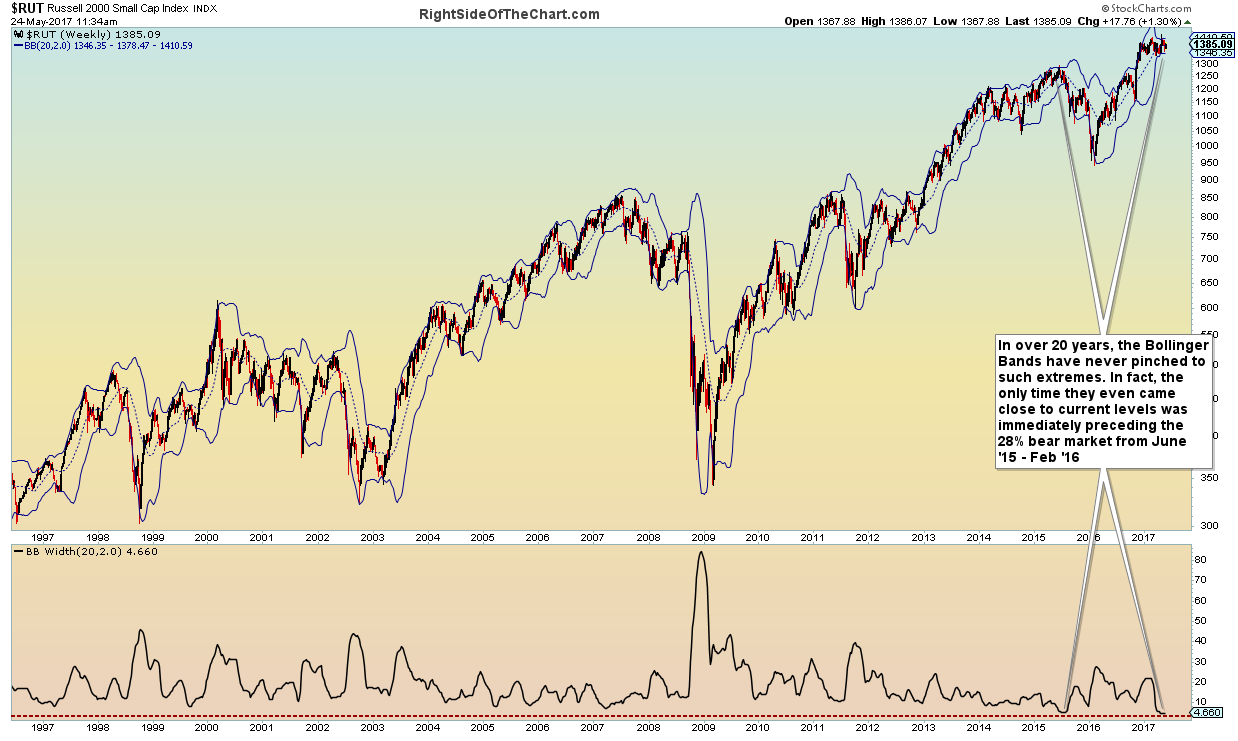

Member @stock51 requested the weekly charts of SPY & QQQ after I had posted the following charts of IWM in the trading room. The following are the daily (spanning 2-years) and weekly (10-years) charts of all three along with a 21-year chart of the Russell 2000 Small-cap index highlight the most extreme pinch in the Bollinger Bands for at least the last two decades & possibly ever.

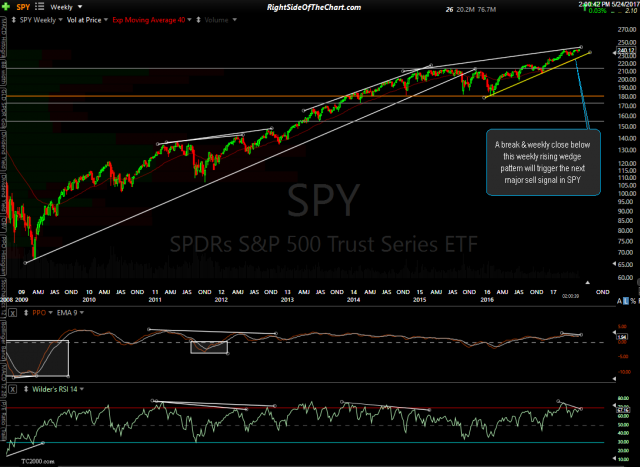

- SPY weekly May 24th

- SPY daily May 24th

- QQQ weekly May 24th

- QQQ daily May 24th

- IWM weekly May 24th

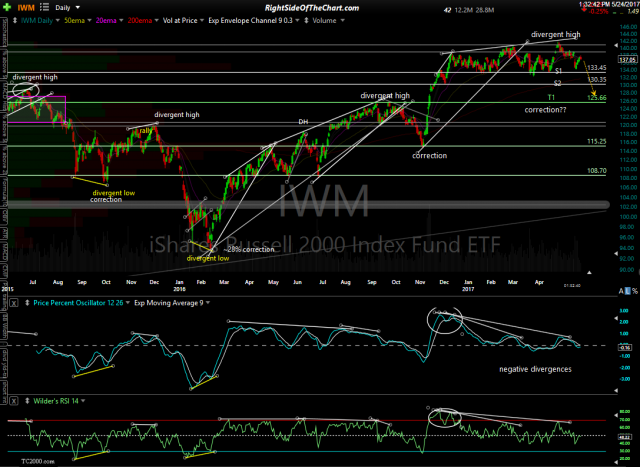

- IWM daily May 24th

Typically, powerful trends follow tight contractions in the Bollinger Bands & although the breakout & subsequent trend following such contractions can go either way, by nearly all metrics that I track using technical analysis indicate that the next major trend following this usually tight (5½% from top to bottom) and long (5.6 months) sideways trading range in the small caps is most likely to resolve to the downside.