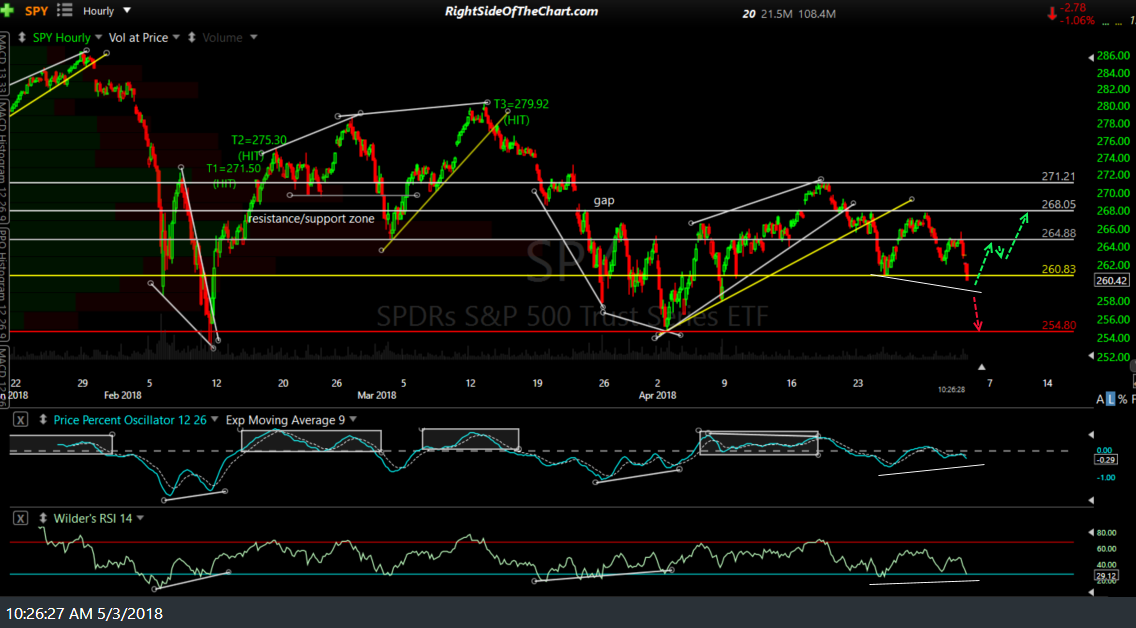

/ES (S&P 500 E-mini futures), as well as SPY, are both at support with potential, but unconfirmed, positive divergences with the PPO & RSI still pointing lower. A slight undercut of the 2610ish support on /ES (260.80ish on SPY) followed by a reversal would put in a divergent low. However, should the SPX futures continue much lower, impulsively taking out support and burning through the divergences, that would be quite bearish.

*click on any of the charts to expand, then use scroll-wheel or touchpad to pan & zoom*

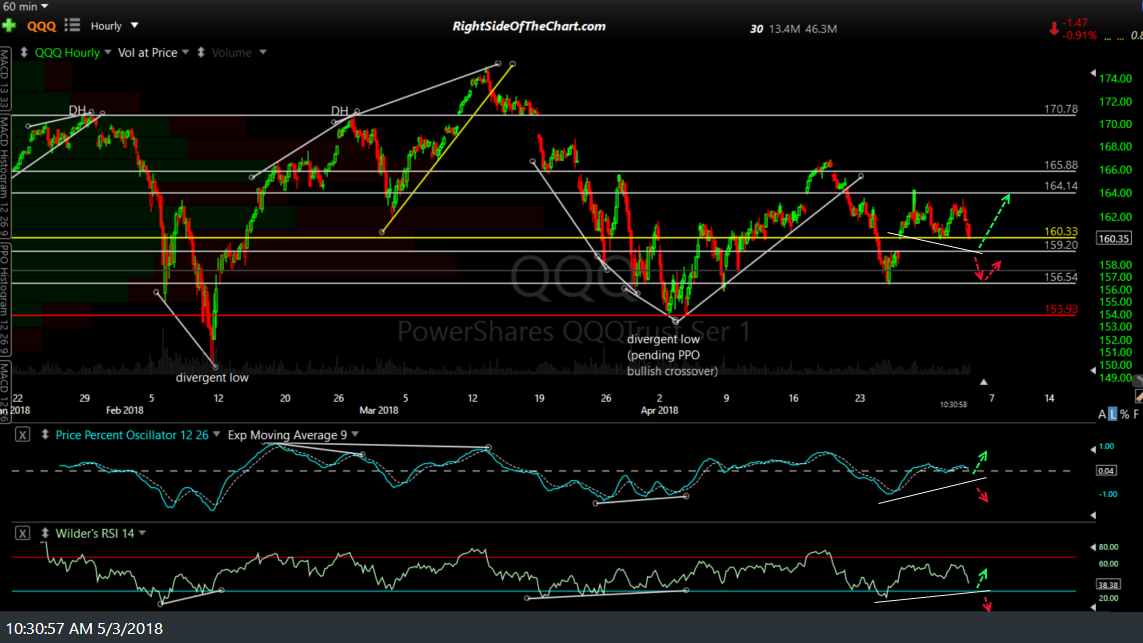

/NQ (Nasdaq 100 E-mini futures) does not have any divergence in place at this time although it could soon if it continues lower & reverses off the 6549.50ish support (159.20ish on QQQ).