Following the expected second reversal off the 10942 support level (as per yesterday’s video), /NQ has once again rallied back to the channel mid-point line & 11156 resistance level (both resistance) with the next objective long entry to come on a solid break above.

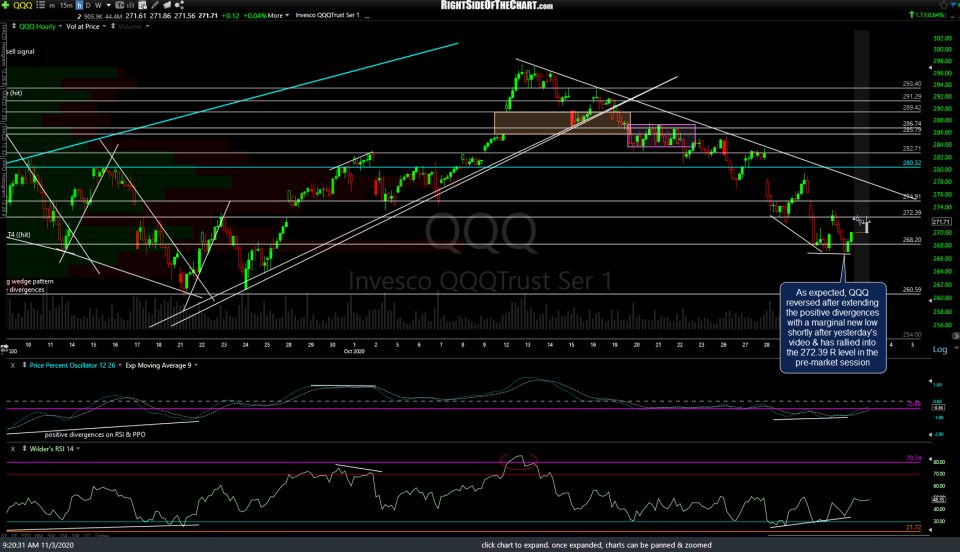

Likewise, QQQ reversed after extending the positive divergences with a marginal new low shortly after yesterday’s video & has rallied into the 272.39 resistance level in the pre-market session.

/ES (S&P 500 futures) has also rallied about 2.25% since the highlighted backtest of the downtrend line during yesterday’s video following the most recent divergent low.

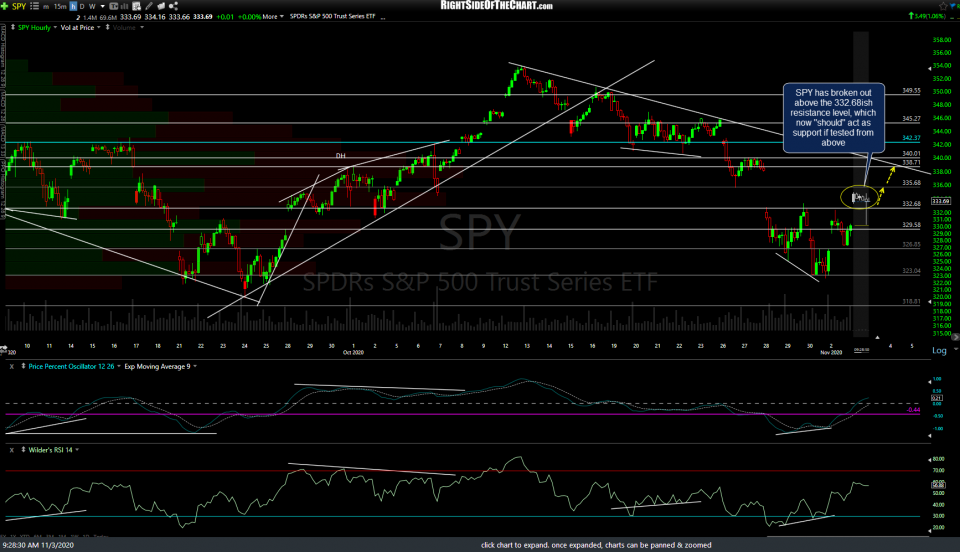

Bottom line: While the elections most certainly have the potential to override the charts, as of now the near-term posture of the equity indices is constructive (bullish). However, as I like to say: Resistance is resistance until & unless taken out & as of now, QQQ & /NQ are trading at resistance with /ES slightly below the 3363 resistance level. It should also be noted that SPY has broken out above the 332.68ish resistance level, which now “should” act as support if tested from above.