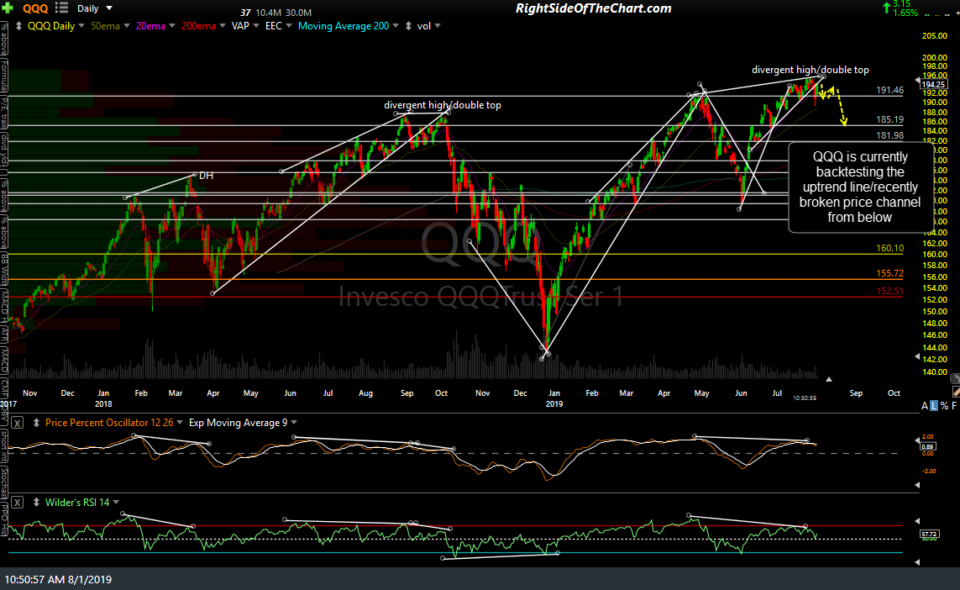

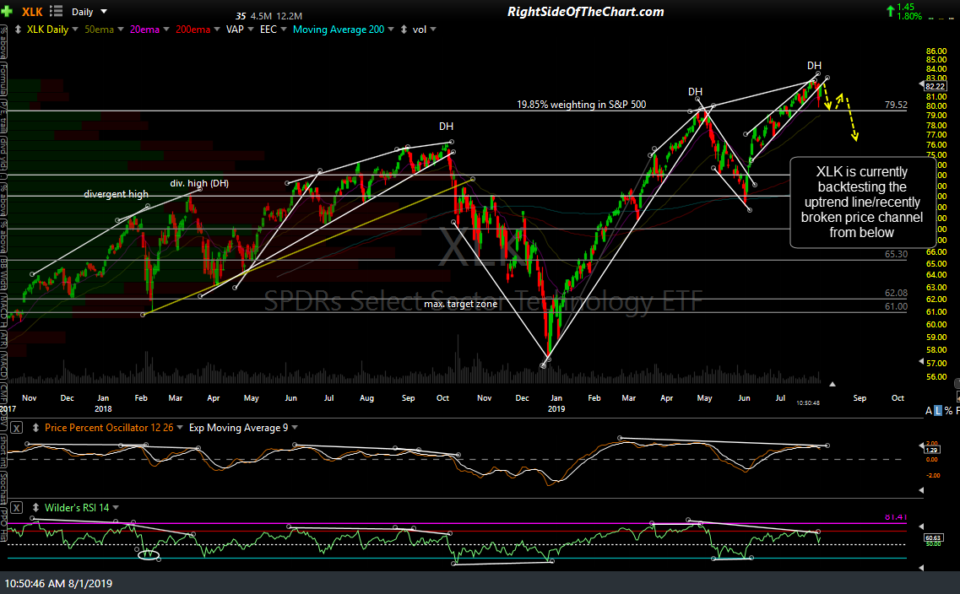

The “Big 3” ETFs that I’ve been watching closely, SPY, QQQ & XLK, are all currently backtesting the uptrend lines/wedges which they impulsively broke down below following yesterday’s FOMC rate decision & subsequent comments. As I’ve stated, the odds for whipsaw signals & false breakouts in the wake of a highly anticipated FOMC announcement are substantially higher than breakouts that occur on non-Fed days. As such, where I might normally add QQQ, XLK or any other index-tracking ETFs as official trade ideas on a backtest such as this, my preference is to wait and see if the major stock indexes & tech sector are rejected here on the initial backtest (or any subsequent/additional backtests in the coming sessions) and if so, to look for impulsive selling following any potential rejection off the backtest of these trendlines from below. Daily charts below:

- SPY daily Aug 1st

- QQQ daily Aug 1st

- XLK daily Aug 1st

While the odds that yesterday’s breakdowns could prove to be FOMC noise-induced whipsaw signals are high, they may or may not prove to be. From a pure TA (technical analysis/charting) perspective, I can say that shorting a backtest of a recently broken trendline with a stop somewhat above is certainly objective. Another way to phrase this would be that a short trade entered here on the backtest, while objective, runs a higher risk of being stopped out since yesterday’s breakdown must be taken with a big grain of salt as it was 100% a result of the post-FOMC announcement “noise”, in which the initial reaction is quite often not the lasting reaction that sticks.

On the flip side, the charts have been and still are indicating that the odds for a trend reversal & substantial correction are elevated at this time with the R/R skewed to the downside, despite the recent bullish trend. As such, more aggressive traders that share my bearish intermediate to longer-term outlook on the stock market might opt to start or continue to scale into a swing short position on the major indexes while those either bullish, uncertain or bearish but not aggressive traders might opt to hold off until the markets trigger some higher probability sell signals, including an impulsive drop back down well below the late April highs in QQQ & SPY.