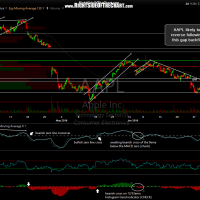

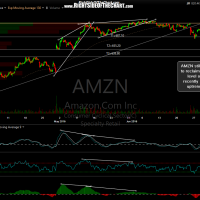

The top 5 components of the top-heavy QQQ/Nasdaq 100 are all at resistance on the 60-minute time frames, including several at gap resistance. These are fairly significant resistance levels on the intraday time frames so 60-minute closes above these levels on most or all 5 of these leading stocks would certainly be near-term bullish although zooming out to the daily charts, there is still much more work to be done in order to firm up the bullish case as the Nasdaq 100 & Nasdaq Composite are still about 8% off their 2015 highs & are still well shy of the 61.8% Fibonacci retracement levels from those 2015 highs.

- AAPL 60-minute June 30th

- GOOG 60 minute June 30th

- MSFT 60-minute June 30th

- AMZN 60-minute June 30th

- FB 60-minute June 30th

Personally, I’m adding back another day trade sized short position on QQQ here, of which I’ll either close all out on a solid break & 60-minute close of 1% above these levels -OR- should we roll over here as I’d expect, I will take partial profits before the close while bringing home the rest of that position.