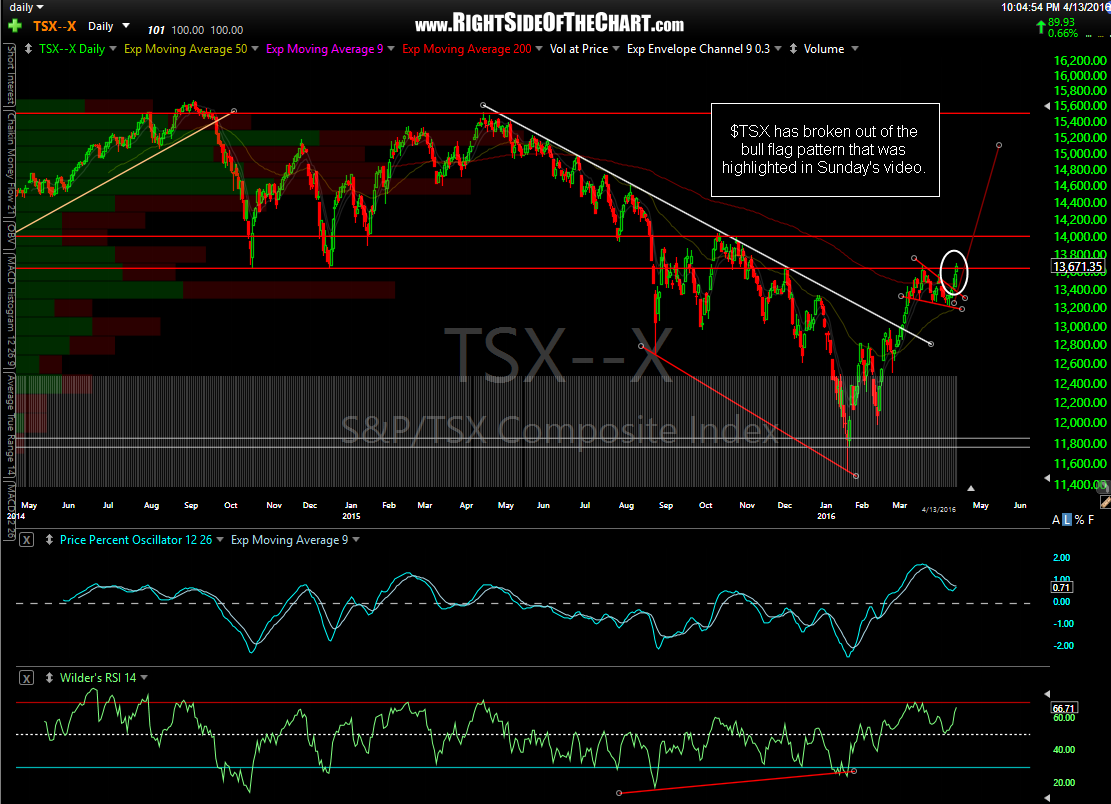

As a follow-up to Sunday’s Global Equity Markets Overview video, two of the three of the countries that I had highlighted as setting up bullishly have since made clear breakouts of the patterns and/or resistance levels that were highlighted. $TSX (Toronto Stock Exchange) has broken out of the bull flag pattern that was highlighted in Sunday’s video. One way for those of us ‘yankees’ to gain direct & diversified exposure to Canada is through EWC is the iShares MSCI Candadian Index Fund ETF. I also plan to scan for any attractive $TSX listed stocks this week, with any standouts to be posted in the trading room.

Finally, we could get a little ‘thunder down under’ should EWA (iShares MSCI Australia Index Fund ETF) take out both this downtrend line + the orange support zone that tops out around the 20.17 area. A break of that downtrend line would also coincide with a breakout above the bullish falling wedge pattern that was highlighted in the video on the $AORD (Sydney All Ordinaries Index) weekly chart.