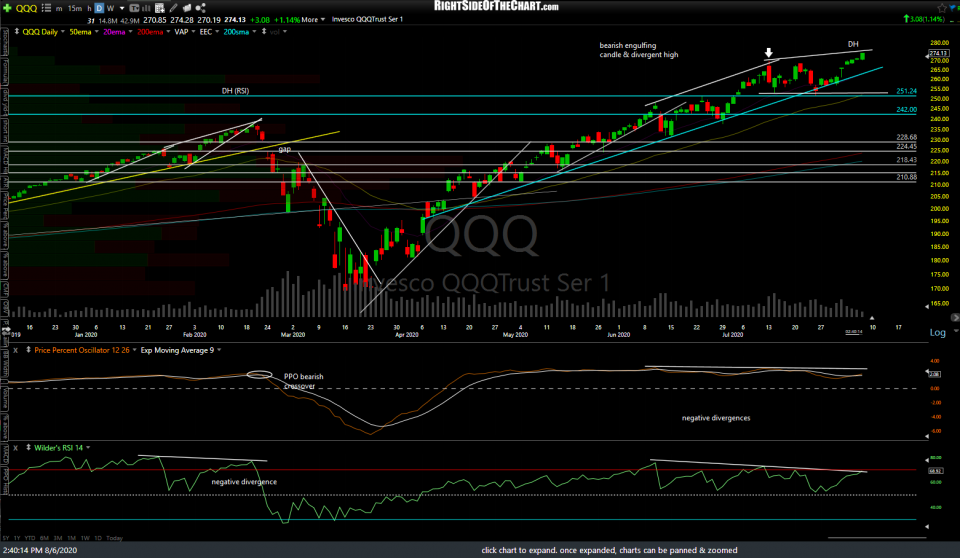

There really aren’t any significant developments to report on the major stock indices although I figured that I would post a couple of charts & a brief update. The mega-cap & over-weighted FAAMG stocks continue to do most of the heavy lifting, keeping QQQ above the uptrend line as well as the July 14th low, with sell signals still pending a break below both those levels.

Both QQQ & SPY continue to drift higher on declining volume with the uptrend still intact as the negative divergences continue to build. Although the broad market isn’t likely to reverse trend until the majority of the FAAMG stocks have broken down, a break below the blue uptrend line & 318.30 support level on the SPY daily chart below would likely open the door to a larger correction. Again, there are not any sell signals at this time but I will continue to monitor the major stock index ETFs & futures and I will post any significant developments asap.

Select agricultural commodities continue to outperform the stock market in recent weeks, with gains of 30% in coffee & 24% in cocoa in recent weeks along with most ag commodities posting double-digit gains in recent weeks and/or months. Should today’s breakdown below the uptrend line take /KC coffee back down towards the 1.1494 former resistance/target, now support level, that would offer an objective add-on or new long entry.

JO (coffee ETN) is taking a breather following today’s trendline breakdown with overbought readings on the RSI following the 30%+ rally over the past couple of weeks. Objective entries would come on pullbacks to or somewhat above the first 2 price targets (now support).

NIB (Cocoa ETN) has rallied about 24% since the last objective entry on the pullback to the primary uptrend line with bullish divergences in place at the time & looks to be headed back up to the long-term target zone that was laid out in late-2017 & hit in early 2018, with the typical minor zigs & zags along the way to be expected.

We don’t have any buy signals on CORN (corn ETN) yet although it does offer an objective long entry (either a hard/full entry or soft/scale-in using multiple lots) here at support as the bullish divergences continue to build.