Despite the large swoon down in the stock futures in the after-hours session yesterday, so far we simply have a successful test of those key support levels on /NQ & QQQ. After testing the key 211.42 support level on QQQ & the comparable 8694 support on /NQ 8694 (with the typical & expected brief momentum-fueled/stop-clearing overshoots), the equity indexes reversed to recover all of yesterday’s post-closing losses & then some. 60-minute charts below (gallery/multiple chart images will not show on email notifications but may be viewed on rsotc.com).

- QQQ 60m Jan 8th

- NQ 60m Jan 8th

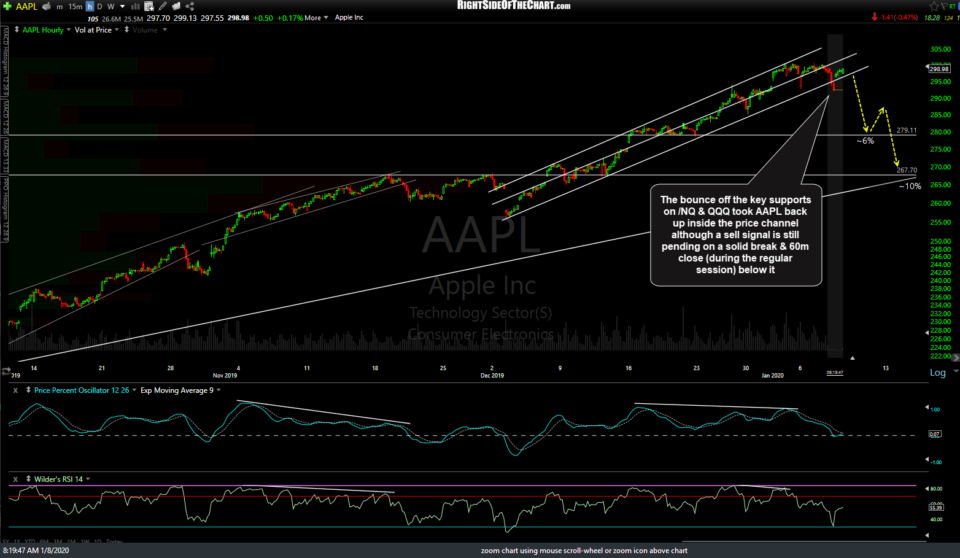

The reversal has also taken AAPL back up comfortably inside the 60-minute price although that is still very much a key level to watch going forward. As I like to say, take everything that happens outside the regular trading session with a grain of salt. One other thing to note is that similar market conditions such as the recent large expansion in volatility in the stock indexes (since December 27th) following an extended low-volatility grind higher typically doesn’t end well.

Essentially, we are currently poised to start today where the market finished yesterday so backing out what happened last night & earlier today, nothing has changed from a technical perspective. Either way, let’s see what the regular session brings today once all the players have stepped onto the field at 9:30 am. As of now, stock futures are trading at resistance & spent a lot of fuel just to recoup last night’s losses so I’d suspect any upside today will likely be limited.