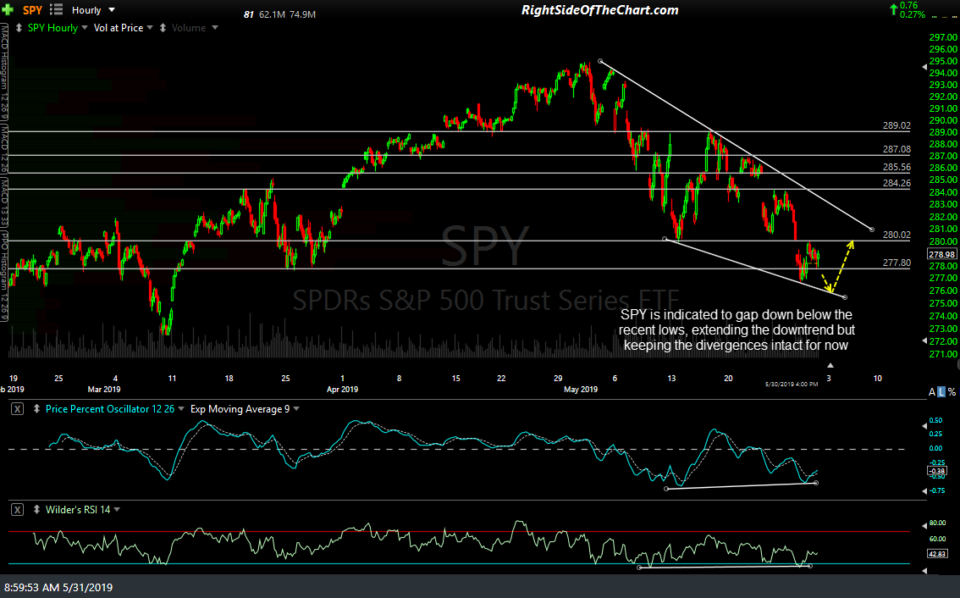

QQQ & SPY are currently poised to gap down within their falling wedge patterns with the divergences still intact for now (based on where they are trading in pre-market). Trump’s tweet last night threatening to impose tariffs Mexico if they don’t do more to stop the influx of refugees across the border had an immediate & sharp impact on the stock futures as well as crude oil, which continues to trade positively correlated to the equity markets.

- QQQ 60-min May 31st

- SPY 60-min May 31st

Futures are prone to sharp moves outside of regular stock market trading hours & it is not uncommon to see large overnight gains or losses reversed once the regular trading session opens & the big institutions begin actively trading. Likewise, that can & sometimes does go the other way as well, with institutional buying or selling extending overnight gains or losses in the futures. Basically, I try not to read too much into the overnight moves in the futures unless that causes the stock indexes to make a clear & impulsive breakout or breakdown above/below a key resistance/support level or any other technically significant event (e.g.- a breakout from a bullish or bearish chart pattern).

- NQ 60-min May 31st

- ES 60-min May 31st

As such, I’ll be watching to see if QQQ & SPY can regain the recently highlighted 175.66 & 277.53 support levels today. If so, I’ll also be watching to see if QQQ can close the day at or above last Friday’s close of 178.16 as that would print the first green weekly candlestick since the May 3rd candle & sharply increase the odds of the countertrend rally that I am still leaning towards at this time, despite the sharp drop in the futures since yesterday’s close.