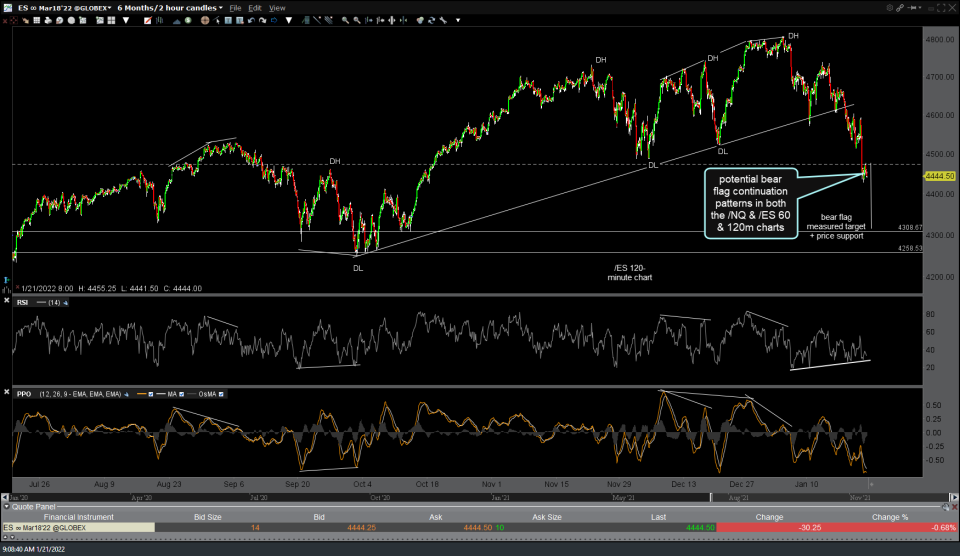

We have some technical cross-currents on the stock futures with both /ES & /NQ bear flagging on the 60 & 120-minute time frames while the positive divergences are still intact, albeit by a narrow margin as much more downside will negate or take out those divergences.

A mixed bag for sure so with the indexes pretty oversold in the near-term as well as trading in close proximity to their 200-day moving averages coupled with the fact that the markets often go into a holding pattern in the days leading up to a key FOMC meeting (rate decision & comments to come next Wednesday at 2 pm EST), I doubt the bear flags will play out, at least to the full extent of their measured targets & I wouldn’t be surprised to see the indexes bounce or consolidate around their 200-day moving averages today and/or early next week. As such, active traders might opt to tighten up stops and/or reverse from short to long in an attempt to game a quick bounce while less active swing & trend traders might opt to sit tight while wider stops in place if holding out for the lower swing targets.

Those unsure what to do might consider lightening up before the weekend & waiting to see how the charts unfold after next week’s FOMC meeting. For now, I’ve reversed from short to long & will follow up with some potential bounce targets for those interested.