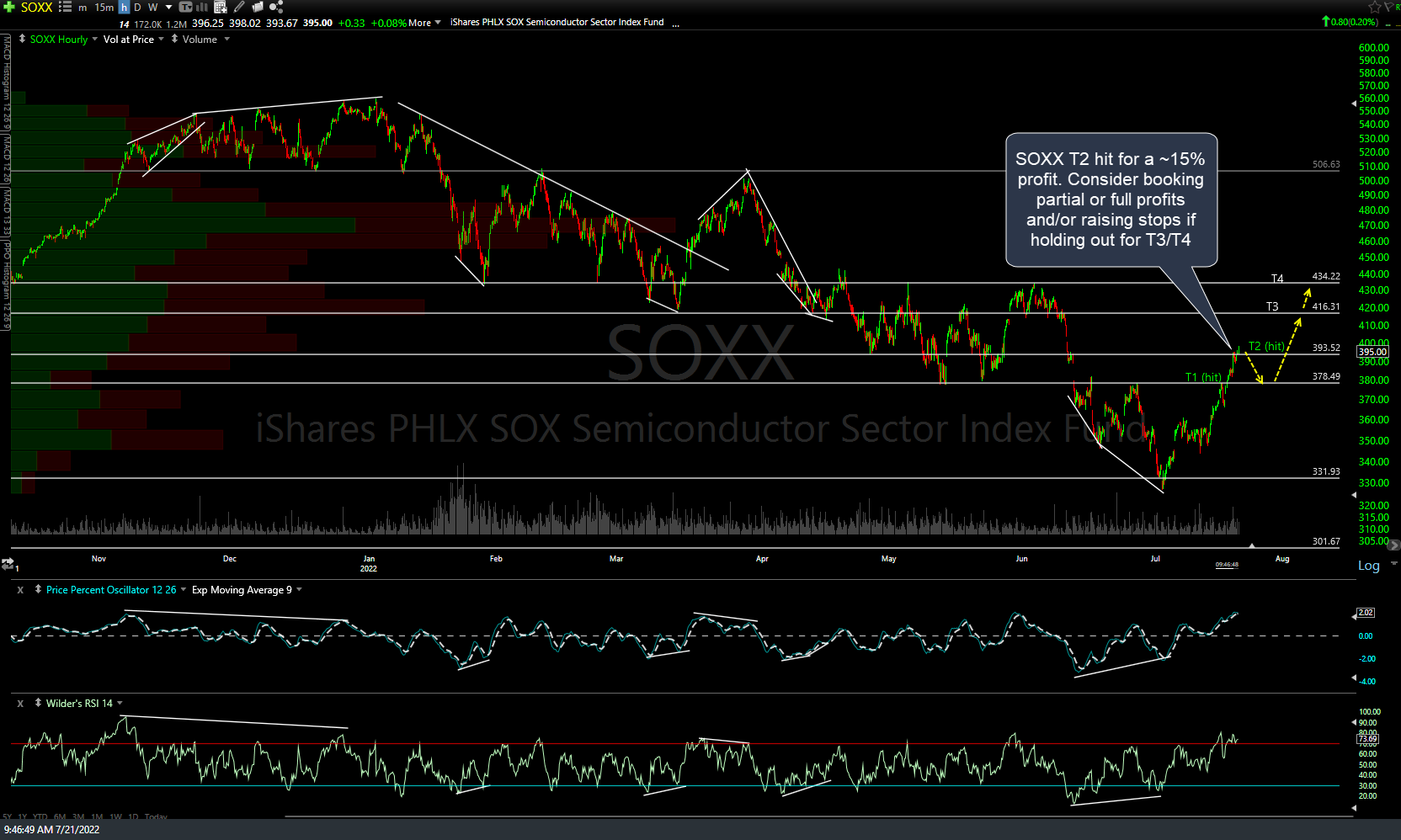

The SOXX (semiconductor sector ETF) swing trade has hit the 2nd price target (T2) for a quick 2-week gain of ~15%. Depending on your trading plan, consider booking partial or full profits and/or raising stops if holding out for T3 or T4. Previous (July 6th) and updated 60-minute charts below.

