QQQ (Nasdaq 100 ETF) so far reversing off the 364ish & 50-day EMA support it hit at Friday’s lows with the divergences still intact. Still looking for a trading bounce before the next leg down. 60-minute chart below.

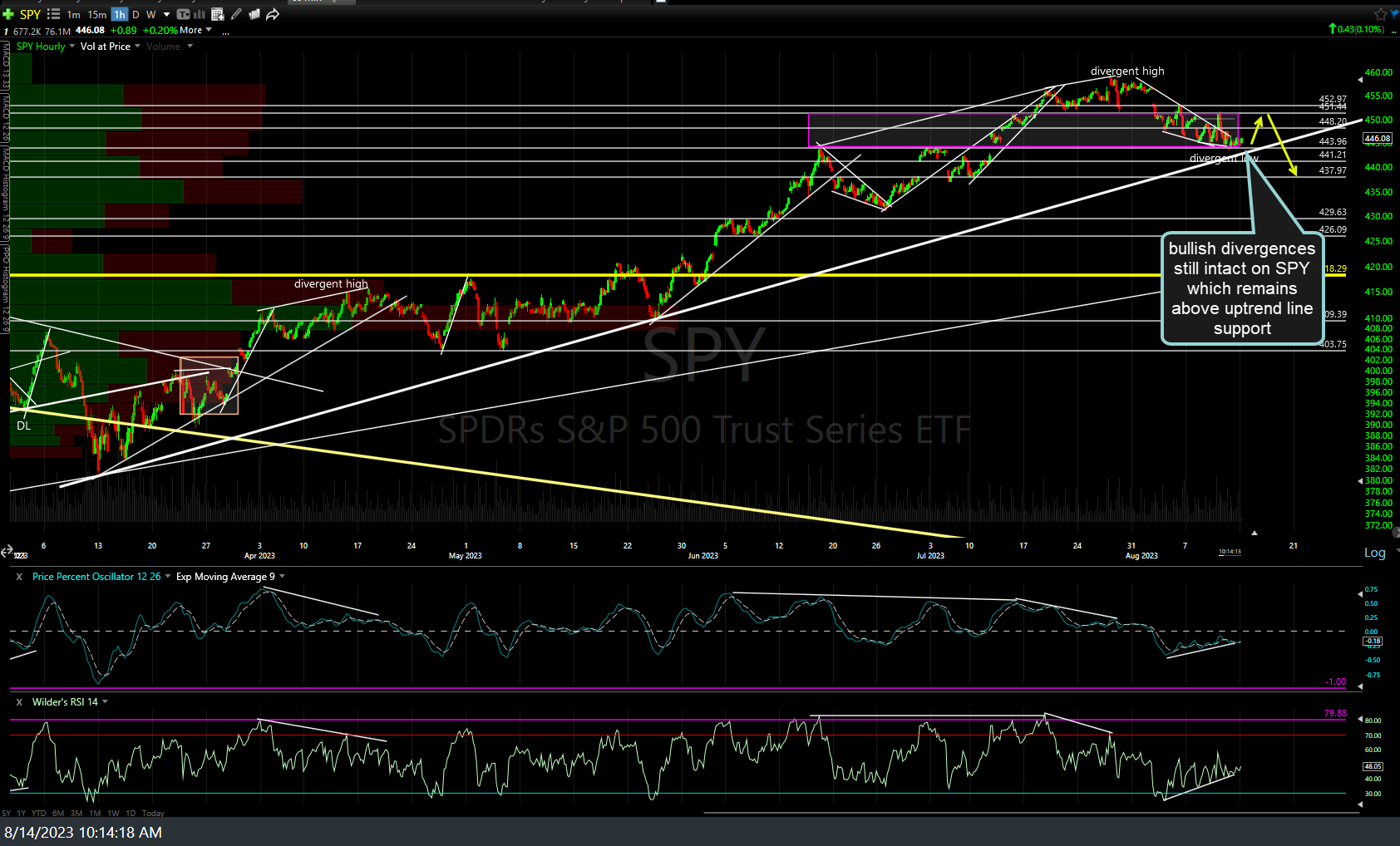

Likewise, bullish divergences still intact on SPY (S&P 500) which remains above uptrend line support on the 60-minute chart below.

IWM (Russell 2000 Small-cap Index ETF) is trading at the 189ish support with positive divergences in place on this 60-minute time frame.

With the indexes opening on those same support levels that I reversed from short to long on Friday (price, trendline, 50-day EMA support, etc…), I added to those index longs at the open today & plan to most likely reverse back to short this week either on a rally into resistance level(s) that appear likely to cap the rally and/or on solid breaks below the aforementioned support levels.

Bottom line: I’m currently looking for a tradable bounce followed by more downside in the coming weeks to months.