Despite yesterday’s fairly strong gains in SPY & QQQ, the intermediate & near-term trends remain bearish although today has the potential to either reaffirm the bearish trend & open the door for the next wave of selling or flip some of the near-term trend indicators, such as the PPO, from bearish to bullish.

On this SPY 60-minute chart above, a breakout above the downtrend line & 266.12-269.55 resistance zone level would be bullish while a break below 263.40 bearish. While the former scenario is likely to spark a rally up to the 275.13ish level, roughly 2.9% above yesterday’s close, an impulsive break below the recent lows around 263 is likely to trigger another sharp leg down in the U.S. stock market.

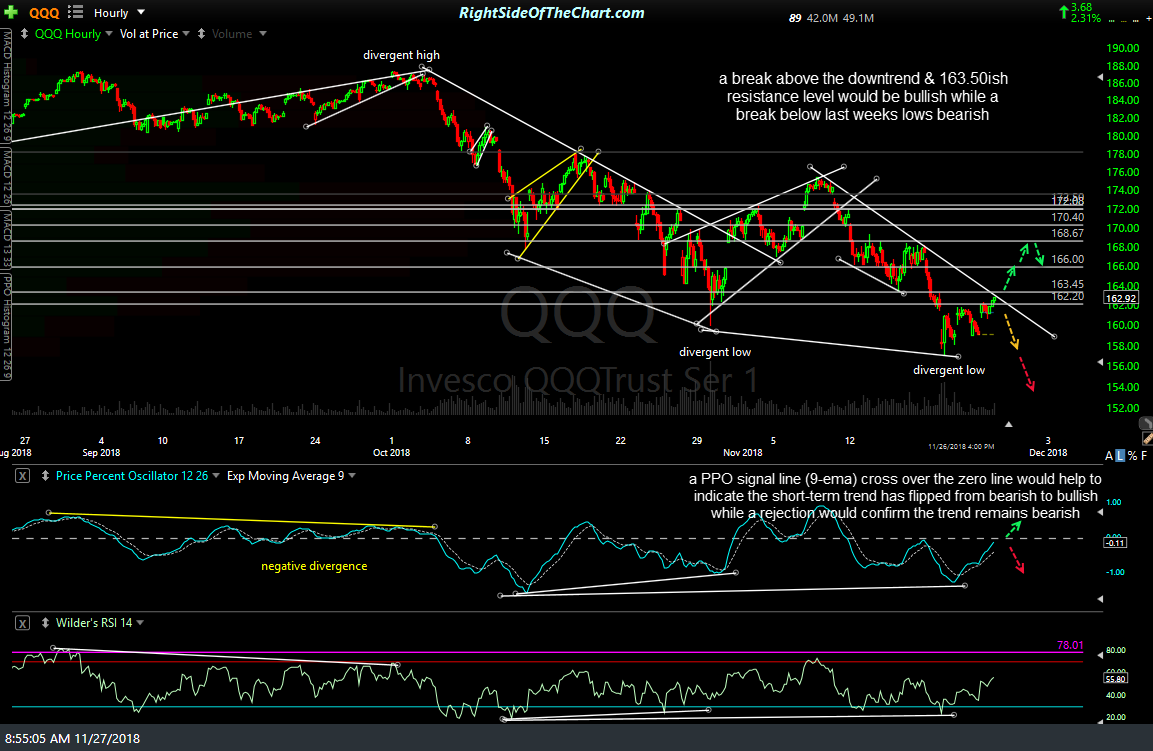

Likewise, a break above the downtrend & 163.50ish resistance level on QQQ would be bullish while a break below last weeks lows bearish. Also, note that a PPO signal line (9-ema) cross over the zero lines of both SPY & QQQ would help to indicate the short-term trend has flipped from bearish to bullish while a rejection would confirm the trend remains bearish.

FWIW, I am leaning towards the bullish scenarios above but with the potential for a 3%+ rip or dip in either direction, depending on which way things break, one should consider remaining flexible at this time & adapt their trading plan accordingly or keep things light if unsure how to be positioned.