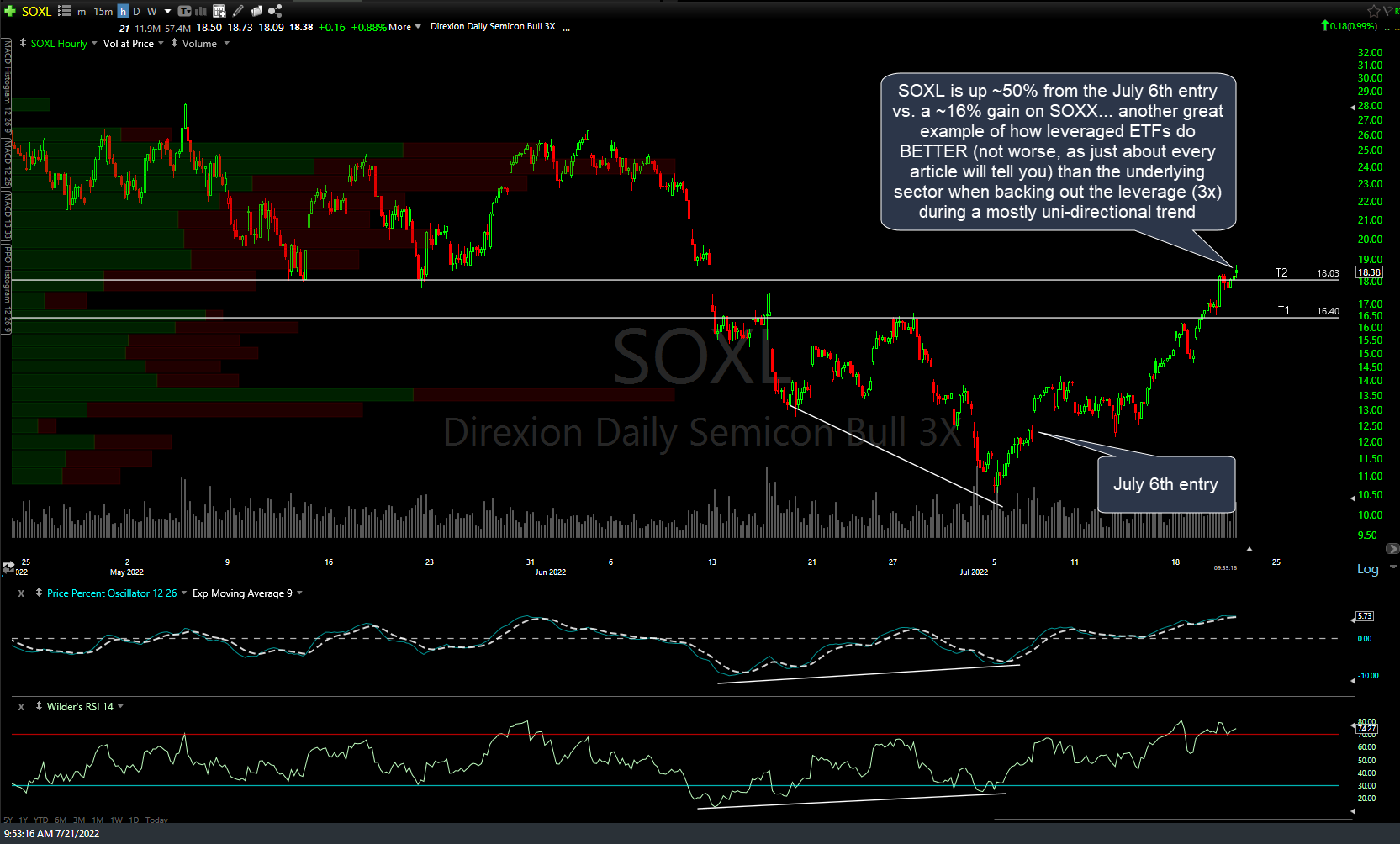

If you’ve followed RSOTC for some time, you’ve often heard me take the other side of the vast consensus that leveraged ETFs are the scourge of Wall Street & should be banned or, at the very least, only used for day trades, never as buy & hold instruments for swing trading. While the leverage can & often does work against a swing position when the underlying sector is trading in a sloppy, back & forth range or even a trend with a lot of green & red closes, here’s yet another example of how that 2x or 3x leverage not only doesn’t work against you but actually results in a return well above 2x or 3x when the underlying sectors have a fairly consistent rally (or correction) with minimal counter-trend rallies or periods of consolidation. Point in case: SOXL (3x semi ETF, tracking the same sector as SOXX) is up ~50% from the July 6th entry vs. a ~16% gain on SOXX… another great example of how leveraged ETFs do BETTER (not worse, as just about every article will tell you) than the underlying sector when backing out the leverage (3x) during a mostly uni-directional trend.

Based on my expectation for a likely pullback and/or consolidation in the semis before the next leg up, I think it would be prudent for those that went with SOXL instead of SOXX to book profits here or, at the very least, roll into SOXX if planning to ride out any pullbacks or periods of consolidation while targeting T3 or T4 on SOXX.