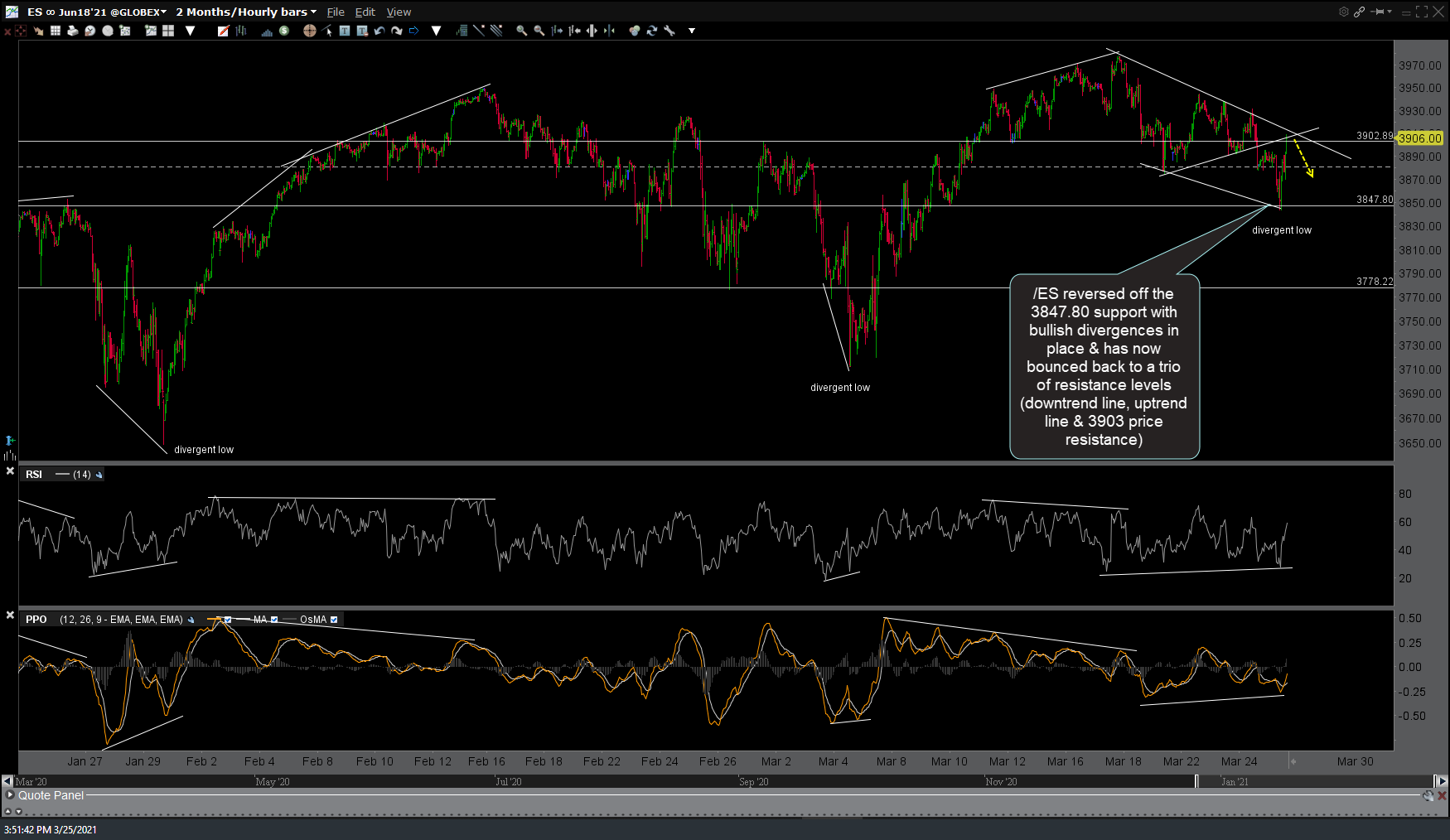

/ES reversed off the 3847.80 support with bullish divergences in place & has now bounced back to a trio of resistance levels (downtrend line, uptrend line & 3903 price resistance).

Today’s divergent low in /NQ could be the catalyst for a tradable rally although SPY & QQQ are poised to close right around those key support levels on the daily chart so another leg down is still likely.

