The markets gapped down to some pretty significant support levels today (and/or hit those levels in pre-market trading before reversing): the 203ish area on SPY & the 104.50ish level on QQQ. While this first tags of those key levels in a while is likely to produce a reaction, which so far it has, with the longer-term bearish case that has been made here in recent weeks, it would appear to me that the reactions off these levels will be fleeting & it is only a matter of time, most likely next week at the latest, before those levels give way.

- QQQ daily June 24th

- SPY daily June 24th

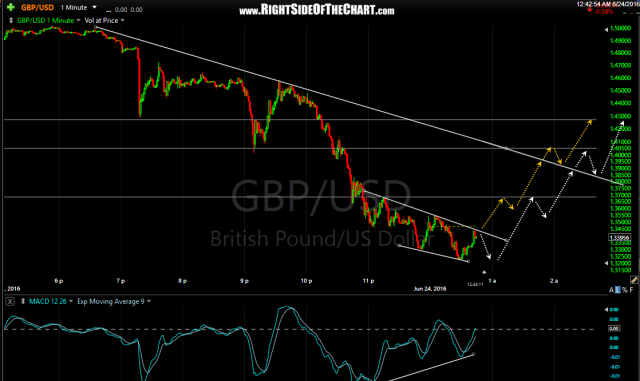

I’ve listed a couple of swing targets/support levels on the QQQ daily chart & will follow up with some targets for the SPY, IWM & some of the sector ETFs that I’ve been highlighting recently. I’ve also included an updated 1-minute chart of the GBP/USD, along with the chart posted last night. As I’ve been positioning for what I believe will likely be the next major leg down in the markets, I haven’t covered any short on today’s move but instead, will be looking to add additional short exposure on this bounce & then again on a break of those support levels (while also moving those cash balances that I swapped from dollars to pounds last night back into dollars as I just wanted to make a few percentage points on the initial bounce following the over-reaction last night).

- GBP-USD 1 minute June 24th

- GBP-USD 1 min 2 June 24th

Bottom line: A lot of technical damage has been done to the charts or, another way to phrase that would be that the bearish case, which was already in place, has very much been firmed up today with the breakdown of the SPY/$SPX below the Ascending Broadening Wedge pattern following the divergent high on the daily time frame. Any bounces into resistance should provide objective shorting opps or add-ons to existing short positions. Updates to existing trades as well as new trade setups will follow throughout today & over the weekend.