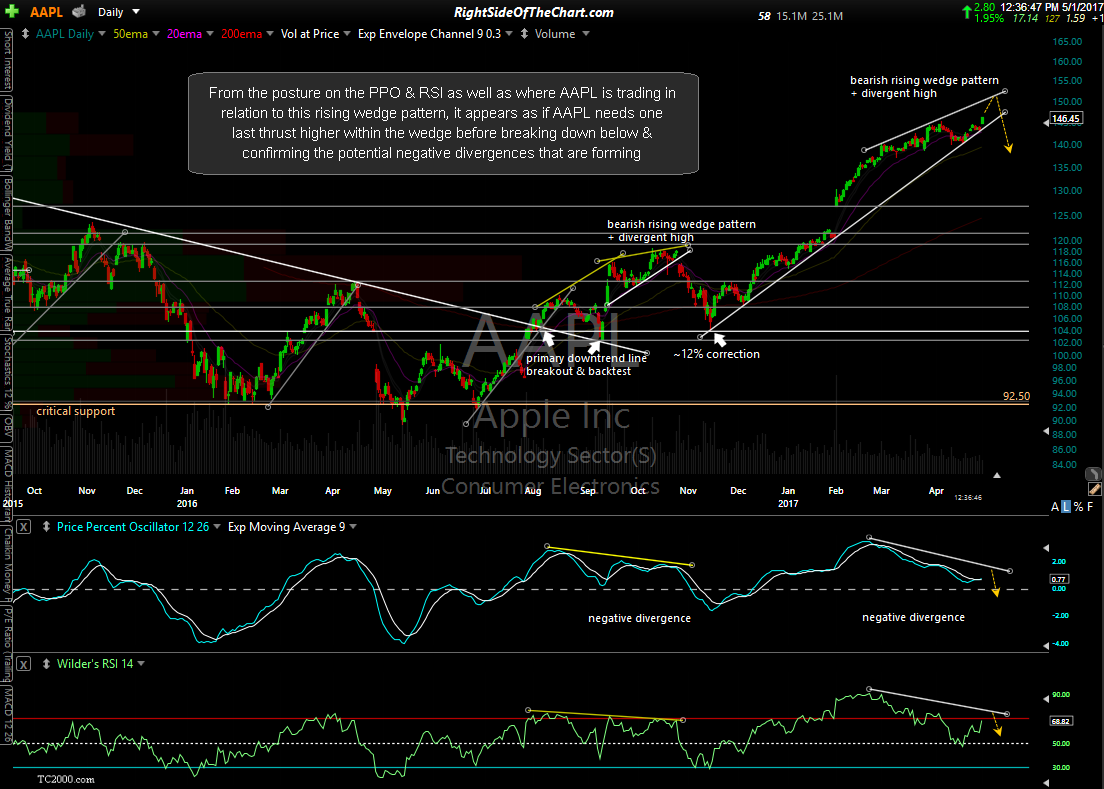

Looking at the AAPL daily chart below, from the posture on the PPO & RSI as well as where AAPL is trading in relation to this rising wedge pattern, it appears as if AAPL needs one last thrust higher within the wedge before breaking down below & confirming the potential negative divergences that are forming.

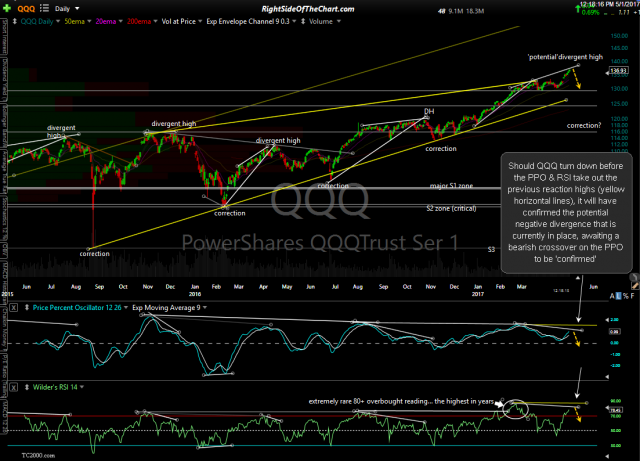

Earlier today in the trading room, I was asked if the divergences in QQQ are officially cancelled now. My reply, follow-up comments & updated daily charts of QQQ & SPY below:

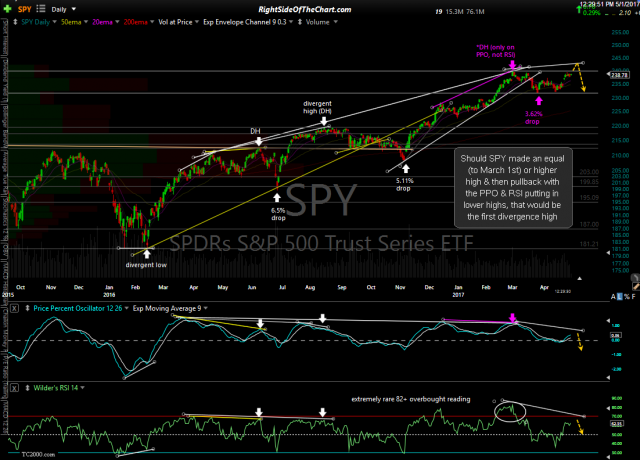

Regarding QQQ, as well as SPY, on or around March 1st we had negative divergence on the PPO but not on the RSI, at the RSI made a higher high, taking out the potential divergence on that oscillator. At the time, I since the RSI hit an extreme overbought reading not seen in at least decades, I figured that a correction would soon follow. However, that wasn’t the case so far as they Q’s continued higher.

In hindsight, we can now say that— 1) That was one of those “10% or so” instances where I say that divergences don’t play out and — 2) While I though the overbought reading was so extreme that a correction would soon follow, the fact that we only (and barely*) had divergence on the PPO & not the RSI as well was (in hindsight) as sign of non-confirmation as I typically prefer to see divergence on both the PPO & RSI.

* I used the term ‘barely’ since the PPO had flat-line divergence, meaning that the peaks in the PPO were roughly equal with the divergence being that prices had made a clear higher high at the time of the second peak in the PPO. In fact, the MACD made a slightly higher high, technically undoing the potential divergence that was building into late February.

Bottom line is that we still need to see at least 4 of the 5 FAAMG stocks break down below their primary uptrend lines or other key support levels. Also worth noting is that QQQ has potential divergence in place now which could be confirmed very soon if it pulls back or even starts to trade sideways for a while as both the PPO & RSI are still well below their previous reaction highs as QQQ trades at new highs.

We also have potential divergence on SPY although SPY would need to make an equal or higher high (at or above the March 1st high) with the a bearish crossover on the PPO and/or MACD before the move above their respective March 1st highs.

Most likely the market will be on hold until AAPL reports after the bell tomorrow so personally, I don’t plan to open many new positions until at least Wednesday. I’ll post some charts of AAPL & QQQ/SPY with some near-term levels to watch for this week soon.I should add that the FOMC rate decision for this week’s meeting is scheduled for 2pm ET on Wednesday so essentially, best to wait until at least Thursday before establishing any new swing trade positions as between AAPL earnings & the FOMC rate decision, the markets could get choppy mid-week, running stops on both longs & shorts alike as well as triggering false breakouts (buy & sell signals).

- QQQ daily May 1st

- SPY daily May 1st