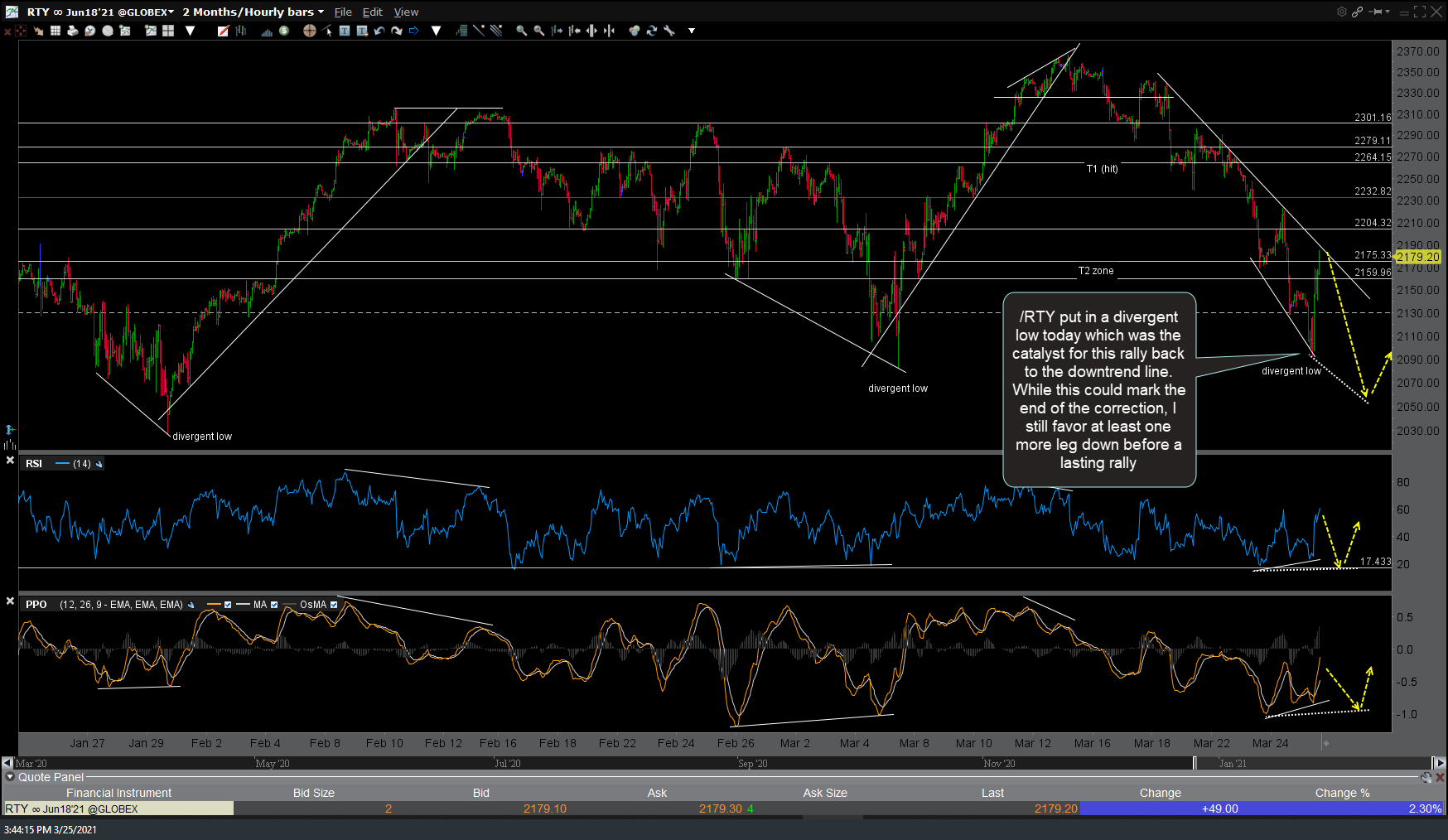

/RTY put in a divergent low today which was the catalyst for this rally back to the downtrend line. While this could mark the end of the correction, I still favor at least one more leg down before a lasting rally.

Bottom line, I’d put high odds on a reversal in the stock futures from around current levels with decent odds that it will prove to be the start of the next leg down. As such, this appears to be an objective level to add back short exposure and/or book profits on any longs.