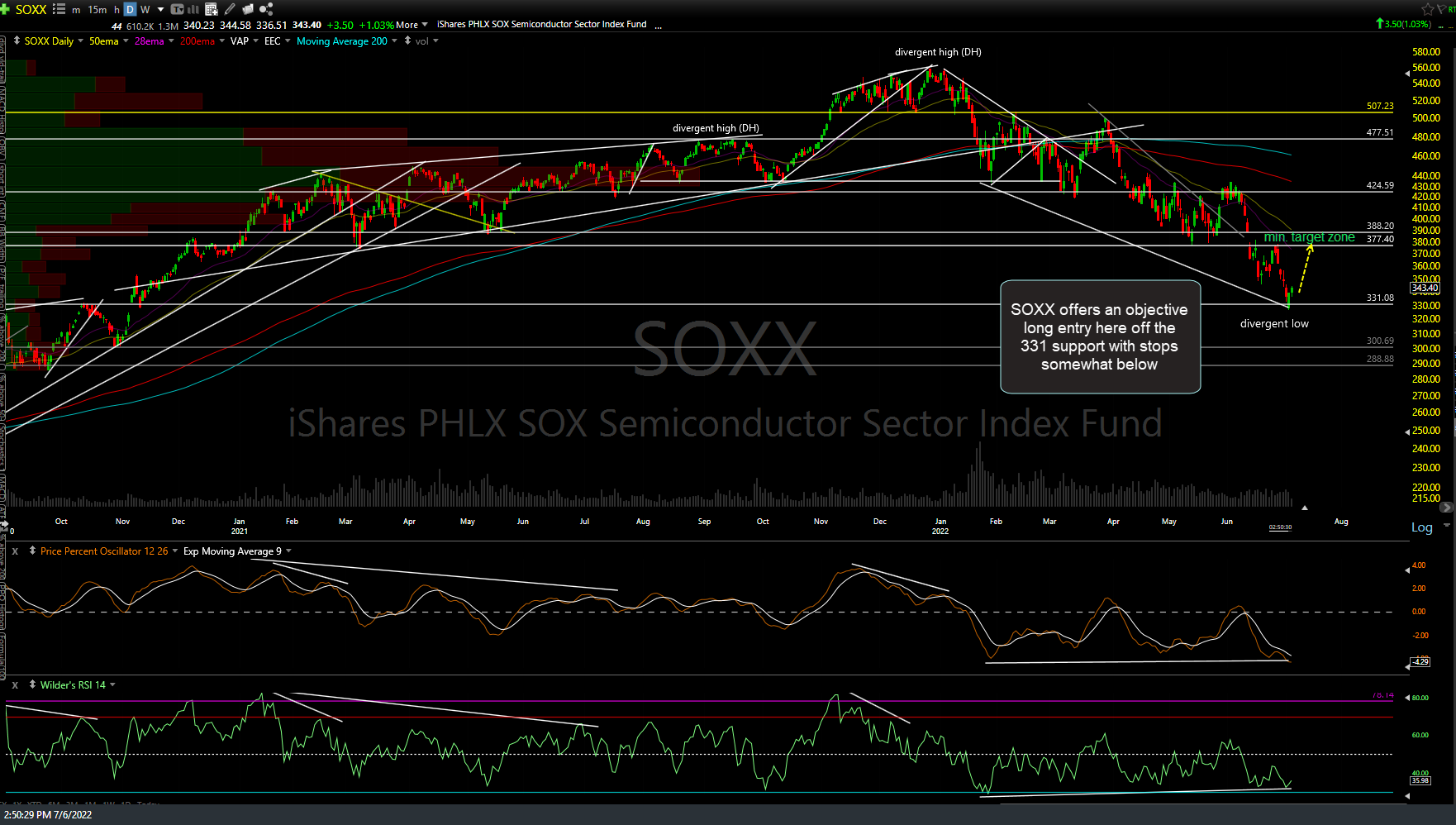

SOXX (semiconductor sector ETF) offers an objective long entry here off the 331 support with stops somewhat below with a minimum swing target zone (based on this daily chart) of 337.40-388.20.

I’ve also listed some price targets on the 60-minute chart below with a minimum/initial target just shy of the 378.50 resistance level, about a 10% profit, if hit.

It goes without saying although definitely worth mentioning that the success (or failure) of this SOXX swing trade will largely if not exclusively, depend on whether my near-to-intermediate-term bullish call for the stock market & in particular, the tech-heavy Nasdaq 100, pans out or not. As of now, one hour after the release of the FOMC Minutes, QQQ is starting to crack above the 60-minute downtrend line but certainly not impulsively, at least not as I type.

As such, less aggressive traders might opt to wait & see if this breakout is firmed up on a solid (or two) 60-minute candlestick closes above the downtrend line, even better if QQQ is poised to print a solid daily close (1-2% above) the trendline in the final minutes of trading today. Otherwise, we could be looking at just another test & rejection (or brief whipsaw) above the trendline.