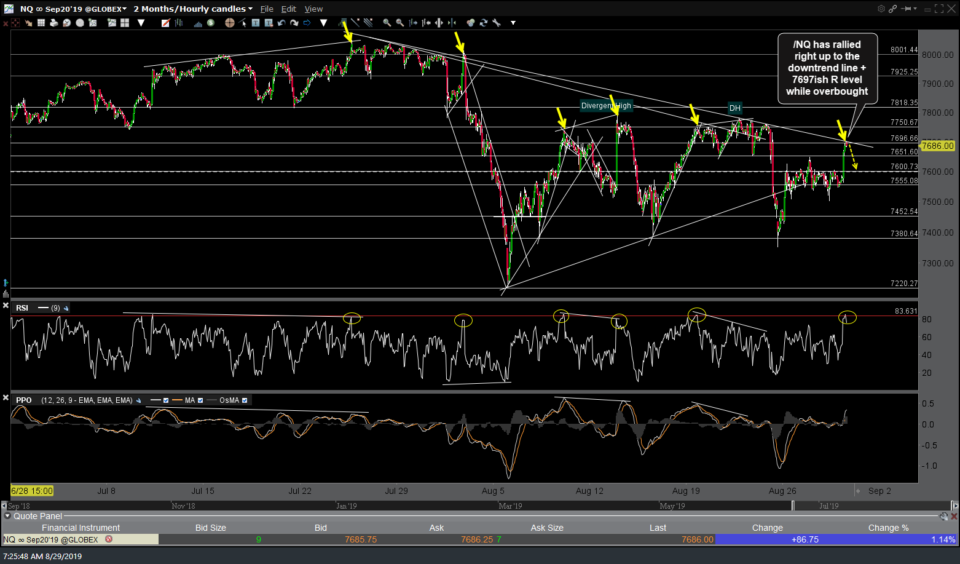

/NQ Nasdaq 100 futures contract) has rallied right up to the downtrend line + 7697ish resistance level while overbought.

Likewise, /ES (S&P 500 futures contract) has also rallied right up to the downtrend line + 2914ish resistance level while overbought. As such, the odds for a reaction/pullback off these levels -or- a false breakout, should the futures pop following the release of the GDP report at 8:30 am EST today.

At most, I would expect the futures to trade flat between now & 8:30 as market participants await the GDP report. The futures spent a lot of fuel just to rally up to these key downtrend lines, hence my expectation that even a positive reaction* to the GDP report is unlikely to propel the indexes much further today, with the most likely max. upside target still the top of the Aug 2nd-current trading ranges which only lie about 3/4ths of 1% above current levels. As such, we have yet another objective shorting opp. on this bounce back to resistance anywhere from these downtrend lines to the tops of the trading ranges less than 1% above with stops somewhat above that.

With that being said, objective or not, I really didn’t want to see the indexes make another run at the top of the trading ranges with tomorrow marking the 4th week within them & the terms objective & high-probability are not one in the same. As such, it might be best to keep things light for at least the early part of the regular trading session today to let the bulls & the bears battle it out.

*Any positive reaction to the GDP will be interesting as a hot GDP number would most likely mean a downward revision in the expectation of future rate cuts whereas GDP coming in below expectation would result in a more dovish Fed yet only confirm that the economy is decelerating at a faster rate than previously anticipated. Either way, today should be interesting.