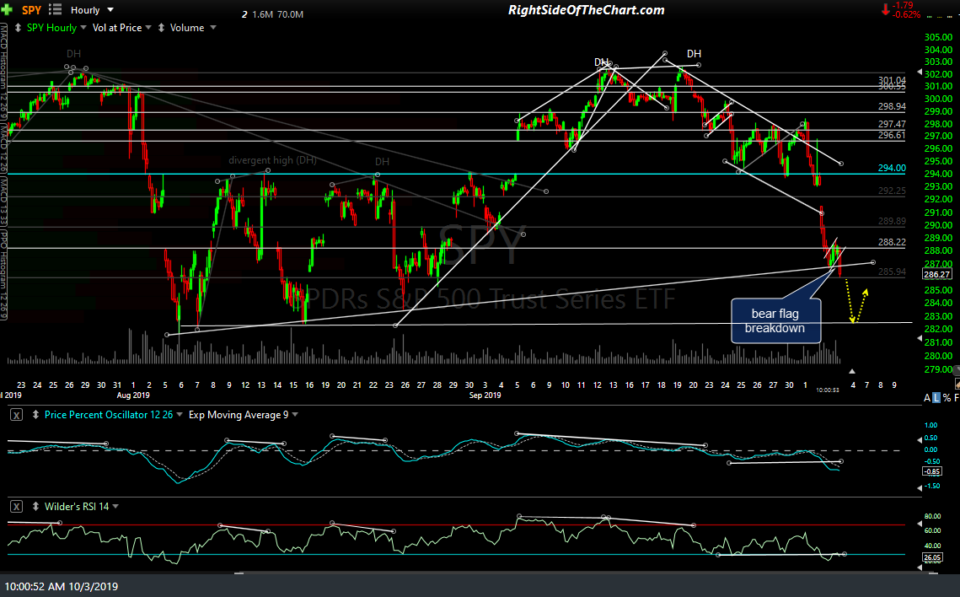

We have confirmed high-probability sell signals with clearly impulsive breakdowns below those bear flag patterns on the major stock indexes. My price near-term price targets (i.e.- where I expect a reversal today) remain as previously posted (/NQ 7402 & /ES 2820) but a couple of things to consider with that. 1) Should the indexes reverse there, there is a decent chance that they might reverse when the first of those two large-cap indexes hit their price target, if they don’t do so concurrently. 2) These are ‘unadjusted’ price targets, meaning they are the actual support levels where a reaction is likely As such, I find it best to cover my shortly and/or reverse to long slightly above the actual support level in order to minimize the chance of missing a fill, should the buyers step in early. Previous & updated 60-minute charts of /ES & /NQ below:

- ES 60m Oct 3rd

- ES 60m 2 Oct 3rd

- NQ 60m Oct 3rd

- NQ 60m 2 Oct 3rd

Likewise, SPY & QQQ also broke down below their respective bear flag continuation patterns with approximate targets shown on these 60-minute charts. To be very clear, these are just near-term targets which may or may not produce a tradable bounce if hit. The more the market drops from here, especially if the major indexes are trading well-below current levels as we head into the close tomorrow (when the weekly candles are finalized), the more the intermediate to longer-term bearish case firms up.

- SPY 60m Oct 3rd

- QQQ 60m Oct 3rd