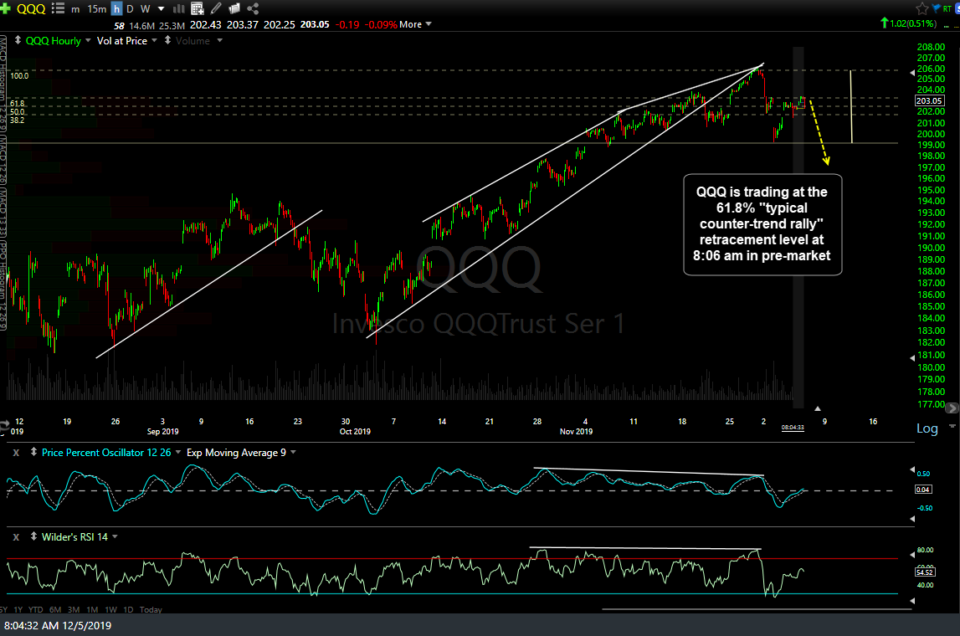

Both SPY & QQQ are trading at their respective 61.8% “typical counter-trend rally” retracement levels at 8:06 am in the pre-market session so it’s still too early to say with any degree of confidence whether the correction off the Nov 27th highs ended with Tuesday’s lows or if this is just a typical counter-trend bounce with more downside to come.

- SPY 60m Dec 5th

- QQQ 60m Dec 5th

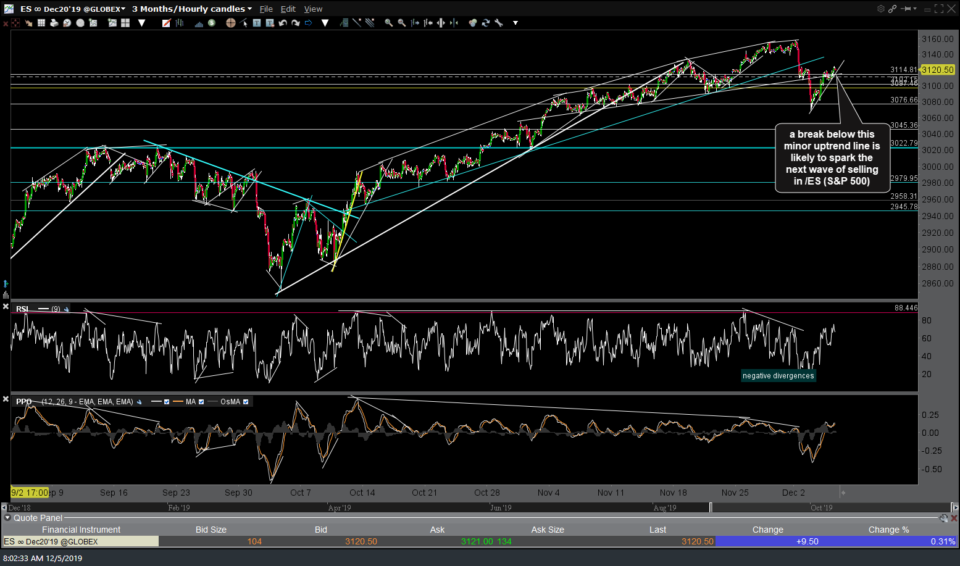

Despite the fact that the stock indexes are still comfortably below last Wednesday’s highs, the very near-term trend (since Tuesday) remains bullish although a solid break & 60-minute candlestick close below the minor uptrend lines on these equity index 60-minute futures charts; /NQ, /ES & /RTY, would likely spark another wave of selling that could undercut those recent lows.

- NQ 60m Dec 5th

- ES 60m Dec 5th

- RTY 60m Dec 5th