Here’s a snapshot of the E-mini stock index futures. /ES (S&P 500) and /NQ (Nasdaq 100) both broke support yesterday & are currently approaching their next support levels with the positive (bullish) divergences still very much intact, albeit pending confirmation via a bullish crossover on the PPO at this time. 120-minute charts below:

- NQ 120-min May 29th

- ES 120-min May 29th

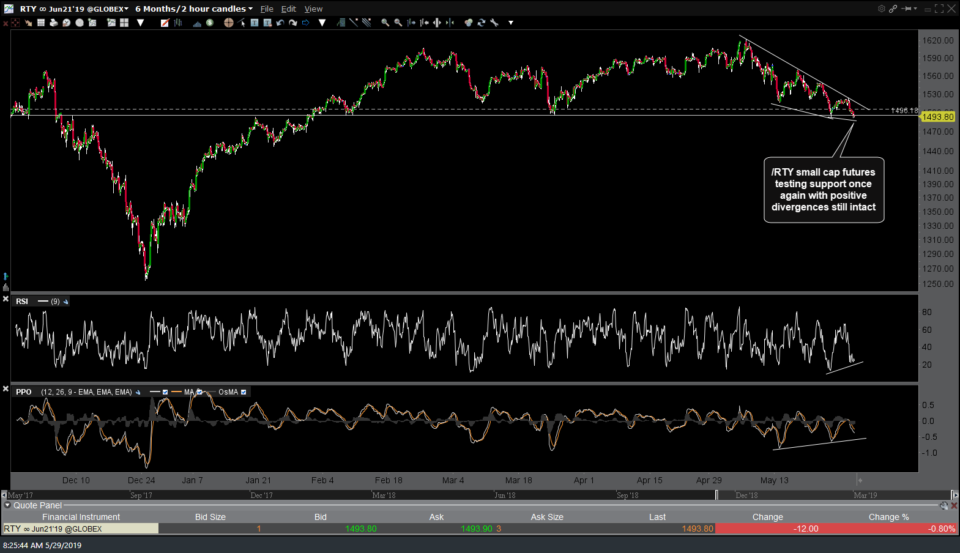

/RTY (Russell 2000 Small Caps) is currently making another test of the 1496 support level with the bullish divergence also still very much intact for now. As I like to say, positive divergences are not a buy signal, merely an indication that an impending trend change is likely so at this point, I’m on the lookout for any potential buy signals such as a potential bullish candlestick reversal pattern or possibly a tag and reversal off the next support levels below. 120-minute chart:

Currently, in pre-market trading both SPY & QQQ are indicated to gap down below the 280 & 178 key support levels with both trading slightly above their next support levels (daily charts) around SPY 277.53 & QQQ 175.66, so my plan is to wait & see if the market reverses off those levels, if hit, and/or if the 280 & 178 former support, now resistance levels are regained after the regular trading session gets underway. While the potential for those next support levels to be taken out with a much deeper slide in the indexes is certainly a possibility at this time, the R/R to adding new index shorts is not very favorable at this time.