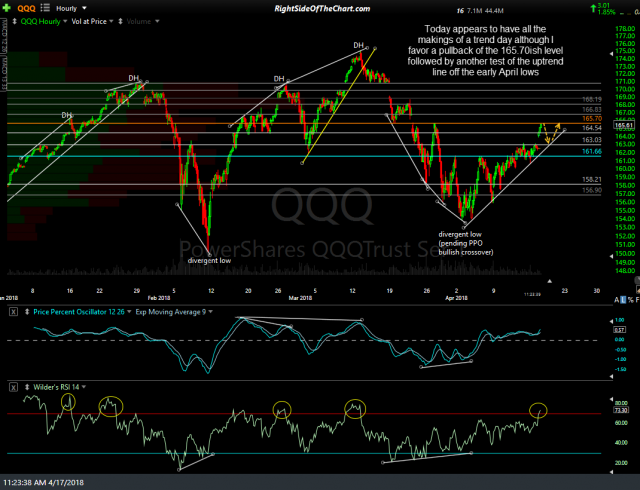

While I’m maintained a consistent bullish bias & position since the early April lows & while I still see the likelihood of another 1.5% – 3% upside for QQQ in the coming days to weeks, it appears that odds for a pullback at this time are substanially elevated. Today appears to have all the makings of a trend day although I favor a pullback of the 165.70ish level followed by another test of the uptrend line off the early April lows & backfill of today’s gap before a resumption of the uptrend.

- QQQ 60-min April 17th

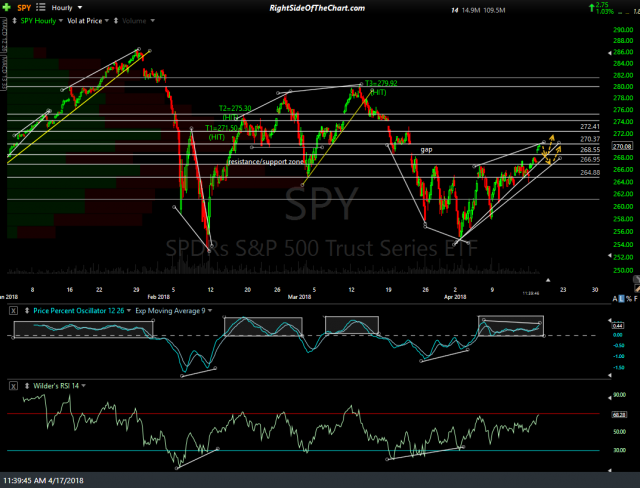

- SPY 60-min April 17th

Keep in mind this is a micro-call. Calling the very short-term zigs & zags in the market can be a difficult task at times but I’m just passing along what I see as the most likely scenario for the next few days. Today smells a lot like the short-covering rally plus natural buying that I had anticipated would occur once those key resistance levels on the SPY (266.95) and QQQ (161.70) levels were taken out & my expectation and while the near-term trend off the early April lows is still very much intact without any signs of a reveral yet, I do favor a reversal here soon as both SPY & QQQ have run into resistance while oversold on the intraday time frames along with the QQQ official long swing trade hitting both today’s revised (slightly lower) final price target as well as the original final target which was strategically set just below the 165.70ish resistance level when the trade was entered back on April 4th (from the 15-minute chart below):