SOXL (3x bullish semiconductor etf) will be added as an Active Short Trade around current levels (trading at 27.34 as I type). SOXL is my preferred trading vehicle for this trade as if the trade plays out as expected, the semis should start the next leg down soon for a multi-week to multi-month swing trade. If so, this trade should benefit from the drop in the semiconductor sector in addition to the price decay suffered over time by leveraged etfs (click here to for a detailed explanation). The current price targets on SOXL are T1 at 23.44 & T2 at 18,14 with a maximum suggested stop on any move over 31.00 (lower, if only targeting T1).

- SOXL 2-day Oct 21st

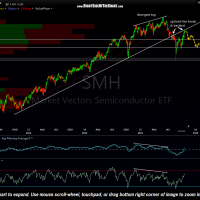

- SMH daily Oct 21st

- SMH weekly Oct 21st

Although I have provided a 4-year, 2-day period chart of SOXL with price targets, those targets may be revised based on the charts of SMH & the $SOXX (PHLX Semiconductor Index). Targets have also been listed on this 2-day period chart of SMH, for those preferring to short this 1x long etf.

While SOXL tracks the $SOXX, SMH tracks the MarketVectors US Listed Semiconductor 25 Index, hence, the slight variation in the charts between the $SOXX and SMH (and of course, the SOXL chart is distorted due to the price decay over time & as such, won’t mirror the chart of the $SOXX over time). Shorting SOXL will also provide a partial hedge to my AMD long trade, which I added to on the break above 2.06 shortly after that previous update on AMD.