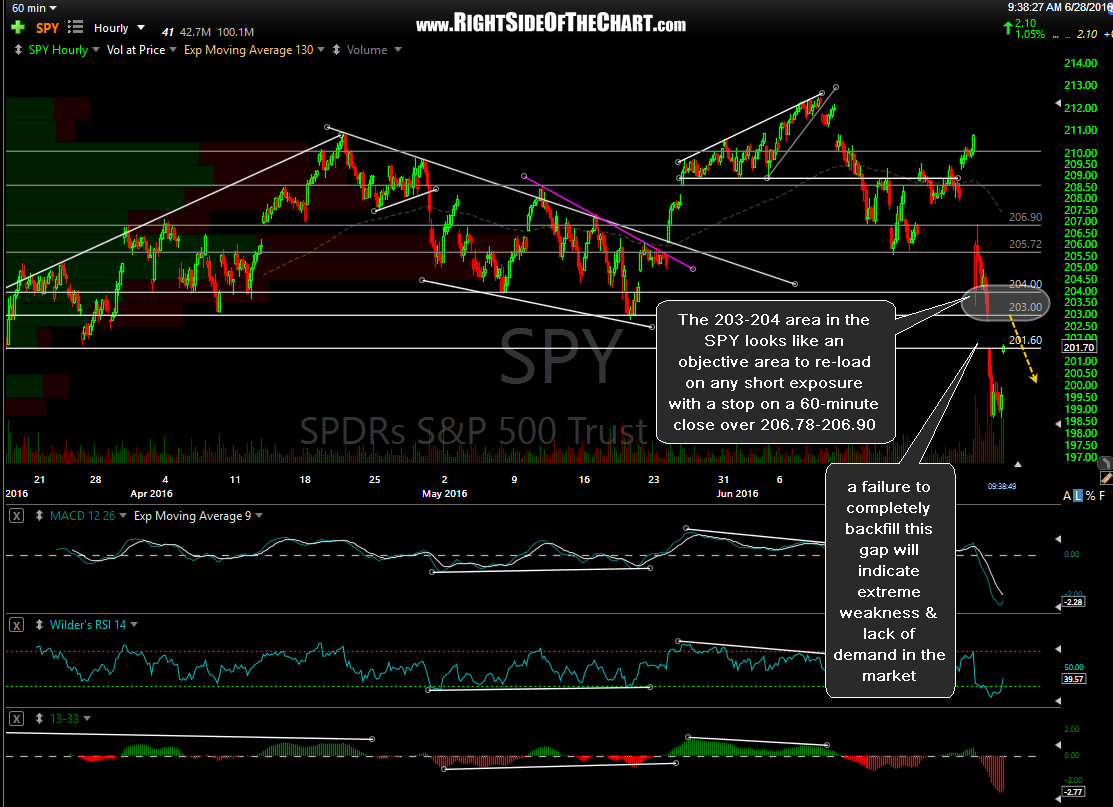

I’ve had several inquired both in the trading room & via private messaging/email from other traders that also closed some short positions yesterday, inquiring as to what levels might provide an objective entry to add back that short exposure. I’ll follow-up with some levels on IWM later but for now, my primary focus is on the large caps. The 203-204 area in the SPY looks like an objective area to re-load on any short exposure with a stop on a 60-minute close over 206.78-206.90 while a failure to completely back-fill yesterday’s gap will indicate extreme weakness & lack of demand in the market.

QQQ looks to offer an objective short entry or add-back for those that reduced exposure yesterday on a bounce to anywhere just below the 104.40 level up to the 105.20 level with a minimum stop on a 60-minute close above 16.40 (or higher, depending on your total position cost). As with the SPY, a failure to completely back-fill Monday’s gap would be quite bearish although my expectation is that a total or near-total back-fill is likely.