All of the following trade ideas were already mentioned as hitting their suggested stop but with some new trade ideas on the way this week, all of the Trade Idea categories will be updated today, moving all of the posted associated with those former trades to the Completed Trades archives.

The tight stop on the previous QQQ short trade that was entered back on March 27th was hit out for a minor loss of 2% just a few days after that trade was entered when the Q’s closed at 182.04, above the suggested stop of a daily close above 181.70. Previous & updated 60-min & 120-minute charts:

- QQQ 60-min March 27th

- QQQ 120-min April 30th

On a related note, I am considering taking the unusual step of adding QQQ back as another official short trade just before AAPL (Apple Inc.) reports after the close today as QQQ has now broken down below the primary uptrend line off the Dec 24th lows & even with an AAPL beat & brief spike back above that trendline, it appears that a breakdown in the Nasdaq 100, as well as the tech sector (XLK), is imminent. Also, the R/R for the major stock indexes has continued to become increasingly favorable on the short side as the risk for a swift & sudden swoon down, should AAPL disappoint as GOOGL did last night, appears to outweigh the risk of a melt-up rally at this time. Whether or not I add QQQ as an official short trade before the close today or within the next week or so, potential price targets are listed on this 120-minute chart below for those interested.

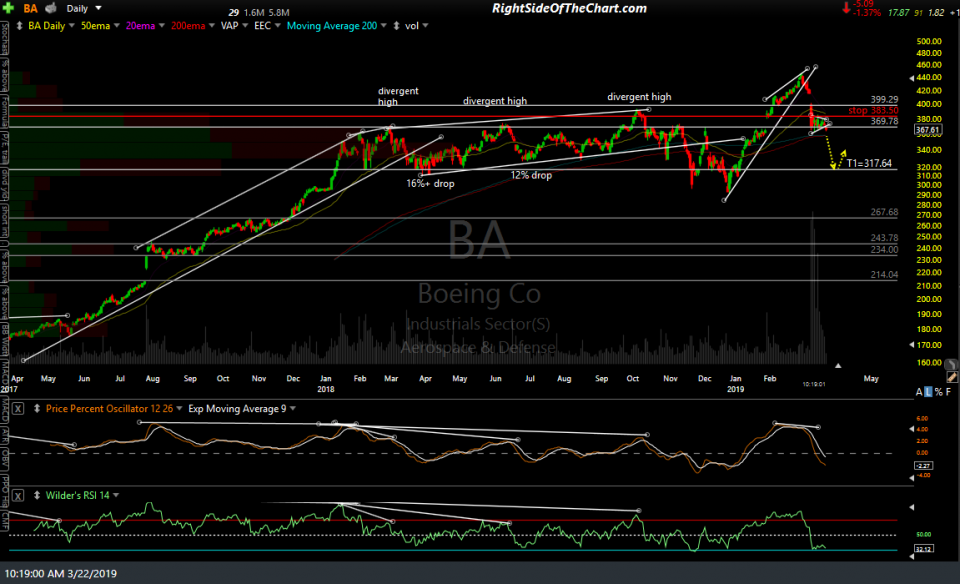

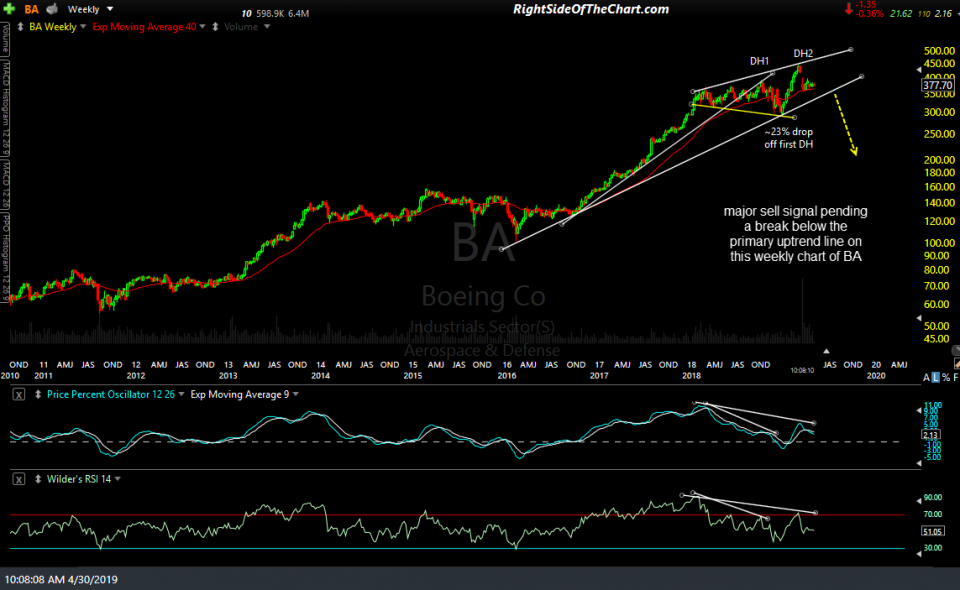

BA (Boeing Co) gapped above the stop of 383.50 to open at 385.80 on 4/1, where any standing stop-loss orders would have been filled for a 4.9% loss. Note how well that 383.50 level has acted as support & then resistance since that stop raid. With the long-term chart on BA still indicative of a major top, this stock is on watch for another short entry & may be added back very soon as it continues to struggle with that 383.50 resistance level. Previous & updated daily charts followed by the updated weekly chart:

- BA daily March 22nd

- BA daily April 30th

- BA weekly April 30th

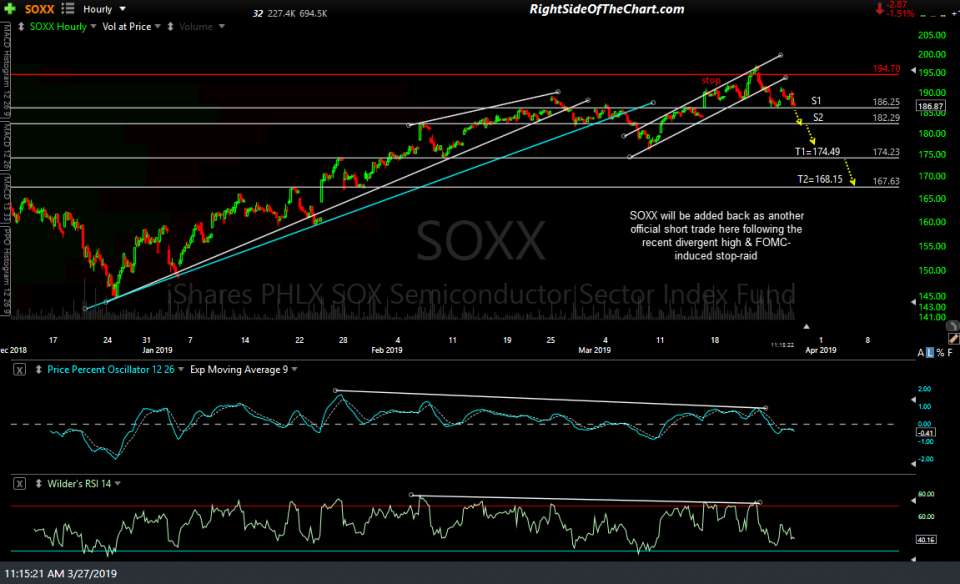

SOXX (Semiconductor ETF) is another one on watch for a new short swing trade after the previous SOXX short trade was stopped out for a 4.2% loss on April 2nd when the 194.70 stop was hit just a few trading sessions after the trade was entered. Previous & updated 60-min charts:

- SOXX 60-min March 27th

- SOXX 60-min April 30th