While anything is still possible as we head into the final 45-minutes of trading, so far the major stock index ETFs as well as XLF have successfully tested & reversed off the previously highlighted former resistance, now support levels. SPY made a breakout & successful backtest of the key downtrend line off the March 4th highs so far today while the PPO signal line has crossed above the zero line, indicating that the near-term trend has shifted to bullish although we still need to see today’s previous high on SPY (242.96) taken out for the early signs of an uptrend (higher highs & higher lows). 30-minute chart below.

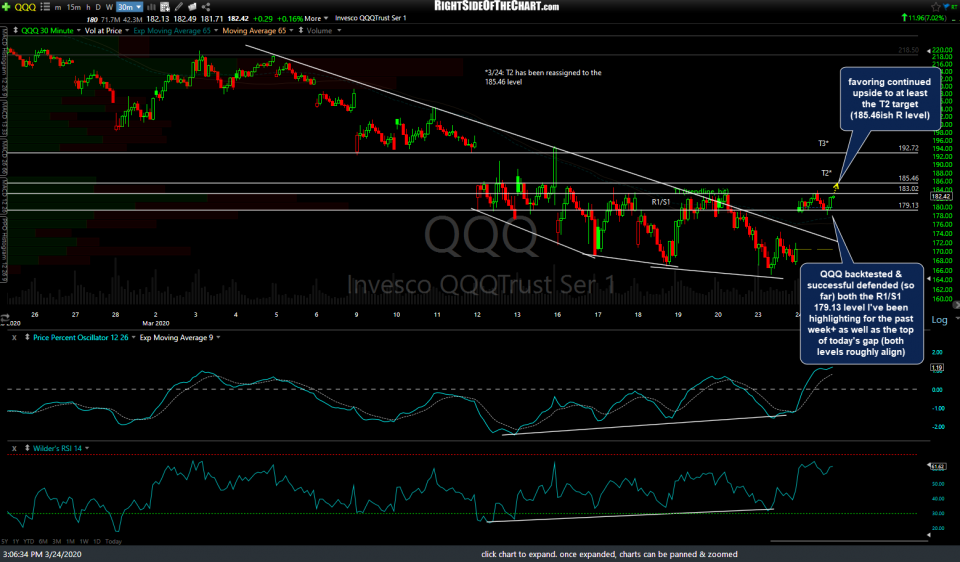

QQQ backtested & successful defended (so far) both the R1/S1 179.13 level I’ve been highlighting for the past week+ as well as the top of today’s gap (both levels roughly align). As of now, I’m favoring continued upside to at least the T2 target (185.46ish R level).

Regarding the XLF Active Long Swing Trade, so far the 19.19 support level has held on the pullback following the initial tag of T1 earlier today. A solid break above the 19.88 resistance level should be the catalyst for another thrust up to the 2nd & final price target.

With the broad market currently trading up 8.30% as I type, we could certainly see a sharp bout of profit-taking before the close today although I suspect that’ll we’re just as, if not more likely to get a late-session ramp into the close as more shorts are squeezed out of their positions, many with forced margin-call selling. Not a bad time to tighten up stops on any long positions. Whether or not we get a late-session sell-off, it still appears the odds are decent for more upside this week to hit those next price targets.