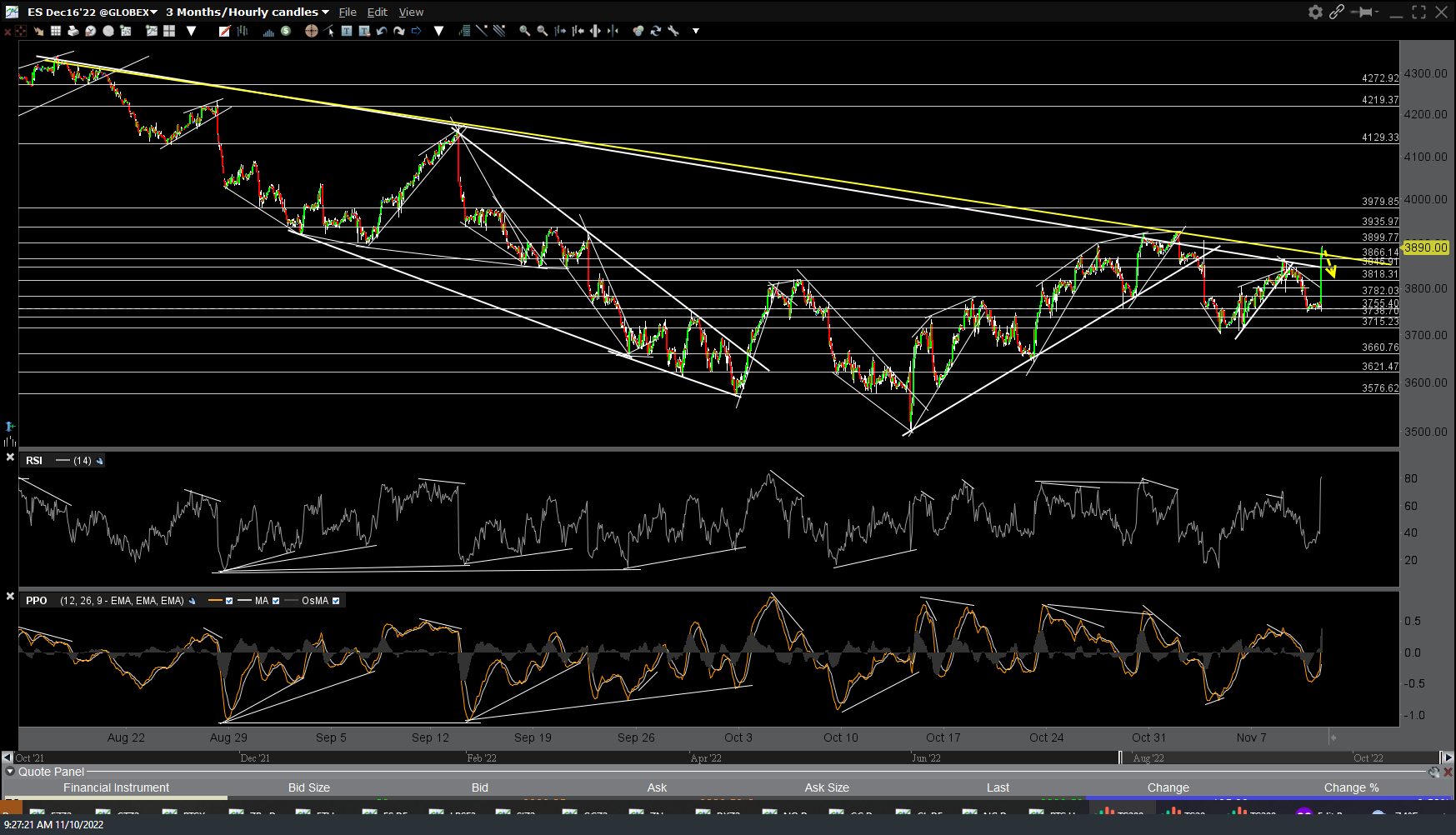

Both /ES (S&P 500) and /NQ (Nasdaq 100 futures) have rallied into their primary downtrend lines off the mid-August highs, both offering objective short entries here for at least a minor pullback trade of 1% or more. One strategy would be to short here at the market open with a relatively tight stop & either go for the quick 1-2% pullback or let it ride, periodically lowering stops, should the trade start to get some traction to the downside. 60-minute charts below (note, I added a BOD or benefit-of-the-doubt downtrend line to /ES just above my primary downtrend line as that BOD line captures the most recent false breakout above the primary TL).

Stock Futures Rally Into Resistance

Share this! (member restricted content requires registration)

4 Comments